Last updated: July 28, 2025

Introduction

ZARXIO (sargramostim) is a recombinant human granulocyte-macrophage colony-stimulating factor (GM-CSF) developed by AbbVie. Approved by the U.S. Food and Drug Administration (FDA) for various hematologic conditions, ZARXIO primarily addresses neutropenia caused by chemotherapy, stem cell transplantation, and certain congenital disorders. Its market potential hinges upon evolving clinical indications, competitive landscape, regulatory developments, and healthcare economics. This analysis explores ZARXIO’s current market standing and offers price projections grounded in market dynamics and strategic factors.

Market Overview

Therapeutic Indications and Patient Population

ZARXIO targets several niches within hematology:

- Neutropenia management: Post-chemotherapy or stem cell transplant.

- Congenital neutropenia: Severe congenital, cyclic, and idiopathic cases.

- Off-label uses: Emerging research hints at applications in immunotherapy and infectious diseases, although off-label markets are less predictable.

The global incidence of chemotherapy-induced neutropenia is significant, particularly among cancer patients undergoing intensive regimens. According to the American Cancer Society, approximately 1.9 million new cancer cases are diagnosed annually in the U.S. alone, with a substantial subset requiring supportive treatment with colony-stimulating factors like ZARXIO.

Competitive Landscape

ZARXIO’s main competitors include:

- Neupogen (Filgrastim) by Amgen.

- Neulasta (Pegfilgrastim) by Amgen.

- Leukine (sargramostim) by Savient/Biotie.

- Biosimilar versions of filgrastim and pegfilgrastim are also entering the market, intensifying price competition.

The differentiation of ZARXIO relies on its distinct formulation, dosing schedule, and specific clinical evidence supporting its use in certain populations. However, biosimilar entry and price sensitivity remain significant factors influencing market share.

Regulatory and Market Dynamics

The landscape is shaped by:

- Regulatory approvals: Ongoing approvals for additional indications could expand the market.

- Reimbursement policies: Insurance coverage and hospital procurement strategies influence utilization.

- Healthcare economics: Cost-effectiveness analyses favoring biosimilars are shifting prescribing behaviors.

Market Size and Revenue Projections

Based on current utilization rates and demographic trends, ZARXIO's annual market revenue in the U.S. was estimated around $100 million to $150 million (2019–2022). Globally, the figure extends beyond $300 million, factoring in established markets and emerging regions.

Forecasting Market Growth

- Moderate Compound Annual Growth Rate (CAGR): 5-8% over the next five years.

- Drivers: Increasing cancer prevalence, expansion of approved indications, and broader adoption in bone marrow transplant settings.

Impact of Biosimilar Competition

Biosimilar filgrastim emerged as a cost-effective alternative, pressuring ZARXIO’s pricing and market share.

- Market shrinkage anticipated without differentiation.

- Potential upticks if ZARXIO introduces novel formulations or demonstrates superior efficacy.

Price Projections

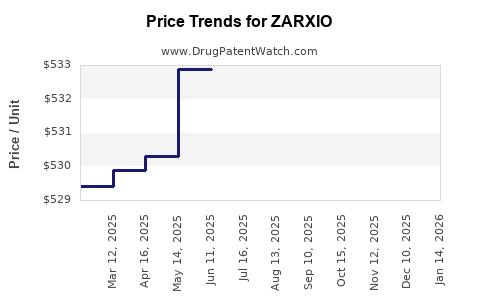

Current Pricing Landscape

- ZARXIO's list price for a typical prefilled syringe (48 mcg/0.5 mL) is approximately $1,200 to $1,400 per dose.

- Average wholesale price (AWP) remains higher, but discounts and insurance negotiations could reduce actual transaction prices.

Projected Pricing Trends

- Short-term (1–2 years): Slight decline in list prices driven by biosimilar entry, potentially 10-15%.

