Last updated: September 23, 2025

Introduction

GRASTEK (ragwitek) is an FDA-approved biologic sublingual immunotherapy (SLIT) designed for allergy treatment, targeting allergic rhinitis and conjunctivitis caused by grass pollen. Since its approval in 2014, GRASTEK has carved a niche within the allergen immunotherapy market, driven by evolving patient preferences, regulatory landscapes, and competitive forces. This detailed analysis explores the market dynamics influencing GRASTEK and projects its financial trajectory amid emerging opportunities and challenges.

Market Landscape and Key Drivers

Growing Prevalence of Allergies

The global prevalence of allergic rhinitis impacts the demand for effective treatment options. According to the World Allergy Organization, allergic rhinitis affects up to 30% of adults and 40% of children worldwide [1]. As awareness about allergy management improves, more patients seek alternatives to symptomatic relief, favoring disease-modifying therapies like GRASTEK.

Shift Towards Subcutaneous and Sublingual Immunotherapies

Traditional allergy immunotherapy heavily relied on subcutaneous injections, which pose concerns regarding safety, convenience, and patient adherence. The emergence of SLIT, exemplified by GRASTEK, addresses these issues through enhanced safety profiles, ease of administration, and improved patient compliance [2]. The global allergy immunotherapy market is projected to reach USD 6.89 billion by 2028, growing at a CAGR of approximately 8.7% (DataMonitor, 2022), with SLIT gaining increasing acceptance.

Regulatory Approvals and Reimbursement Policies

GRASTEK’s regulatory pathway in multiple regions has expanded its market access. The European Medicines Agency (EMA) approved GRASTEK in 2018, facilitating broader European distribution [3]. In the United States, FDA approval in 2014 catalyzed adoption, supported by shifts towards reimbursement for allergy immunotherapy.

Reimbursement policies heavily influence market penetration. In the U.S., insurance coverage for allergy immunotherapy has improved, especially as the economic benefits of reducing long-term medication reliance and healthcare visits become evident [4]. Similar trends are observed in Europe, where reimbursement mechanisms increasingly favor immunotherapies.

Competitive Landscape

Main Competitors

GRASTEK faces competition from both traditional allergy immunotherapies (SCIT) and other SLIT products. Notable competitors include:

- Oralair (Stallergenes Greer): A SLIT tablet for grass pollen, approved in multiple markets including the EU and US.

- ACARIZAX (Merck): An oral allergic immunotherapy for house dust mite allergy, approved in Europe.

- D. A. T. (Dendroctonus Aspergillus Toxin): For specific indications.

While SCIT remains a significant part of the market, SLIT products like GRASTEK are gaining favor due to safety and convenience, creating a competitive dynamic that shapes market share distribution.

Market Penetration and Adoption Barriers

Despite advantages, GRASTEK’s adoption is slowed by factors such as clinician familiarity, patient awareness, and logistical hurdles associated with positioning SLIT as a mainstream treatment. Additionally, the cost of biologic formulations, often higher than conventional therapies, impacts payer decisions.

Financial Trajectory and Growth Potential

Sales Performance and Revenue Projections

Since its initial launch, GRASTEK’s sales have steadily increased. Industry analysis estimates that GRASTEK’s annual revenue in North America exceeds USD 50 million (2019 figures), with potential for growth as awareness spreads and more regions approve the product [5].

Projections suggest a compound annual growth rate (CAGR) of approximately 12–15% over the next five years. This optimistic outlook hinges on market expansion, improved reimbursement, and increased clinician acceptance.

Market Expansion Opportunities

- Geographical Expansion: Entry into Asian markets like Japan and South Korea, where allergy prevalence is high, offers substantial growth potential due to burgeoning middle-class populations seeking convenient allergy treatments.

- New Indications: Clinical trials investigating GRASTEK for pollen season duration extension and multi-allergen formulations could broaden its therapeutic scope.

- Combination Therapies: Potential development of combination biologic immunotherapies with other allergens or adjunct treatments could enhance efficacy and market appeal.

