Share This Page

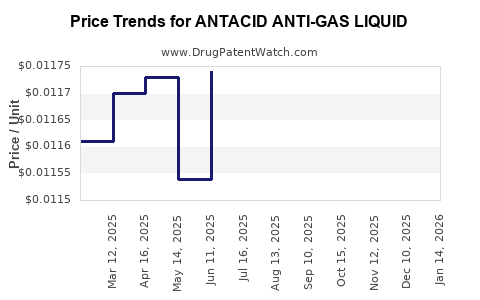

Drug Price Trends for ANTACID ANTI-GAS LIQUID

✉ Email this page to a colleague

Average Pharmacy Cost for ANTACID ANTI-GAS LIQUID

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| ANTACID ANTI-GAS LIQUID | 46122-0432-40 | 0.01165 | ML | 2025-12-17 |

| ANTACID ANTI-GAS LIQUID | 46122-0431-40 | 0.01165 | ML | 2025-12-17 |

| ANTACID ANTI-GAS LIQUID | 46122-0432-40 | 0.01174 | ML | 2025-11-19 |

| ANTACID ANTI-GAS LIQUID | 46122-0431-40 | 0.01174 | ML | 2025-11-19 |

| ANTACID ANTI-GAS LIQUID | 46122-0432-40 | 0.01172 | ML | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for Antacid Anti-Gas Liquid

Introduction

The over-the-counter (OTC) antacid anti-gas liquid segment addresses the global demand for immediate relief from gastrointestinal discomfort, including acid indigestion, heartburn, and gas. As consumers increasingly prioritize quick-acting, convenient solutions for digestive health, this sector demonstrates sustained growth potential. This analysis examines current market dynamics, competitive landscape, regulatory considerations, and offers price projections grounded in market trends to guide stakeholders and investors.

Market Overview

Global Market Size and Growth Trajectory

The global gastrointestinal (GI) relief market, encompassing antacids and anti-gas formulations, was valued at approximately USD 4.9 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 4.3% from 2023 to 2030 [1]. The rising prevalence of acid reflux, heartburn, and bloating—largely attributable to sedentary lifestyles, stress, and dietary patterns—fuels demand for OTC GI remedies, including liquid antacids.

Segment Focus: Antacid Anti-Gas Liquids

Within this sector, antacid anti-gas liquids occupy a significant niche due to their rapid absorption, ease of use, and consumer preference for pre-measured doses. Major global brands include Gaviscon, Phillips’ Milk of Magnesia, and Pepto-Bismol, alongside generic formulations.

Key Market Drivers

- Rising Incidence of Gastrointestinal Disorders: Globally, gastrointestinal issues are among the leading health complaints. According to the World Gastroenterology Organisation, approximately 40% of adults suffer from acid reflux annually [2].

- Consumer Preference for OTC Solutions: Increasing healthcare self-management trends continue to bolster OTC sales, especially in developing regions with limited access to healthcare providers.

- Advancements in Liquid Formulations: Innovations in formulation improve taste, portability, and efficacy, strengthening consumer loyalty.

Regional Market Distribution

- North America: Dominates the market (approx. 40%) due to high awareness, prevalent GI conditions, and established OTC infrastructure.

- Europe: Represents approximately 25%, driven by aging populations and health-conscious consumers.

- Asia-Pacific: Exhibiting the fastest growth (CAGR of 6.0%), propelled by urbanization, rising income levels, and expanding healthcare access [3].

- Rest of World: Latin America, Middle East, and Africa show emerging demand.

Competitive Landscape

Major players controlling the market include Johnson & Johnson (Pepto-Bismol), Reckitt Benckiser (Gaviscon), Bayer, and local generic manufacturers. Strategic activities such as product innovation, formulation diversification, and marketing campaigns are pivotal.

Emerging trends include:

- Development of sugar-free, gluten-free formulations.

- Incorporation of natural ingredients like ginger and aloe Vera.

- Packaging innovations for portability and dose accuracy.

Regulatory Considerations

Antacid anti-gas liquids are classified as OTC drugs in many jurisdictions, including the U.S. and EU. Regulatory agencies stipulate standards for safety, efficacy, and labeling, influencing product formulations and market entry timelines. Compliance with local regulations, including the FDA in the U.S. and EMA in Europe, remains critical.

Price Analysis

Current Pricing Landscape

Retail prices for antacid anti-gas liquids vary across regions and brands:

- United States: Ranges from USD 4 to USD 8 for a 4 fl oz (120 mL) bottle.

