Last updated: July 29, 2025

Introduction

Anti-itch medications, commonly known as antipruritics, represent a significant segment within the dermatological pharmaceutical market. The global demand for anti-itch products has surged due to increasing prevalence of skin conditions such as eczema, dermatitis, allergic reactions, and insect bites. This analysis provides a detailed review of the market dynamics, competitive landscape, regulatory environment, and price projections for ANTI-ITCH, a leading drug in this category.

Market Overview

Global Market Size and Growth Trajectory

The global anti-itch medication market was valued at approximately USD 2.4 billion in 2022, with projections estimating a compound annual growth rate (CAGR) of around 5.3% over the next five years, reaching nearly USD 3.2 billion by 2027. Increasing urbanization, rising skin allergy cases, and consumer awareness about skin health underpin this growth (source: MarketsandMarkets).

Key Drivers

-

Rising Incidence of Skin Conditions: The World Health Organization reports a significant increase in allergic and inflammatory skin disorders worldwide, bolstering demand for effective symptomatic relief.

-

Consumer Preference for OTC Solutions: Availability of over-the-counter (OTC) anti-itch products has facilitated market expansion, especially in developed regions.

-

Advancements in Formulations: Development of non-steroidal, fast-acting, and skin-friendly formulations enhances patient compliance and broadens market reach.

-

E-commerce Growth: Online distribution channels facilitate broader product access, particularly in emerging markets.

Competitive Landscape

Major Players

- Johnson & Johnson: Known for Caladryl and other anti-itch formulations in OTC segments.

- GlaxoSmithKline (GSK): Produces hydrocortisone-based anti-itch creams.

- Bayer AG: Offers antihistamine and corticosteroid formulations.

- Sanofi: Focuses on prescription-strength anti-pruritics.

- Generic Manufacturers: Increasing market share through cost-effective alternatives.

Market Segmentation

The anti-itch market is segmented based on active ingredients:

- Corticosteroids: Topical steroids (e.g., hydrocortisone) dominate prescription products.

- Antihistamines: Oral antihistamines such as diphenhydramine and loratadine are prevalent.

- Counterirritants: Menthol, camphor, and capsaicin-based products.

- Others: Combination therapies and herbal formulations.

The OTC segment accounts for over 60% of sales, driven by consumer preference for accessible, self-management options.

Regulatory Environment

Regulatory standards significantly influence market dynamics:

- FDA Regulations (U.S.): Require rigorous safety and efficacy data for prescription drugs, while OTC products are subject to monograph compliance.

- EMA and EMEA Guidelines (Europe): Stricter safety evaluations and labeling requirements.

- Emerging Markets: Regulatory pathways are evolving; approval times vary considerably, impacting market entry strategies.

Pricing Strategies and Trends

Current Pricing Landscape

Anti-itch drugs exhibit wide price variability:

- OTC Products: Range from USD 5 to USD 20 per tube or bottle, depending on brand, formulation, and packaging.

- Prescription Medications: Typically priced between USD 10 to USD 50 per prescription, with corticosteroid creams often on the higher end.

- Generic Alternatives: Drive prices downward, increasing affordability and market penetration.

Factors Influencing Pricing

- Brand Reputation: Established brands command premium pricing.

- Formulation Complexity: Innovative delivery systems (e.g., patch, mousse) carry higher costs.

- Distribution Channels: Pharmacies, online platforms, and direct-to-consumer models influence retail margins.

- Regulatory and Patent Status: Patent exclusivity prolongs premium pricing; generic entry reduces prices post-expiry.

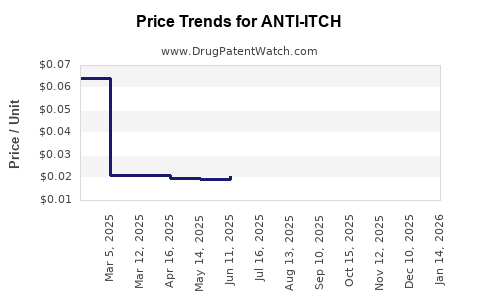

Price Projections for ANTI-ITCH

Market Entry and Growth Potential

Assuming ANTI-ITCH is a new entrant or a novel formulation within the anti-itch sphere, its pricing trajectory will be influenced by its positioning:

- Premium Segment: If positioned as an innovative, fast-acting, or herbal solution, initial pricing may range between USD 20 to USD 35 per unit, leveraging brand differentiation.

