Last updated: November 7, 2025

Introduction

SkyRIZI (risankizumab) stands as a prominent biologic therapy targeting certain autoimmune disorders, notably moderate-to-severe plaque psoriasis. As a product of innovative monoclonal antibody technology, SKYRIZI has reshaped treatment paradigms, supported by compelling clinical data and strategic market positioning. This analysis explores the evolving market dynamics, competitive landscape, regulatory influences, and financial trajectory that shape SKYRIZI’s trajectory within the biopharmaceutical industry.

Market Overview and Therapeutic Indication

SkyRIZI, developed by AbbVie, was approved by the U.S. Food and Drug Administration (FDA) in June 2019 for plaque psoriasis and later for additional indications such as psoriatic arthritis and Crohn's disease in certain regions. Its mechanism targets interleukin-23 (IL-23), a cytokine critical in the inflammatory cascade influencing psoriasis pathogenesis.

The global psoriasis market, anticipated to reach USD 30 billion by 2028 (CAGR ~8%), exhibits high growth potential driven by increasing prevalence, unmet needs, and the expanding use of biologics. SkyRIZI aims to capture a significant share due to its efficacy and dosing convenience—a pivotal factor in treatment adherence.

Market Dynamics Influencing SKYRIZI

1. Competitive Landscape

SkyRIZI competes in a saturated biologics market dominated by key players such as Johnson & Johnson’s Stelara (Ustekinumab), Novartis’s Cosentyx (Secukinumab), and Janssen’s Tremfya (Guselkumab). Its principal advantage lies in its promising efficacy profile, sustained durability, and less frequent dosing—administered every 12 weeks after initial therapy.

Emerging biosimilars and next-generation IL-23 inhibitors pose long-term competitive threats. However, SkyRIZI’s patent protections and favorable pharmacokinetic profile provide a temporary moat.

2. Clinical and Regulatory Progress

Robust Phase III trials demonstrated superior efficacy of SkyRIZI over placebo and some comparators—marked by high PASI (Psoriasis Area Severity Index) 90/100 responses. Regulatory agencies, beyond the FDA, have granted approval or prioritized review pathways in multiple markets, facilitating rapid access and increasing sales potential.

Ongoing trials extending indications, such as Crohn’s disease and generalized pustular psoriasis, could diversify revenue streams and expand market share.

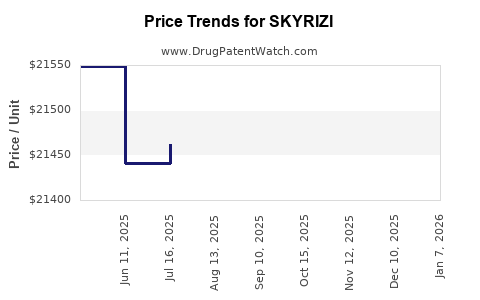

3. Pricing and Reimbursement Dynamics

Biologics like SkyRIZI often command premium pricing, justified by clinical benefits. Payor negotiations, reimbursement policies, and formulary placements directly influence uptake. Resistance to high-cost therapies among public and private payers imposes constraints, emphasizing the importance of demonstrating cost-effectiveness.

4. Market Penetration Strategies

AbbVie’s aggressive commercialization, including physician education, patient assistance programs, and real-world evidence generation, enhances adoption rates. Digital marketing initiatives and strategic alliances with healthcare providers further reinforce market penetration.

Financial Trajectory and Revenue Forecasts

1. Revenue Growth Trends

Since its launch, SkyRIZI has exhibited rapid revenue growth, propelled by increasing prescriptions in developed markets. In 2022, sales exceeded USD 2.5 billion, representing approximately 70% year-over-year growth, according to company disclosures. The uptake reflects a combination of existing indications and expanding approval scope.

2. Key Revenue Drivers

- Market Penetration: Steady expansion in the U.S., Europe, and Asia-Pacific.

- Indication Expansion: Additional approvals for psoriatic arthritis and Crohn’s disease broaden customer base.

