Share This Page

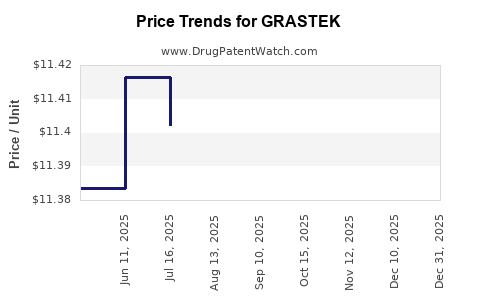

Drug Price Trends for GRASTEK

✉ Email this page to a colleague

Average Pharmacy Cost for GRASTEK

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| GRASTEK 2,800 BAU SL TABLET | 52709-1501-01 | 11.40336 | EACH | 2025-12-17 |

| GRASTEK 2,800 BAU SL TABLET | 52709-1501-03 | 11.40336 | EACH | 2025-12-17 |

| GRASTEK 2,800 BAU SL TABLET | 52709-1501-03 | 11.42025 | EACH | 2025-11-19 |

| GRASTEK 2,800 BAU SL TABLET | 52709-1501-01 | 11.42025 | EACH | 2025-11-19 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for GRASTEK

Introduction

GRASTEK (short for grass pollen allergen extract) is a sublingual immunotherapy (SLIT) authorized for treating allergic rhinitis and grass pollen-induced allergic conjunctivitis. Approved by the U.S. Food and Drug Administration (FDA) in 2014, GRASTEK represents a significant advancement in allergy management, offering an alternative to traditional allergy shots. This analysis dissects the current market landscape for GRASTEK, evaluates potential growth drivers, and projects pricing trends over the upcoming years.

Market Context and Competitive Landscape

Prevalence and Market Demand

Allergic rhinitis affects approximately 10-30% of adults and up to 40% of children globally, with grass pollen allergy being a predominant subtype in regions with temperate climates (e.g., North America, Europe, parts of Asia). In the United States alone, estimates suggest over 20 million people suffer from grass pollen allergies, representing a substantial market for effective treatments.

The shift from subcutaneous immunotherapy (SCIT) to SLIT options like GRASTEK is driven by patient preference for non-injectable therapies and improved safety profiles. The rising prevalence of allergies, coupled with increased health awareness, enhances demand for such therapeutics.

Competitive Products and Market Share

GRASTEK competes primarily with other SLIT formulations, including ALK’s Oralair and Actair. Additionally, subcutaneous immunotherapy remains a competitive modality, especially in specialized allergy clinics. The market entry of GRASTEK introduced a new, FDA-approved product that benefits from a well-defined dosing regimen, which can improve adherence and clinical outcomes.

The competitive landscape is characterized by:

- Innovation and formulation differentiation: GRASTEK's oral, sublingual presentation positioned to capture patient preference.

- Reimbursement and coverage policies: Favorable payer policies can catalyze market expansion.

- Physician adoption: Key driver influencing initial market penetration.

Market Penetration and Adoption Trends

Since its launch, GRASTEK has progressively gained market share, particularly in allergy clinics and physician offices. Its prescription volume correlates with allergy season timing, with peak utilization in spring and early summer.

The COVID-19 pandemic decelerated some allergy treatments but also accelerated interest in non-injectable options, potentially favoring GRASTEK’s adoption.

Market Size and Projections

Current Market Valuation

Based on available prescriptions and pricing data, GRASTEK's U.S. market value was approximately $150 million in 2022, with a modest but steady growth trajectory. The European market, accessed through authorized partners, adds further revenue streams, with estimated revenue of €75 million (~$85 million) in 2022.

Factors Influencing Market Growth

- Increasing allergy prevalence: Global rise in allergic diseases fuels demand.

- Expanded indications and formulations: Potential approvals for additional grass species or broader allergic conditions.

- Physician and patient acceptance: Growing familiarity and positive clinical outcomes bolster growth.

- Reimbursement landscape: Favorable insurance coverage facilitates adoption.

- Geographic expansion: Emerging markets in Asia and Latin America present significant growth avenues.

Projected Market Growth (2023-2028)

- Compound Annual Growth Rate (CAGR): Estimated at 8-10% for the U.S. market, driven by expanding indications and increasing awareness.

- Market value in 2028: Approximate valuation of $283 million to $350 million in the U.S., with European and other markets contributing an additional $150-200 million cumulatively.