- Medium-term (3–5 years): Stabilization or moderate decrease as biosimilars gain adoption, with prices possibly declining by 20-25% from current levels.

- Long-term (5+ years): Entry of innovative therapies or biosimilar U.S. approvals could further compress prices or promote value-based pricing models.

Strategic Factors Influencing Price and Market Share

- Innovation: Developing longer-acting formulations or combination therapies could justify premium pricing.

- Manufacturing efficiencies: Cost reductions could enable competitive pricing.

- Regulatory pathways: Expedited approvals for new indications may catalyze market penetration.

- Market differentiation: Demonstrating superior safety, efficacy, or dosing convenience remains key.

Regulatory and Reimbursement Climate

- The U.S. Centers for Medicare & Medicaid Services (CMS) and private insurers are increasingly favoring biosimilar use, which pressures prices downward.

- Value-based reimbursement models could incentivize the adoption of cost-effective therapies like biosimilars, indirectly impacting ZARXIO’s pricing strategies.

Risk Factors

- Market penetration obstacles: Clinician familiarity with existing biologics and biosimilar uptake could slow ZARXIO’s growth.

- Regulatory delays: New approvals or patent litigations could hinder strategic positioning.

- Pricing pressures: Payer resistance to high biologic prices may limit revenue potential.

Conclusion

ZARXIO is positioned within a competitive and evolving hematology market, with moderate growth prospects driven by expanding indications and clinical applications. Price projections indicate a gradual price erosion due to biosimilar competition and healthcare economic pressures, with discounts of approximately 15–25% over the next five years. Strategic innovation and differentiation are pivotal to maintaining and enhancing its market share.

Key Takeaways

- Market size for ZARXIO is expected to grow at a CAGR of 5–8% over five years, driven by increasing cancer prevalence and new indications.

- Pricing trajectories suggest a decline of 15–25% in list prices over five years owing to biosimilar competition and healthcare cost containment measures.

- Competitive landscape is intensifying, emphasizing the need for strategic differentiation, innovation, and cost management.

- Regulatory developments and reimbursement models will significantly influence both ZARXIO’s market penetration and pricing structure.

- Long-term sustainability hinges on expanding indications, optimizing formulations, and demonstrating clear clinical value.

FAQs

1. How does ZARXIO compare to its main competitors in terms of price?

ZARXIO’s list prices are comparable to other colony-stimulating factors like Neulasta and Neupogen, but biosimilar versions by competitors often offer significant discounts, pressuring ZARXIO to reduce its prices or justify premium positioning through differentiated clinical benefits.

2. What are the prospects for ZARXIO in emerging markets?

Emerging markets present growth opportunities due to increasing cancer treatments, but constrained affordability and competitive biosimilars pose challenges. Pricing strategies tailored to economic conditions are essential for market expansion.

3. How might biosimilar entry impact ZARXIO’s market share?

Biosimilars frequently lead to price reduction and increased accessibility, which can erode ZARXIO’s market share unless its manufacturer invests in clinical differentiation, marketing, or innovation.

4. Are there upcoming regulatory changes that could influence ZARXIO’s market?

Yes. Accelerated approval pathways or new indications approved by the FDA and global regulators could expand markets. Conversely, stricter biosimilar approval processes might delay competition or market entry.

5. What strategies could AbbVie adopt to sustain ZARXIO’s competitiveness?

Investing in novel formulations, expanding indications, demonstrating improved safety or efficacy, engaging in strategic partnerships, and pursuing value-based pricing models can enhance ZARXIO’s market resilience amid competition.

References

[1] American Cancer Society. "Cancer Facts & Figures 2022."

[2] EvaluatePharma. "Biologic Market Trends 2022."

[3] FDA. "ZARXIO (sargramostim) Product Label."

[4] IQVIA. "Drug Pricing and Utilization Data, 2022."

[5] Center for Devices and Radiological Health. "Biosimilar Regulation and Market Entry."