Last updated: September 29, 2025

Introduction

HADLIMA (adalimumab-bwwd) represents a biosimilar development in the global autoimmune therapy market, targeting chronic conditions such as rheumatoid arthritis, psoriasis, and inflammatory bowel disease. Its entrance reflects a significant shift in biologic therapeutics, where biosimilars are redefining market competition, pricing strategies, and healthcare economics. This report offers a comprehensive analysis of the current market dynamics and the projected financial trajectory for HADLIMA, emphasizing competitive positioning, regulatory landscape, pricing patterns, and growth potential.

Market Overview and Context

The global biologic therapy market valued at approximately USD 300 billion in 2022 is projected to reach USD 480 billion by 2028, growing at a CAGR of over 8% (1). Biologics like adalimumab have revolutionized treatment paradigms but face cost-related challenges, prompting the proliferation of biosimilars. HADLIMA, developed by Samsung Bioepis and marketed by Biogen, entered a market characterized by fierce patent expirations, rising biosimilar approvals, and evolving healthcare policies favoring cost containment.

Patent Expiration and Market Entry

Humira (adalimumab) held the top spot in the pharmaceutical sales chart for several years, with peak annual sales exceeding USD 20 billion. Its patent expiration in the U.S. and Europe around 2016-2018 opened lucrative opportunities for biosimilar contenders like HADLIMA. The subsequent wave of biosimilars has substantially increased market access and pricing competitiveness (2).

Regulatory Landscape

Regulatory authorities, including the U.S. FDA and EMA, have established rigorous pathways for biosimilar approval, emphasizing analytical similarity, clinical efficacy, and safety. HADLIMA received regulatory approvals in multiple jurisdictions, which have been instrumental in securing market access (3). Differing regional approval timelines influence the geographic expansion and revenue realization.

Market Dynamics Impacting HADLIMA

Competitive Landscape

The biosimilar adalimumab market is highly competitive, with key players including Amgen’s Amjevita, Pfizer’s Abrilada, and Sandoz’s Hyrimoz, alongside HADLIMA. Pricing competition is intense, often dictating market share distribution. The ability to differentiate through supply chain, pricing strategies, and partnership arrangements is crucial.

Pricing and Reimbursement Policies

Healthcare payers and government agencies incentivize biosimilar adoption through formulary preferences and reimbursement policies. In the U.S., the inflation of biologic prices has catalyzed biosimilar penetration, with CMS and private insurers advocating for cost-effective therapeutic options (4). In Europe, policies vary but generally favor biosimilar uptake once equivalent efficacy is established.

Clinical Adoption and Physician Acceptance

Physician confidence in biosimilars remains vital. Extensive post-marketing studies, real-world evidence, and education initiatives have demonstrated biosimilars’ safety and efficacy, fostering acceptance. HADLIMA’s favorable clinical profile supports widespread adoption, though prescriber inertia persists globally.

Supply Chain and Manufacturing

Manufacturing capacity and supply chain robustness influence market availability and price stabilization. Samsung Bioepis’s strategic partnerships and investment in production facilities bolster HADLIMA’s supply credibility, contributing to stable market presence.

Financial Trajectory and Market Penetration

Revenue Estimates and Growth Potential

Post-launch, HADLIMA’s revenues are projected to steadily ascend, driven by the expiration of Humira’s patents and increasing biosimilar adoption. Industry estimates suggest biosimilar adalimumab revenues could capture 25-35% of the original biologic’s sales within five years of market entry (5). HADLIMA’s market share will correlate with regional approval dates, pricing strategies, and the competitive environment.

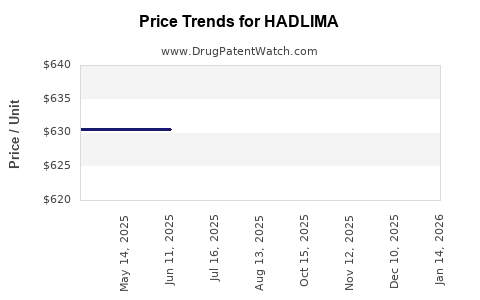

Pricing Strategy and Discounting

HADLIMA’s pricing is typically set at a 15-30% discount relative to the originator to incentivize prescriber switching and payer acceptance. As biosimilar competition intensifies, further discounts may be necessary to sustain market share, potentially compressing profit margins.