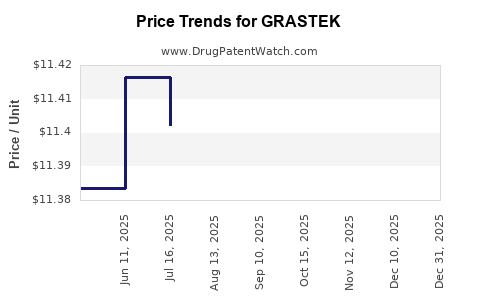

Pricing Strategies and Reimbursement Outlook

GRASTEK’s pricing remains competitive within the biologic allergen immunotherapy segment. As payers recognize the long-term cost savings from reduced healthcare utilization, reimbursement levels are expected to improve, positively impacting sales.

Challenges and Risks

Regulatory Hurdles and Market Saturation

Differences in approval timelines and regulatory requirements across regions can delay GRASTEK’s market entry. Furthermore, market saturation in mature regions could limit growth unless new formulations or indications emerge.

Pricing Pressures and Payer Constraints

Increasing pricing scrutiny and demand for value-based care models pose risks to profit margins. Payers may negotiate for discounts or prefer biosimilar substitutes, although biosimilars are less relevant due to the nature of biologic allergy therapies.

Competitive Innovation and Evolving Therapies

Advancements in biotech could introduce superior or more cost-effective biologics, challenging GRASTEK’s market position. Additionally, the development of peptide-based or mRNA-based allergy therapies could disrupt traditional biologic immunotherapy markets.

Conclusion

GRASTEK’s market dynamics are shaped by demographic drivers, evolving regulatory landscapes, innovation in allergen immunotherapy, and shifting payer strategies. Its financial trajectory appears promising, with projected steady growth driven by regional expansion, increased awareness, and ongoing clinical research validating its efficacy across more indications. However, competitive pressures, reimbursement complexities, and market maturation warrant vigilant strategic planning for sustained success.

Key Takeaways

- GRASTEK benefits from a rising demand for allergy immunotherapies, especially as SLIT becomes the preferred delivery modality.

- Expanding geographical access, notably in Asia and new European markets, constitutes critical growth avenues.

- Regulatory approvals and reimbursement policies remain pivotal; streamlined pathways enhance sales prospects.

- Competitive innovation demands continual product differentiation and clinical validation to maintain market leadership.

- Strategic engagement with payers and clinicians is essential to overcome adoption barriers and sustain financial growth.

FAQs

1. What factors influence GRASTEK’s market share in allergy immunotherapy?

Patient preference for non-injectable therapies, clinician familiarity, regulatory approvals, reimbursement policies, and competitive products all influence GRASTEK’s market share.

2. How does GRASTEK compare to other grass pollen immunotherapies?

GRASTEK offers the convenience of sublingual administration and a favorable safety profile, differentiating it from subcutaneous options like Oralair, which require injections. Its biologic formulation enhances efficacy for certain patient groups.

3. What are the growth prospects for GRASTEK in emerging markets?

Emerging markets with high allergy prevalence and improving healthcare infrastructure present significant opportunity. Regulatory approval processes and payer acceptance are critical success factors.

4. What challenges could hinder GRASTEK’s financial growth?

Market saturation, pricing pressures, delayed approvals, and competition from innovative therapies could slow revenue expansion.

5. Are there ongoing clinical studies that could expand GRASTEK’s indications?

Yes, ongoing trials are investigating multi-allergen formulations and broader use cases, which could enhance its market appeal and facilitate further commercialization.

References

[1] World Allergy Organization. "Allergy Prevalence and Trends." 2022.

[2] Bernstein, J.A. et al. "Immunotherapy for Allergic Rhinitis." Journal of Allergy and Clinical Immunology, 2020.

[3] European Medicines Agency. "GRASTEK (ragwitek) approval status." 2018.

[4] American Academy of Allergy, Asthma & Immunology. "Reimbursement and Access to Allergy Immunotherapy." 2021.

[5] IQVIA. "Biopharmaceutical Market Data and Forecasts." 2022.