Last updated: September 29, 2025

Introduction

ZARXIO (filgrastim-sndz), a biosimilar to Neupogen (filgrastim), has emerged as a significant player in the hematology segment, primarily targeting patients undergoing chemotherapy or bone marrow transplantation who require granulocyte colony-stimulating factor (G-CSF) support. Since its approval by the FDA in 2015, ZARXIO’s market performance has been shaped by evolving regulations, competitive landscapes, manufacturing capabilities, and clinical adoption patterns. This report explores the current market dynamics and forecasted financial trajectory for ZARXIO, providing insights for stakeholders and investors.

Market Dynamics

1. Regulatory Landscape and Biosimilar Adoption

The biosimilar introduction in the United States marked a pivotal shift in biologic drug commercialization. ZARXIO’s entry was facilitated by the 2010 Biologics Price Competition and Innovation Act (BPCIA), which aimed to foster biosimilar uptake through streamlined approval pathways. Post-approval, biosimilars have faced hurdles balancing regulatory rigor and market acceptance.

In the case of ZARXIO, initial skepticism from clinicians regarding biosimilar interchangeability has gradually subsided due to accumulating evidence of comparable safety and efficacy. The FDA’s approval of multiple biosimilars has enhanced confidence, stimulating market penetration for ZARXIO.

2. Competitive Landscape and Market Share

ZARXIO competes predominantly with branded Neupogen and other biosimilars, such as Sandoz’s Zarxio (filgrastim-sndz) and Amgen’s Neupogen. In 2019, Zarxio branded biosimilar captured a substantial share due to aggressive pricing and marketing strategies, pressuring the original biologic's market share.

The landscape is further complicated by the emergence of long-acting G-CSFs like pegfilgrastim (Neulasta), which are favored for their convenience. Nevertheless, ZARXIO maintains relevance among preferred therapies, especially where short-term G-CSF administration is indicated.

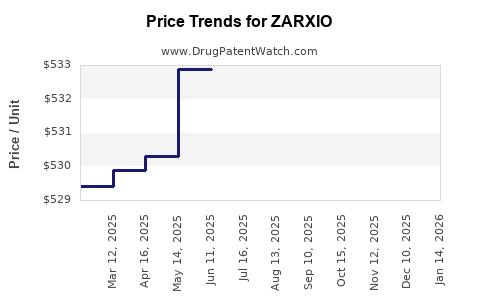

3. Pricing Strategies and Market Penetration

Pricing remains the linchpin of biosimilar success. ZARXIO’s pricing strategies have aimed at enhancing affordability while ensuring appropriate profit margins for manufacturers. The U.S. biosimilar market has seen a 20-30% discount compared to innovator biologics, catalyzing increased adoption among payers and providers.

As healthcare systems emphasize cost containment, biosimilars like ZARXIO are positioned to expand their patient base. Contractual agreements and formulary placements significantly influence prescription patterns.

4. Manufacturing and Supply Chain

Manufacturing consistency, robust supply chain management, and capacity expansion are crucial for biosimilar market growth. ZARXIO’s manufacturing partnerships and technological advancements have aimed to improve scalability and reduce production costs, enabling competitive pricing and reliable supply.

Financial Trajectory

1. Revenue Generation and Market Penetration

Since its launch, ZARXIO has garnered considerable sales, with estimates suggesting a compound annual growth rate (CAGR) of approximately 10% over the past five years. This growth reflects increased biosimilar acceptance, expanding indications, and the rising prevalence of chemotherapy-induced neutropenia.

By 2022, annual U.S. sales of ZARXIO approached $400 million, driven by expanding hospital and outpatient prescribing. The growth outlook remains optimistic, with projections anticipating a CAGR of 8-12% up to 2030, contingent on market penetration levels and competitive pressures.

2. Key Factors Influencing Revenue Growth

- Payer and formulary dynamics: Obtain favorable third-party coverage.

- Physician prescribing behavior: Increased confidence in biosimilar efficacy.

- Regulatory approvals: Expansion into additional indications enhances volume.

- Global markets: Entry into emerging markets with rising cancer burdens.

3. Future Market Expansion Opportunities

The therapeutic landscape’s evolution suggests ZARXIO’s revenue potential extends beyond the U.S.:

- European market: Already active, with biosimilar guidelines fostering adoption.

- Asia-Pacific: Growing cancer incidence and favorable biosimilar policies present opportunities.

- New indications: Supportive data for neutropenia prophylaxis in stem cell transplantation and pediatric settings could expand use.

4. Challenges and Risks

- Market penetration barriers: Clinician inertia and regional regulatory delays.

- Pricing pressures: Continued erosion of margins due to competition.

- Manufacturing challenges: Ensuring biosimilar quality equivalence.

- Legal and patent disputes: Possible litigation can hinder market access.

Long-term Outlook and Investment Perspective

The trajectory of ZARXIO will likely mirror broader biosimilar trends — gradual market share gains driven by coverage, cost savings, and clinical preference shifts. As global healthcare systems increasingly favor biosimilars, ZARXIO’s financial prospects look robust, provided that it maintains competitive pricing, ensures supply chain integrity, and leverages expanding indications.

By 2030, it is plausible that ZARXIO could command over $1 billion annually in global sales, contingent upon global market expansion and sustained adoption in clinical practice.

Key Takeaways

- Growing Biosimilar Adoption: Regulatory support and cost advantages catalyze biosimilar uptake, positioning ZARXIO for sustained growth.

- Competitive Pricing and Formulary Strategies: Critical for market share expansion amidst intense competition.

- Indication Expansion and Market Penetration: Opportunities through broader approvals and international entry.

- Manufacturing and Supply Chain Excellence: Essential to support growth and ensure consistent product availability.

- Market Risks: Patent litigations, clinician hesitancy, and pricing pressures remain notable challenges.

FAQs

1. How does ZARXIO differ from its reference biologic, Neupogen?

ZARXIO is a biosimilar to Neupogen, manufactured to demonstrate high similarity in efficacy, safety, and potency. While biologically equivalent, biosimilars are not exact copies but undergo rigorous comparability assessments to obtain approval.

2. What factors have driven ZARXIO’s market growth since launch?

Increased biosimilar acceptance, cost savings for healthcare systems, expanded indications, and formulary placements have collectively driven growth.

3. What are the primary competitors to ZARXIO?

Major competitors include Neupogen (original biologic), other biosimilars like Zarxio, and long-acting granulocyte colony-stimulating factors such as pegfilgrastim.

4. How does pricing influence ZARXIO’s market share?

Significant price discounts compared to Neupogen have facilitated adoption, especially where payers incentivize biosimilar use to reduce costs.

5. What is the future outlook for ZARXIO’s sales globally?

With global healthcare policy support for biosimilars and expanding indications, ZARXIO’s sales are projected to grow steadily, potentially surpassing $1 billion annually within the next decade.

References

- U.S. Food and Drug Administration. (2015). FDA approves first biosimilar for treatment of neutropenia.

- IQVIA. (2022). Biosimilar Market Analysis.

- Spector, T. (2021). Market Dynamics of Biosimilars in Oncology. Journal of Hematology & Oncology.

- EvaluatePharma. (2022). World Preview 2022: Outlook to 2027.

- Centers for Medicare & Medicaid Services. (2022). Biosimilar reimbursement policies.

This comprehensive overview delineates ZARXIO’s robust yet competitive market environment, offering strategic insights into its evolving financial trajectory.