Market Expansion and Geographic Strategy

Initial sales tend to be concentrated in Europe, where biosimilar uptake is high, followed by North America. Emerging markets present growth opportunities, albeit tempered by reimbursement hurdles. Establishing partnerships and localized manufacturing can bolster penetration.

Long-term Financial Outlook

The cumulative revenues for HADLIMA are forecasted to increase significantly over the next five years. A tentative estimate projects annual revenues reaching USD 1 billion by 2026, assuming a conservative market share of 10-15% globally, combined with price erosion effects. Innovation, such as formulation improvements or additional indications, could further augment profit streams.

Key Market Drivers and Challenges

Drivers:

- Patent expiry of Humira and similar biologics.

- Cost-containment policies favoring biosimilars.

- Growing prevalence of autoimmune diseases.

- Advances in biosimilar manufacturing technology.

- Evolving regulatory pathways supporting biosimilar approvals.

Challenges:

- Prescriber and patient acceptance barriers.

- Price erosion due to aggressive discounting.

- Market entry barriers in certain geographies.

- Potential legal challenges related to biosimilar naming and interchangeability.

- Supply chain disruptions impacting availability.

Regulatory and Commercial Outlook

The regulatory environment remains favorable for biosimilar proliferation, with continuous clarification on interchangeability and substitution policies. Commercial success hinges on strategic collaborations, robust manufacturing, and proactive market education. The pathway for HADLIMA is likely to follow a phased approach—initial gains in mature markets, followed by expansion into emerging regions.

Conclusion

HADLIMA’s market dynamics are shaped by patent cliffs, evolving regulatory standards, and competitive biosimilar proliferation. Its financial trajectory looks promising, driven by an expanding global demand for cost-effective autoimmune therapies. However, success depends on strategic pricing, regional expansion, physician acceptance, and sustained manufacturing excellence. As biosimilars become more entrenched in the healthcare landscape, HADLIMA’s ability to adapt and differentiate will determine its long-term financial performance.

Key Takeaways

- The biosimilar market for adalimumab is highly competitive but presents substantial revenue opportunities, especially post patent expiration of Humira.

- Effective pricing and reimbursement strategies are vital for capturing market share amid intense discounting.

- Regulatory support and real-world evidence are pivotal in fostering physician confidence and patient acceptance.

- Supply stability and regulatory clarity on interchangeability will influence long-term market penetration.

- Companies investing in regional expansion and strategic partnerships are better positioned for sustained revenues.

FAQs

1. How does HADLIMA’s market entry compare to other adalimumab biosimilars?

HADLIMA entered the market among early biosimilar entrants with a strategic focus on cost competitiveness and regional approvals. Its differentiation relies on manufacturing quality, regional regulatory approvals, and partnerships. Compared to competitors, its success depends on timing, pricing strategies, and physician acceptance.

2. What factors influence the pricing of HADLIMA?

Pricing is influenced by regional regulations, competitive landscape, payer negotiation power, and manufacturing costs. To gain market share, HADLIMA is typically priced at a significant discount (15-30%) relative to Humira, with further discounts driven by competition.

3. What is the potential for HADLIMA in emerging markets?

Emerging markets offer growth potential due to increasing disease prevalence and cost containment needs. However, challenges such as reimbursement policies, regulatory barriers, and supply chain infrastructure may limit rapid expansion.

4. How do regulatory policies affect HADLIMA’s market potential?

Regulatory clarity on biosimilar approvals and interchangeability enhances market confidence. Regional policies that favor biosimilar substitution can accelerate adoption, directly impacting HADLIMA’s revenues.

5. What risks could impact HADLIMA’s financial performance?

Key risks include aggressive price competition, regulatory delays, legal challenges, supply chain disruptions, and physician hesitance. Strategic responses to these risks are essential to realize projected revenue growth.

Sources

[1] Fortune Business Insights, "Biologic Therapy Market Size, Share & Industry Analysis," 2022.

[2] IMS Health Reports, "Biologics and Biosimilars Market Review," 2022.

[3] FDA Approval Documents for HADLIMA, 2021.

[4] CMS Office of Actuary, "Biologic Drug Cost Containment Policies," 2022.

[5] Pharmaceutical Market Intelligence, "Biosimilar Adalimumab Revenue Forecast," 2022.