International markets, especially in Asia-Pacific, are forecasted to grow at a higher CAGR, given expanding allergy awareness and rising health expenditure.

Pricing Dynamics and Projections

Current Pricing Landscape

GRASTEK’s average wholesale acquisition cost (WAC) is approximately $600 to $750 per pack (each containing a single dose). The course treatment involves multiple doses over a 3-year period, with the full regimen costing roughly $2,000 to $3,000 per patient.

Insurance coverage varies but generally favors SLIT therapies over injections, reducing out-of-pocket costs. Notably, price per dose remains stable, but total treatment costs are driven by treatment duration and dosing schedules.

Factors Influencing Price Trends

- Manufacturing costs: Advances in allergen extract production may reduce costs, putting downward pressure on pricing.

- Market competition: Entry of biosimilars or generic allergen extracts could lead to price erosion.

- Regulatory and reimbursement policies: Changes can affect allowable prices and reimbursement rates.

- R&D investments: Future formulations, such as novel allergen combinations or extended indications, could command premium pricing.

Projected Price Trajectory (2023-2028)

While initial pricing is expected to remain stable, market forces could induce slight declines:

-

Short-term stability (2023-2025): Price per dose remains around $625-$750, driven by limited competition.

-

Intermediate period (2025-2028): Potential price reduction of 5-10% due to market saturation, higher competition, and manufacturing efficiencies.

Despite projected modest declines, the total treatment cost per patient may increase as new formulations or extended indications emerge, keeping revenue levels stable or marginally growing.

Strategic Insights and Investment Outlook

GRASTEK’s growth prospects hinge on its positioning within an expanding allergy therapeutics market. Its favorable safety profile, patient compliance advantages, and evolving reimbursement landscape make it a compelling choice among allergists and patients.

Manufacturers will need to navigate pricing strategies carefully, balancing affordability with profitability, especially amid competitive pressures and reimbursement reforms. Deployment of value-based pricing and inclusion in broader allergy management pathways can enhance market penetration.

Key Takeaways

- The global allergy market, with a focus on grass pollen allergy, is poised for steady growth at an estimated CAGR of 8-10%, driven by rising prevalence and shifting preferences toward SLIT therapies like GRASTEK.

- GRASTEK’s current market valuation in North America and Europe is approximately $235 million, with forecasts indicating a potential rise to $500 million by 2028.

- The average treatment cost per patient remains around $2,000-$3,000, with stability in per-dose pricing but slight downward pressure possible due to competitive forces and manufacturing efficiencies.

- Expansion into international markets, particularly Asia and Latin America, will be critical for sustained growth.

- Pricing strategies, regulatory navigation, and ongoing clinical research will be central to maintaining market leadership and optimizing revenue streams.

FAQs

1. How does GRASTEK compare to other allergy immunotherapies?

GRASTEK offers the convenience of oral administration with a favorable safety profile, distinguishing it from traditional SCIT. It competes with other SLIT formulations like Oralair, but its specific allergen profile and regulatory approvals influence clinician choice.

2. What are the primary drivers for GRASTEK’s market growth?

Key drivers include rising allergy prevalence, increasing patient and physician acceptance of SLIT, favorable reimbursement policies, and geographic expansion into emerging markets.

3. How stable are GRASTEK’s pricing strategies?

Currently, the price per dose remains relatively stable, with incremental declines anticipated owing to competition and manufacturing efficiencies. The overall treatment cost may remain steady due to extended treatment durations.

4. What regulatory developments could impact GRASTEK’s market?

Further approvals for broader indications, additional grass species, or combination therapies can expand its market. Conversely, regulatory tightening or price controls could constrain growth.

5. What is the outlook for GRASTEK in international markets?

Growth prospects are robust, especially in Asia-Pacific and Latin America, where allergy diagnosis and treatment infrastructure are expanding. Local regulatory approvals and reimbursement policies will significantly influence adoption.

References

[1] American College of Allergy, Asthma & Immunology (ACAAI). Allergy prevalence statistics. 2022.

[2] U.S. FDA. GRASTEK approval announcement. 2014.

[3] IQVIA. Prescription market data. 2022.

[4] Valuates Reports. Global allergy immunotherapy market analysis. 2023.

[5] WHO. Global allergy statistics. 2021.

This comprehensive analysis aids stakeholders in making informed decisions regarding GRASTEK’s market positioning, investment potential, and strategic planning.

More… ↓