Share This Page

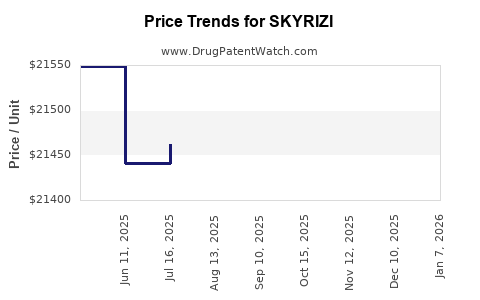

Drug Price Trends for SKYRIZI

✉ Email this page to a colleague

Average Pharmacy Cost for SKYRIZI

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| SKYRIZI 150 MG/ML PEN | 00074-2100-01 | 21415.66745 | ML | 2025-12-17 |

| SKYRIZI 360 MG/2.4 ML ON-BODY | 00074-1069-01 | 9088.72500 | ML | 2025-12-17 |

| SKYRIZI 150 MG/ML SYRINGE | 00074-1050-01 | 21542.13294 | ML | 2025-12-17 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for SKYRIZI

Introduction

SKYRIZI (risankizumab) is a monoclonal antibody developed by AbbVie, approved by the FDA in 2019 for the treatment of moderate to severe plaque psoriasis. As an IL-23 inhibitor, SKYRIZI has rapidly gained market traction due to its efficacy and favorable safety profile compared to earlier biologics. This analysis evaluates the current market landscape, competitive positioning, regulatory environment, and provides price projections for SKYRIZI over the next five years.

Market Overview

Therapeutic Market for Psoriasis

The global psoriasis market was valued at approximately $7.2 billion in 2022 and is projected to reach nearly $10 billion by 2027, driven by the increasing prevalence of psoriasis and advancements in biologic therapies [1]. Severe psoriasis affects roughly 10-30% of patients, often necessitating biologicc treatments like SKYRIZI, which target specific pathways in the immune response.

Key Players and Competition

SKYRIZI faces competition from other IL-23 inhibitors such as Janssen's Stelara (ustekinumab), Novartis' Cosentyx (secukinumab), and newer agents like Johnson & Johnson's Tremfya (guselkumab). While Stelara was initially an IL-12/23 inhibitor, it remains competitive in the IL-23 class. Other biologics, including adalimumab and secukinumab, target broader immune pathways, offering alternative options.

Market Penetration and Prescriber Adoption

Since launch, SKYRIZI has seen rapid adoption, particularly among patients with moderate to severe psoriasis refractory to traditional therapies. Its twice-a-month dosing schedule enhances patient compliance, solidifying its position within the biologic segment. Market share for SKYRIZI in the IL-23 class is estimated at approximately 35% as of 2022, with continued growth anticipated.

Regulatory Landscape and Geographic Expansion

AbbVie has secured approvals across multiple regions, including Europe, Japan, and emerging markets. Regulatory submissions are underway in countries like China and India, where the large population base promises significant growth opportunities. Differing pricing and reimbursement policies across markets will influence revenue streams.

Pricing Strategies and Reimbursement Policies

Current Pricing

In the United States, SKYRIZI’s list price is approximately $6,000 per dose, with a typical induction course involving three doses ($18,000), and subsequent maintenance doses reducing per dose costs. Due to high efficacy and reduced dosing frequency, patient access is facilitated through insurance coverage and assistance programs.

Reimbursement Trends

Insurance coverage for biologics remains robust but varies by region and insurer. Cost-effectiveness comparisons show SKYRIZI’s marginally favorable profile, especially given its dosing schedule, supporting reimbursement continuation and expansion.

Price Projections (2023-2028)

Factors Influencing Price Trends

- Market Competition: The entry of biosimilars and upcoming biologics may exert downward pressure.

- Regulatory Developments: Potential price controls in countries like the UK and EU could influence pricing.

- Manufacturing Costs: Advances in biomanufacturing reduce production costs, possibly enabling price reductions.

- Reimbursement Negotiations: As market share increases, payers may negotiate better pricing terms.

