TRESIBA Drug Profile

✉ Email this page to a colleague

Summary for Tradename: TRESIBA

| High Confidence Patents: | 53 |

| Applicants: | 1 |

| BLAs: | 1 |

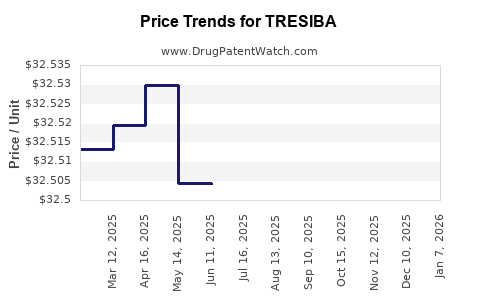

| Drug Prices: | Drug price information for TRESIBA |

| Recent Clinical Trials: | See clinical trials for TRESIBA |

Recent Clinical Trials for TRESIBA

Identify potential brand extensions & biosimilar entrants

| Sponsor | Phase |

|---|---|

| Gan and Lee Pharmaceuticals, USA | PHASE1 |

| Profil Institut fr Stoffwechselforschung GmbH | PHASE1 |

| Novo Nordisk A/S | PHASE1 |

Pharmacology for TRESIBA

| Established Pharmacologic Class | Insulin Analog |

| Chemical Structure | Insulin |

Note on Biologic Patents

Matching patents to biologic drugs is far more complicated than for small-molecule drugs.

DrugPatentWatch employs three methods to identify biologic patents:

- Brand-side disclosures in response to biosimilar applications

- DrugPatentWatch analysis and company disclosures

- Patents from broad patent text search

These patents were identified from disclosures by the brand-side company, in response to a potential biosimilar seeking to launch. They have a high certainty of blocking biosimilar entry. The expiration dates listed are not estimates — they're expiration dates as indicated by the brand-side company.

These patents were identified from searching various sources, including drug labels and other general disclosures from the brand-side company. This list may exclude some of the patents which block biosimilar launch, and some of these patents listed may not actually block biosimilar launch. The expiration dates listed for these patents are estimates, based on the grant date of the patent.

For completeness, these patents were identified by searching the patent literature for mentions of the branded or ingredient name of the drug. Some of these patents protect the original drug, whereas others may protect follow-on inventions or even inventions casually mentioning the drug. The expiration dates listed for these patents are estimates, based on the grant date of the patent.

1) High Certainty: US Patents for TRESIBA Derived from Brand-Side Litigation

No patents found based on brand-side litigation

2) High Certainty: US Patents for TRESIBA Derived from DrugPatentWatch Analysis and Company Disclosures

| Applicant | Tradename | Biologic Ingredient | Dosage Form | BLA | Patent No. | Estimated Patent Expiration | Source |

|---|---|---|---|---|---|---|---|

| Novo Nordisk Inc. | TRESIBA | insulin degludec | Injection | 203314 | ⤷ Get Started Free | 2035-04-30 | DrugPatentWatch analysis and company disclosures |

| Novo Nordisk Inc. | TRESIBA | insulin degludec | Injection | 203314 | ⤷ Get Started Free | 2035-08-27 | DrugPatentWatch analysis and company disclosures |

| Novo Nordisk Inc. | TRESIBA | insulin degludec | Injection | 203314 | ⤷ Get Started Free | 2036-03-08 | DrugPatentWatch analysis and company disclosures |

| Novo Nordisk Inc. | TRESIBA | insulin degludec | Injection | 203314 | ⤷ Get Started Free | 2026-07-17 | DrugPatentWatch analysis and company disclosures |

| Novo Nordisk Inc. | TRESIBA | insulin degludec | Injection | 203314 | ⤷ Get Started Free | 2037-11-15 | DrugPatentWatch analysis and company disclosures |

| Novo Nordisk Inc. | TRESIBA | insulin degludec | Injection | 203314 | ⤷ Get Started Free | 2037-11-17 | DrugPatentWatch analysis and company disclosures |

| Novo Nordisk Inc. | TRESIBA | insulin degludec | Injection | 203314 | ⤷ Get Started Free | 2037-02-24 | DrugPatentWatch analysis and company disclosures |

| >Applicant | >Tradename | >Biologic Ingredient | >Dosage Form | >BLA | >Patent No. | >Estimated Patent Expiration | >Source |

