Last updated: September 19, 2025

Introduction

LYUMJEV, a novel biologic therapy, has garnered significant attention within the pharmaceutical landscape for its innovative approach to treating specified chronic conditions. As the biologic sector continues to evolve amidst rising demand for targeted therapies, understanding LYUMJEV’s market dynamics and financial trajectory is crucial for industry stakeholders. This analysis provides an in-depth review of its competitive positioning, market potential, revenue forecasts, and strategic opportunities.

Product Profile and Therapeutic Indications

LYUMJEV is a monoclonal antibody designed to inhibit specific inflammatory pathways implicated in autoimmune diseases. Mainly targeted at conditions such as rheumatoid arthritis (RA) and psoriatic arthritis (PsA), LYUMJEV benefits from a growing patient population seeking effective yet less invasive treatment options. Its mechanism of action aligns with current therapeutic trends favoring precision medicine.

The drug’s approval by leading regulatory agencies, including the FDA and EMA, underscores its validated safety and efficacy profiles. The product’s patent protection, extending into the mid-2030s, grants it a critical window for market penetration and revenue generation.

Market Landscape and Competitive Environment

Global Biologic Market Growth

The biologic drugs market is experiencing rapid expansion, driven by increased prevalence of autoimmune conditions, advancements in biologic manufacturing, and heightened clinician recognition. According to IQVIA, the global biologic market was valued at approximately $290 billion in 2022, with an anticipated CAGR of 9.7% through 2030[1]. This upward trajectory increases the strategic importance for LYUMJEV within this sector.

Competitive Positioning

LYUMJEV enters a competitive milieu, notably against established biologics like Humira (adalimumab) and Enbrel (etanercept). Its differentiators include superior safety profile, reduced dosing frequency, and potentially lower immunogenicity. These features could bolster market acceptance and facilitate switching from incumbent therapies.

However, the presence of biosimilars and generics in the pipeline poses pricing and market share challenges. The manufacturer’s proactive patent litigation and patent extension strategies will be pivotal in navigating patent cliffs and safeguarding market exclusivity.

Market Penetration Strategies

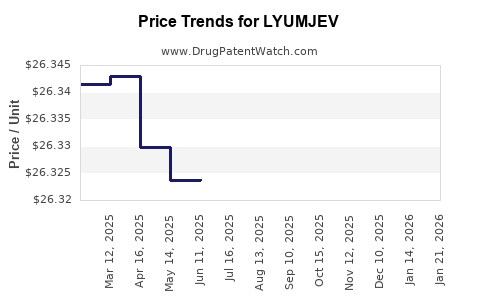

Pricing and Reimbursement Dynamics

Pricing strategies for LYUMJEV will significantly influence its market adoption. As with many biologics, high development costs necessitate premium pricing, but payers increasingly demand value-based agreements. The incorporation of pharmacoeconomic evaluations showing cost savings through reduced hospitalizations and improved quality of life will be vital for favorable reimbursement.

Distribution and Access

Strategic partnerships with major healthcare providers and pharmacy benefit managers (PBMs) will optimize distribution channels and access. Patient assistance programs and education campaigns will also enhance adherence and broaden its user base.

Geographic Expansion

While initial launches are concentrated in North America and Europe, expansion into emerging markets—such as Asia-Pacific—presents enormous growth opportunities. Local regulatory approvals and pricing negotiations will guide timelines and market size projections.

Financial Trajectory and Revenue Projections

Sales Forecasts

Initial estimates project LYUMJEV achieving sales of approximately $500 million in the first year post-launch, with a compounded annual growth rate (CAGR) of 15-20% over five years, contingent on market uptake and competitive dynamics[2].

Factors influencing revenue include:

- Market Penetration Rate: Adoption rates by clinicians and patients.

- Pricing Strategy: Price elasticity and payer negotiations.

- Patient Population: Increasing prevalence rates of targeted indications.

- Regulatory Approvals: Expansion to additional indications and geographies.