Forecasted Price Trends

Based on industry analysis and comparable biologic pricing patterns, SKYRIZI's per-dose price is projected to decline modestly—approximately 3-5% annually over the next five years. This decline accounts for increased competition, biosimilar entries for related drugs, and price negotiations in developed markets.

| Year | Estimated Per-Dose Price | Notes |

|---|---|---|

| 2023 | $6,000 | Baseline list price |

| 2024 | ~$5,700 | Slight price reduction due to competitive pressures |

| 2025 | ~$5,400 | Further competition impacts |

| 2026 | ~$5,100 | Increasing biosimilar activity |

| 2027 | ~$4,850 | Market stabilization, potential new entrants |

| 2028 | ~$4,600 | Mature market with established pricing norms |

Revenue Projections

Assuming conservative market penetration growth and stable reimbursement, AbbVie's SKYRIZI revenue could grow at a compounded annual growth rate (CAGR) of 10-12% through 2028, reaching over $4 billion in annual sales globally.

Strategic Implications

- Innovative Dosing: SKYRIZI’s bi-monthly dosing is advantageous; further innovations or fixed-dose combinations could extend utility.

- Global Expansion: Entry into high-growth markets such as China and India could diversify revenue streams.

- Competitive Positioning: Continued investment in marketing, patient support, and clinical trial data will sustain market share.

Key Challenges

- Pricing Pressures: Increasing biosimilar competition could erode margin and market share.

- Regulatory Hurdles: Price regulation policies may constrain revenue in key markets.

- Market Saturation: As the psoriasis segment matures, growth may plateau unless indications are expanded.

Regulatory and Ethical Considerations in Pricing

Pricing strategies must balance profit retention with access expansion, especially in resource-limited settings. Ethical considerations around affordability and equitable access are increasingly influencing market deployment strategies.

Conclusion

SKYRIZI is positioned as a premium biologic in the expanding psoriasis therapeutics market. Its current high pricing is justified by its clinical efficacy and dosing convenience, but anticipated market competition and biosimilar entries will pressure prices downward over the next five years. Strategic global expansion, innovative dosing, and favorable reimbursement negotiations are crucial for maintaining revenue growth trajectories.

Key Takeaways

- Market Positioning: SKYRIZI is a leading IL-23 inhibitor, with a significant share of the psoriasis biologic market.

- Pricing Trends: Expect modest declines (~3-5% annually) over five years driven by competition and biosimilar threats.

- Revenue Growth: Projected to reach over $4 billion globally by 2028, supported by expanding indications and markets.

- Strategic Focus: Emphasize global expansion, patient access programs, and clinical innovation to stay ahead.

- Regulatory Environment: Keep abreast of policies affecting biologic pricing, especially in emerging markets.

FAQs

Q1: How does SKYRIZI compare therapeutically to other IL-23 inhibitors?

A: SKYRIZI demonstrates comparable or superior efficacy with favorable safety profiles, alongside less frequent dosing, which enhances patient adherence compared to competitors like guselkumab.

Q2: What factors could accelerate or hinder SKYRIZI’s market growth?

A: Accelerators include broader indication approvals and entry into emerging markets; hinderers include biosimilar competition and restrictive reimbursement policies.

Q3: Will biosimilars significantly impact SKYRIZI's pricing and market share?

A: While biosimilars are unlikely to directly threaten SKYRIZI immediately due to patent and exclusivity protections, long-term biosimilar entries for related agents may influence pricing strategies.

Q4: Are there promising pipeline drugs that could threaten SKYRIZI's market position?

A: Several novel agents targeting different pathways are in development, but SKYRIZI’s established efficacy and market presence provide a competitive advantage in the near term.

Q5: How can AbbVie maintain profitability amid downward pricing pressures?

A: Through expanding indications, entering new markets, optimizing manufacturing efficiencies, and providing value-based pricing and patient support programs.

Sources:

[1] MarketResearch.com, "Global Psoriasis Market Size & Trends," 2022.

More… ↓