- Patient Outreach: Enhanced access and affordability programs supporting adherence.

- Clinical Evidence: Favorable real-world data strengthening physicians’ confidence.

3. Revenue Projections

Analysts project SkyRIZI reaching USD 6-8 billion in annual sales by 2027, predicated on:

- Sustained growth rates (~20-25% annually).

- Successful indication expansion.

- Competitive positioning amidst biosimilar emergence.

Market penetration is expected to plateau as most eligible patients receive therapy, but new indications and geographic expansion will sustain growth momentum.

4. Cost Structure and Profitability

AbbVie’s extensive R&D investments and manufacturing efficiencies support high margins. The high-price point, coupled with scalable manufacturing processes, yields robust profitability prospects. Operating margins for SkyRIZI are projected to stabilize above 75%, contingent upon market uptake and competitive pressures.

Regulatory and Market Risks

- Patent Litigation and Biosimilar Competition: Patent expirations and legal challenges could erode exclusivity, impacting revenue.

- Pricing Pressures: Payer negotiations and international price controls, especially in Europe and Asia, may restrict revenue growth.

- Emerging Therapies: Substitutes with superior efficacy or safety profiles could challenge SkyRIZI’s market share.

- Regulatory Delays: Approval delays for new indications or in key markets could hinder growth.

Strategic Opportunities and Future Outlook

- Indication Diversification: Targeting additional autoimmune conditions like Crohn’s disease could unlock new revenue streams.

- Combination Therapies: Sysemining SkyRIZI with other biologics or small-molecule drugs may improve efficacy and patient outcomes.

- Geographic Expansion: Increasing penetration in emerging markets with large patient populations.

- Personalized Medicine: Integration with biomarker-driven approaches to enhance treatment precision.

These strategies are expected to support SkyRIZI’s financial trajectory, maintaining its position as a leading IL-23 inhibitor amid intensifying competition.

Key Takeaways

- Market Positioning: SkyRIZI’s efficacy, dosing convenience, and expanding indications bolster its competitive advantage and revenue potential.

- Growth Trajectory: Strong sales growth driven by market expansion, indication approvals, and strategic marketing suggest revenues could reach USD 8 billion annually by 2027.

- Competitive Risks: Patent expiries, biosimilar threats, and payer resistance necessitate continuous innovation and strategic adaptation.

- Financial Outlook: High-margin profile and scalable manufacturing underpin expected sustained profitability and cash flow generation.

- Strategic Focus: Diversification into new indications, geographic markets, and combination therapies will be pivotal in shaping long-term financial success.

FAQs

1. What are the primary factors contributing to SkyRIZI’s market success?

Its high efficacy, convenient dosing schedule (every 12 weeks), and expanding approved indications have been critical. Strategic marketing and favorable clinical trial outcomes also play vital roles.

2. How does SkyRIZI compare to competing biologics?

SkyRIZI demonstrates superior PASI response rates and sustained durability in trials. Its less frequent dosing provides convenience benefits over some competitors like Stelara and Secukinumab.

3. What are the key risks impacting SkyRIZI’s future revenues?

Patent expirations, biosimilar competition, payer pressure, and regulatory delays pose significant risks to revenue streams.

4. Which emerging indications could significantly impact SkyRIZI’s market position?

Potential approval for Crohn’s disease, psoriatic arthritis, and other autoimmune conditions could substantially expand its market footprint.

5. How is AbbVie’s commercialization strategy influencing SkyRIZI’s adoption?

Aggressive physician education, patient assistance programs, and digital outreach have facilitated rapid uptake and sustained market penetration.

References

- [1] AbbVie. SkyRIZI (risankizumab) prescribing information. 2022.

- [2] MarketWatch. Global psoriasis market forecast 2023-2028.

- [3] FDA. SkyRIZI (risankizumab) approval and label updates.

- [4] EvaluatePharma. Biologics market analysis, 2023.

- [5] IMS Health. Biologic drug pricing and reimbursement trends, 2022.