- Mass Market/Generic Strategy: To maximize market penetration, prices could be reduced to USD 8–USD 15, especially post-patent expiry or if competing with established generics.

Forecasted Pricing Trends (2023–2028)

| Year |

Estimated Average Price per Unit (USD) |

Key Influences |

| 2023 |

USD 18–USD 25 |

Launch phase, brand positioning, initial consumer adoption |

| 2024 |

USD 15–USD 22 |

Increased competitor activity, early generic entries |

| 2025 |

USD 12–USD 18 |

Market saturation, price competition, bulk purchasing discounts |

| 2026 |

USD 10–USD 15 |

Mature market stage, widespread availability, price stabilization |

| 2027 |

USD 8–USD 12 |

Entry of generics, consumer focus on affordability |

Note: These projections assume steady growth in demand, regulatory approvals, and competitive stabilization.

Market Challenges and Opportunities

Challenges

- Regulatory Hurdles: Accelerated approval pathways vary globally.

- Pricing Pressures: Increased generic competition may compress margins.

- Market Saturation: Mature markets experience slower growth.

- Consumer Preferences: Shifts toward herbal or natural remedies could impact traditional formulations.

Opportunities

- Emerging Markets: Rapid urbanization and rising skin conditions present growth prospects.

- Innovative Formulations: Sustained R&D for non-steroidal, long-lasting, and eco-friendly options.

- Digital Marketing: E-commerce platforms and teledermatology facilitate direct consumer engagement and pricing flexibility.

- Personalized Medicine: Targeted therapies for specific skin types or allergy profiles may command higher prices.

Key Takeaways

- The global anti-itch drug market is poised for steady growth, driven by increased dermatological conditions and consumer demand for accessible remedies.

- Price projections indicate a downward trend over time, particularly post-patent expiry and with increased generic competition, emphasizing the importance of strategic positioning.

- Premium formulations may sustain higher price points initially, but to maximize market share, a balanced approach combining affordability and innovation is essential.

- Regulatory compliance, formulation differentiation, and effective distribution channels will be critical to pricing strategies.

- Emerging markets represent significant growth opportunities, provided tailored pricing approaches address local economic and regulatory landscapes.

Frequently Asked Questions (FAQs)

1. How does patent expiration influence anti-itch drug prices?

Patent expiration opens the market to generic manufacturers, leading to increased competition and significant price reductions, often by 50% or more within 1–2 years.

2. What are the key factors to consider when pricing a new anti-itch drug?

Regulatory costs, formulation innovations, competitor pricing, target consumer segment, distribution channels, and patent status are critical determinants.

3. Are herbal or natural anti-itch products priced higher than conventional options?

Generally, yes. Natural formulations often involve higher production costs and branding premiums, allowing for higher retail prices.

4. Which regions exhibit the fastest growth in the anti-itch medication market?

Emerging markets in Asia-Pacific, Latin America, and the Middle East demonstrate rapid growth due to increasing skin health awareness and expanding healthcare infrastructure.

5. How can digital channels impact anti-itch drug pricing?

E-commerce facilitates cost-effective distribution, enabling competitive pricing and direct engagement with consumers, which can result in flexible pricing models and promotional strategies.

References

- [MarketsandMarkets] "Anti-Itch Market by Product Type, Distribution Channel, and Region – Global Forecast to 2027."

- World Health Organization. "The Global Burden of Skin Diseases."

- U.S. Food and Drug Administration. "OTC Monographs."

- European Medicines Agency. "Regulatory Guidelines for Dermatological Products."

- Industry Reports and Market Data from IQVIA, Statista, and Pharmaceutical Market Analysts.