Last updated: September 19, 2025

Introduction

Humalog (insulin lispro) is a rapid-acting insulin analog developed by Eli Lilly and Company for managing blood glucose levels in people with diabetes mellitus. Since its launch in 1996, Humalog has become a cornerstone in diabetes management, benefiting from technological advances and evolving healthcare landscapes. This article examines the current market dynamics, financial trajectory, competitive environment, regulatory influences, and future growth prospects for Humalog within the global biologic drug sector.

Market Landscape and Demand Drivers

The global diabetes epidemic remains a critical driver of the insulin market. According to the International Diabetes Federation, approximately 537 million adults worldwide suffer from diabetes as of 2021, with projections reaching 783 million by 2045 (IDF, 2021). Insulin therapy constitutes a fundamental treatment modality, especially for type 1 diabetes and advanced type 2 cases.

Humalog’s position as a fast-acting insulin analog capitalizes on the need for precise glycemic control, especially around meal times. Its rapid onset and shorter duration of action offer improved postprandial glucose management, enhancing patient safety and quality of life. As awareness and diagnosis rates increase globally, demand for rapid-acting insulin analogs like Humalog rises correspondingly.

The expansion in developed markets such as North America and Europe is driven by healthcare infrastructure, high disease prevalence, and reimbursement coverage. Emerging markets—particularly China, India, and Brazil—are experiencing rapid growth due to rising diabetes incidence, urbanization, and increasing healthcare access.

Growth in personalized medicine and technological integration, such as connected insulin pens and continuous glucose monitoring, further supports the demand for optimized insulin formulations like Humalog.

Competitive Landscape

Humalog competes primarily with Novo Nordisk’s NovoRapid (insulin aspart) and insulin glulisine (Apidra), along with biosimilar products that have entered the market post-patent expiry. Key factors influencing market share include efficacy, safety profile, ease of use, and formulary positioning.

Despite Eli Lilly's historical dominance, the expiration of patent protections in some territories has facilitated increased biosimilar adoption, intensifying competitive pressure. The entry of biosimilars is expected to lower prices and expand access, especially in price-sensitive markets.

Additionally, emerging treatments such as ultra-rapid insulins, inhaled insulins, and oral insulin formulations present potential future competition, although they are currently in various stages of development and regulatory review.

Regulatory Environment

Regulatory agencies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) play pivotal roles. Approval pathways for biosimilars and new formulations influence market entry strategies and timing.

Humalog’s initial patent protections provided exclusive market rights, but subsequent patent expirations have opened avenues for biosimilar development. Eli Lilly has responded by pursuing patent extensions and developing next-generation formulations to delay biosimilar erosion.

In markets such as the U.S. and European Union, reimbursement policies and drug pricing regulations significantly impact market access. The Biden administration’s initiatives for insulin price caps and broader affordability programs could influence future sales volumes.

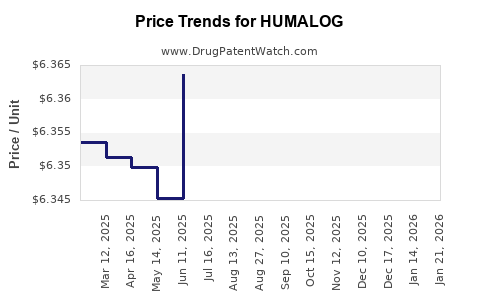

Financial Trajectory

Humalog has historically generated robust revenues for Eli Lilly, accounting for a significant share of its diabetes portfolio. In 2022, Lilly’s diabetes division reported approximately $8.4 billion in sales, with Humalog representing a substantial proportion (Eli Lilly Annual Report, 2022).

The company’s financial trajectory for Humalog is shaped by several factors:

-

Patent Expiry and Biosimilar Entry: The expiration of key patents in various regions has led to increased biosimilar competition, exerting downward pressure on prices and margins. Nevertheless, Lilly’s strategic deployment of next-generation analogs and reformulations aims to sustain revenue streams.

-

Pricing and Reimbursement Negotiations: Price regulation measures, especially in the U.S. and Europe, may restrain revenue growth. However, Lilly’s ongoing negotiations with payers, coupled with efforts to demonstrate Humalog’s clinical value, aim to mitigate declines.