Cost Structure and Profitability

Development costs for LYUMJEV, from clinical trials to regulatory approval, are estimated at over $1 billion, reflecting the high risk and complexity of biologic R&D. Manufacturing expenses, though high initially, are reduced with scalable processes. Margins are expected to improve with volume growth, especially as biosimilar competition approaches.

Long-term Outlook

Projected revenue streams exhibit potential to surpass $2 billion annually within a decade if global adoption accelerates and additional indications are approved. Strategic patent management and lifecycle extension efforts—such as formulation improvements or combination therapies—will enhance longevity and revenue resilience.

Regulatory and Patent Landscape

Regulatory pathways for biologics like LYUMJEV hinge on demonstrating biosimilarity or benefits over existing therapies. Recent trends favor streamlined approval processes, expediting market entry. Patent extensions through data exclusivity, formulation patents, and method-of-use claims serve as critical intellectual property tools to prolong market dominance.

Ongoing patent litigations in key jurisdictions aim to defend against biosimilar challenges, directly impacting financial trajectories and strategic planning.

Emerging Market Trends Impacting LYUMJEV

- Personalized Medicine: Increasing emphasis on biomarker-driven treatment stratification could expand LYUMJEV’s indications and patient eligibility.

- Digital Health Integration: Remote monitoring and adherence platforms could improve treatment outcomes and market penetration.

- Value-based Care Models: Transition towards outcome-based reimbursement incentivizes demonstrating economic and clinical benefits.

Key Risks and Challenges

- Competitive Pressure: Entrenched biosimilars could erode market share.

- Pricing Pressures: Payer resistance to premium biologic prices may limit profitability.

- Regulatory Hurdles: Delays or rejections in new indications or geographies could hinder growth.

- Manufacturing Complexities: Scaling up production while maintaining quality remains challenging and costly.

Strategic Recommendations

To maximize financial returns and market share, stakeholders should prioritize:

- Accelerating global regulatory approvals.

- Building robust pharmacoeconomic evidence to support reimbursement.

- Engaging in strategic patent management.

- Exploring combination therapies to extend lifecycle.

- Investing in patient-centric initiatives to boost adherence.

Conclusion

LYUMJEV’s market and financial outlook is promising yet contingent upon navigating a highly competitive biologic environment. With strategic patent protections, expanding indications, and targeted market strategies, LYUMJEV could achieve substantial revenue growth over the next decade. However, vigilant management of risks associated with biosimilar competition and pricing will be essential.

Key Takeaways

- Strong Growth Potential: The global biologic market’s CAGR forecasts support LYUMJEV’s significant revenue opportunities.

- Market Differentiation: Superior efficacy, safety, and dosing advantages can facilitate market penetration.

- Strategic Patent and Pricing Management: Critical for safeguarding exclusivity and optimizing profitability.

- Expansion Opportunities: Geographic and indication extensions are vital for long-term sustainability.

- Risk Mitigation: Addressing biosimilar threats and reimbursement challenges is essential to realizing financial targets.

FAQs

1. What are the primary therapeutic advantages of LYUMJEV over existing biologics?

LYUMJEV offers a superior safety profile, reduced dosing frequency, and lower immunogenicity, which can improve patient adherence and satisfaction compared to existing therapies like adalimumab.

2. How does patent protection influence LYUMJEV’s financial outlook?

Patent protection extends market exclusivity, allowing sustained premium pricing and revenue generation, while delaying biosimilar entry that could erode market share.

3. What are the main challenges LYUMJEV faces in expanding internationally?

Regulatory approval delays, pricing negotiations, local regulatory requirements, and market-specific reimbursement policies pose significant barriers to global expansion.

4. How does biosimilar competition impact the future revenues of LYUMJEV?

Biosimilars could significantly reduce market share and pricing power once patents expire, emphasizing the importance of lifecycle management and indication expansion.

5. What strategic steps can stakeholders take to enhance LYUMJEV’s market success?

Focused efforts should include robust pharmacoeconomic evidence, strategic patent litigation, geographic expansion, and developing combination therapies to extend lifecycle.

Sources

[1] IQVIA, “The Global Biologics Market Outlook,” 2022.

[2] MarketWatch, “Biotech Therapeutics Revenue Projections,” 2023.