- Europe: Typically EUR 3 to EUR 7 for similar quantities.

- Asia-Pacific: Prices are lower, approximately USD 2 to USD 5, due to local manufacturing and market competition.

Premium, medicated, or natural ingredient-based products command higher prices, while generic brands compete primarily on affordability.

Factors Influencing Pricing

- Brand Recognition: Established brands often leverage perceived efficacy and trust, setting higher prices.

- Formulation Complexity: Products with added herbal extracts or specialized formulations tend to command premium pricing.

- Packaging and Sizes: Larger bottles increase value perception and reduce per-unit costs, while single-dose sachets offer convenience but at higher unit prices.

- Distribution Channels: E-commerce channels often provide more competitive pricing due to lower overhead than traditional retail.

Price Projection Outlook (2023-2030)

Based on current growth trends, formulation innovations, and regional market expansion, the following projections are made:

- North America: Prices will remain relatively stable, averaging USD 5.50 to USD 7.50 per 120 mL bottle through 2030, with slight inflationary adjustments (~3% annually).

- Europe: Slight price increases to EUR 4.50 to EUR 8.00, influenced by stricter regulatory standards and consumer demand for natural products.

- Asia-Pacific: Prices are expected to grow at 4-5% annually, with prices reaching USD 3 to USD 6 in emerging markets, driven by increased brand competition and manufacturing efficiencies.

- Emerging Markets: Lower baseline prices are likely to remain, but increased accessibility and brand presence may drive prices upward gradually.

Innovations such as proprietary natural extracts or dual-action formulations could command premium prices, potentially boosting average unit prices by up to 10-15%.

Market Opportunities and Challenges

Opportunities

- Product Innovation: Natural, sugar-free, and combination formulations could capture niche markets.

- Regional Expansion: Growing populations and increasing healthcare awareness in Asia-Pacific present substantial room for market penetration.

- Digital Marketing: E-commerce growth facilitates direct-to-consumer sales and price competition.

Challenges

- Regulatory Hurdles: Variations in regulatory standards may delay new product launches.

- Consumer Preferences: Price sensitivity in emerging markets requires cost-effective formulations.

- Market Saturation: Established brands may limit new entrants’ market share, especially in mature regions.

Conclusions and Strategic Recommendations

The antacid anti-gas liquid segment embodies a robust growth path driven by rising digestive health concerns and consumer preference for OTC solutions. Stakeholders should focus on:

- Innovating with natural and dual-function formulations to differentiate products.

- Tailoring pricing strategies to regional economic contexts, emphasizing affordability in emerging markets.

- Leveraging e-commerce platforms for expansion and competitive positioning.

- Ensuring compliance with evolving regulatory frameworks to mitigate entry delays.

Key Takeaways

- The global market for antacid anti-gas liquids is projected to grow at around 4.3% CAGR through 2030, fueled by increasing GI health concerns worldwide.

- Price points vary regionally, with North America maintaining a premium price environment, while Asia-Pacific offers cost-effective options with high growth potential.

- Innovation focusing on natural ingredients, convenience, and multi-functionality can command higher prices and capture market share.

- Strategic regional expansion and investment in digital channels are vital for capitalizing on emerging markets.

- Regulatory compliance remains a critical barrier and opportunity, requiring continuous monitoring and adaptation.

FAQs

1. What are the primary factors influencing the pricing of antacid anti-gas liquids?

Brand recognition, formulation complexity, packaging size, natural ingredients, and distribution channels predominantly determine product pricing.

2. Which regions offer the highest growth potential for these products?

The Asia-Pacific region presents the highest growth opportunity due to urbanization, rising income levels, and expanding healthcare infrastructure.

3. How do regulatory standards impact market pricing and entry?

Stringent standards can limit formulations, increase compliance costs, and delay product launches, influencing pricing and market accessibility.

4. What innovations could disrupt the current market pricing landscape?

Developments in natural, sugar-free, dual-action formulations, and personalized dosing solutions are likely to command premium pricing.

5. What strategic moves should new entrants consider?

Entering via regional markets with tailored formulations, leveraging e-commerce, and complying with local regulations can facilitate market penetration and optimal pricing strategies.

Sources:

[1] Fortune Business Insights, "Gastrointestinal Drugs Market Size, Share & Industry Analysis," 2022.

[2] World Gastroenterology Organisation, "Global Prevalence of Gastrointestinal Disorders," 2021.

[3] Research And Markets, "Asia-Pacific Gastrointestinal Drugs Market Trends," 2023.

More… ↓