3) Low Certainty: US Patents for TRESIBA Derived from Patent Text Search

| Applicant | Tradename | Biologic Ingredient | Dosage Form | BLA | Patent No. | Estimated Patent Expiration | Source |

|---|---|---|---|---|---|---|---|

| Novo Nordisk Inc. | TRESIBA | insulin degludec | Injection | 203314 | ⤷ Get Started Free | 2034-04-30 | Patent claims search |

| Novo Nordisk Inc. | TRESIBA | insulin degludec | Injection | 203314 | ⤷ Get Started Free | 2038-06-27 | Patent claims search |

| Novo Nordisk Inc. | TRESIBA | insulin degludec | Injection | 203314 | ⤷ Get Started Free | 2037-05-24 | Patent claims search |

| Novo Nordisk Inc. | TRESIBA | insulin degludec | Injection | 203314 | ⤷ Get Started Free | 2036-12-05 | Patent claims search |

| Novo Nordisk Inc. | TRESIBA | insulin degludec | Injection | 203314 | ⤷ Get Started Free | 2037-10-13 | Patent claims search |

| Novo Nordisk Inc. | TRESIBA | insulin degludec | Injection | 203314 | ⤷ Get Started Free | 2038-11-02 | Patent claims search |

| Novo Nordisk Inc. | TRESIBA | insulin degludec | Injection | 203314 | ⤷ Get Started Free | 2036-10-21 | Patent claims search |

| >Applicant | >Tradename | >Biologic Ingredient | >Dosage Form | >BLA | >Patent No. | >Estimated Patent Expiration | >Source |

International Patents for TRESIBA

| Country | Patent Number | Estimated Expiration |

|---|---|---|

| Japan | 7590811 | ⤷ Get Started Free |

| European Patent Office | 3192524 | ⤷ Get Started Free |

| Poland | 1843809 | ⤷ Get Started Free |

| European Patent Office | 2264066 | ⤷ Get Started Free |

| Spain | 2507504 | ⤷ Get Started Free |

| Japan | 6758577 | ⤷ Get Started Free |

| Norway | 20061026 | ⤷ Get Started Free |

| >Country | >Patent Number | >Estimated Expiration |

Supplementary Protection Certificates for TRESIBA

| Supplementary Protection Certificate | SPC Country | SPC Expiration | SPC Description |

|---|---|---|---|

| 92213 | Luxembourg | ⤷ Get Started Free | PRODUCT NAME: INSULINE DEGLUDEC SOUS TOUTES LES FORMES PROTEGEES PAR LE BREVET DE BASE |

| C20130014 00133 | Estonia | ⤷ Get Started Free | PRODUCT NAME: DEGLUDEKINSULIIN/ASPARTINSULIIN;REG NO/DATE: K(2013)368 (LOPLIK) 23.01.2013 |

| C300597 | Netherlands | ⤷ Get Started Free | PRODUCT NAME: INSULINE DEGLUDEC EN INSULINE ASPART; REGISTRATION NO/DATE: EU/1/12/806/001EU/1/12/806/004EU/1/12/806/005EU/1/12/806/007EU/1/12/806/008 2013210121 |

| C02107069/01 | Switzerland | ⤷ Get Started Free | PRODUCT NAME: INSULIN DEGLUDEC; SWISSMEDIC-ZULASSUNG, 62562 12.03.2013 |

| 92226 | Luxembourg | ⤷ Get Started Free | PRODUCT NAME: COMBINATION D'INSULINE DEGLUDEC ET INSULINE ASPARTE SOUS TOUTES LES FORMES PROTEGEES PAR LE BREVET DE BASE; FIRST REGISTRATION DATE: 20130121 |

| CA 2013 00030 | Denmark | ⤷ Get Started Free | |

| 1390029-5 | Sweden | ⤷ Get Started Free | PRODUCT NAME: INSULIN DEGLUDEK; REG. NO/DATE: EU/1/12/807/001 20130121 |

| >Supplementary Protection Certificate | >SPC Country | >SPC Expiration | >SPC Description |

Market Dynamics and Financial Trajectory for the Biologic Drug: Tresiba

More… ↓