-

Market Expansion: Growth in emerging markets offers additional revenue streams, though price controls and healthcare infrastructure limitations pose challenges.

-

Product Innovation: Introduction of new formulations, such as ultra-rapid insulins, enhances Lilly’s pipeline and offers potential for premium pricing, offsetting biosimilar competition.

Eli Lilly’s investment in manufacturing capacity, development of biosimilar fast-acting insulins, and digital health integration forecast a mixed but resilient financial outlook for Humalog. Revenue growth is expected to stabilize in mature markets but remain buoyant in emerging economies.

Future Outlook and Strategic Considerations

The long-term growth of Humalog hinges on multiple factors:

-

Pipeline Development: Eli Lilly’s pipeline includes next-generation ultra-rapid insulins, which may outperform Humalog in onset and duration, potentially capturing market share.

-

Digital and Connected Devices: Integration with glucose monitoring systems and smart delivery devices will enhance user experience and adherence, providing competitive differentiation.

-

Regulatory and Policy Shifts: Favorable policies promoting insulin affordability, along with regulatory approvals for biosimilar insulins, could reshape the landscape. Eli Lilly’s strategic responses, including patent litigation and formulation innovation, will influence competitive positioning.

-

Global Access Initiatives: Expanding access in low- and middle-income countries remains a priority but entails navigating complex reimbursement and distribution channels.

The combination of rising diabetes prevalence and technological advancements positions Humalog favorably for continued relevance, provided Eli Lilly successfully manages patent protections and market competition.

Conclusion

Humalog remains a vital component in the global insulin market, underpinned by steadily increasing demand driven by the diabetes crisis and advancements in delivery and monitoring technologies. While patent expirations and biosimilar competition pose challenges, Eli Lilly’s strategic investments in innovation, pipeline development, and market expansion bolster its prospects. Success will depend on navigating regulatory landscapes, maintaining pricing strategies, and differentiating through digital health integration. Overall, Humalog’s financial trajectory remains cautiously optimistic, with sustainable growth potential across mature and emerging markets.

Key Takeaways

- The global diabetes epidemic sustains demand for rapid-acting insulins like Humalog, especially as healthcare infrastructure improves worldwide.

- Patent expiries lead to biosimilar competition, exerting pricing pressure but also motivating innovation and pipeline investments.

- Eli Lilly’s focus on next-generation formulations and digital health solutions aims to sustain market relevance and revenue streams.

- Evolving regulatory policies and pricing negotiations are critical factors impacting Humalog’s future financial performance.

- Growth opportunities exist in emerging markets and through technological integration, but challenges include pricing pressures and market access barriers.

FAQs

1. How has biosimilar competition affected Humalog’s market share?

Biosimilars have encroached on Humalog’s market share in regions where patent protections have expired, leading to price competition and profit margin pressures. Eli Lilly’s response includes developing next-generation insulins and reformulations to retain market positioning.

2. What are the emerging alternative therapies to Humalog?

Novel ultra-rapid insulins, inhaled insulins, and oral insulin formulations are under development, aiming to improve convenience and glycemic control. These innovations could redefine treatment paradigms and challenge Humalog’s dominance.

3. How do regulatory policies influence Humalog’s sales?

Regulatory bodies influence market access through approval pathways, patent rulings, and drug pricing policies. In particular, approaches to insulin affordability and biosimilar approvals significantly impact sales trajectories.

4. What are the key growth strategies for Eli Lilly regarding Humalog?

Lilly’s strategies include pipeline expansion with next-generation insulins, digital health integration, entering emerging markets, and engaging in strategic patent litigations and collaborations to delay biosimilar entry.

5. What is the outlook for Humalog in emerging markets?

Growing diabetes prevalence and increasing healthcare access support expansion. However, affordability, healthcare infrastructure, and regulatory hurdles require tailored approaches for sustainable growth.

Sources:

[1] International Diabetes Federation, 2021. IDF Diabetes Atlas, 10th Edition.

[2] Eli Lilly and Company, Annual Report 2022.

[3] Market intelligence reports on insulin biosimilars and diabetes management.