Last updated: September 25, 2025

Introduction

FULPHILA (Pegfilgrastim-jmdb) is a biosimilar biologic drug developed as a strategic alternative to biologic therapies addressing neutropenia, a common complication in cancer patients undergoing chemotherapy. Approved by the U.S. Food and Drug Administration (FDA) in 2022, FULPHILA represents a significant shift within the growing biologics landscape, driven by increasing demand for cost-effective treatment options and a robust pipeline of biosimilars designed to improve access and affordability. This analysis explores the key market dynamics shaping FULPHILA’s financial trajectory, including competitive positioning, market size, regulatory developments, and commercialization strategies.

Market Landscape: The Rise of Biosimilars in Oncology

Growing Demand for Biosimilars

The global biologics market stood at approximately $430 billion in 2022, with biosimilars accounting for a substantial share expected to grow at a CAGR of over 11% through 2030 ([1]). The oncology segment constitutes a significant portion of this growth, driven by increasing cancer incidence, expanding treatment landscapes, and healthcare cost pressures. Biosimilars like FULPHILA address these cost concerns by offering comparable efficacy at substantially reduced prices.

Market Drivers

- Cost Reduction Imperatives: Healthcare systems worldwide are prioritizing cost containment; biosimilars enable significant savings, especially in oncology where biologics such as Neulasta (filgrastim) dominate treatment regimens.

- Patent Expiries: Key biologics like Neulasta lost patent protection, paving the way for biosimilars to enter the market.

- Regulatory Facilitations: Agencies like the FDA and EMA have streamlined pathways for biosimilar approval, decreasing the time and cost to market entry ([2]).

FULPHILA’s Competitive Positioning

Product Profile and Differentiation

FULPHILA is a biosimilar pegfilgrastim, designed to stimulate neutrophil production, minimizing chemotherapy-induced neutropenia risk. It is priced approximately 15-20% lower than Neulasta, the reference biologic. Its biosimilarity to Neulasta was demonstrated through rigorous analytical, nonclinical, and clinical studies, ensuring it meets regulatory standards for safety, efficacy, and quality ([3]).

Market Entry and Adoption

Despite being a biosimilar, FULPHILA faces competition from multiple biosimilars launched across geographies. Its market penetration relies on:

- Physician Acceptance: Confidence in biosimilar efficacy and safety—established through extensive clinical data.

- Payer Reimbursement Policies: Favorable formulary placement and incentivization of biosimilars.

- Distribution Networks: Rapid supply chains aligned with oncology clinics and hospitals.

Intellectual Property Considerations

The biosimilar landscape is intertwined with patent litigations and exclusivity periods. FULPHILA’s manufacturer, Pfizer, capitalized on legal pathways to secure market access shortly after patent expiries of reference biologics, although potential patent litigation may pose future hurdles.

Market Size and Revenue Projections

Global and Regional Outlook

Global pegfilgrastim market revenues were valued at over $2.8 billion in 2022 ([4]). The biosimilar segment is expected to grow at a CAGR exceeding 12%, driven predominantly by mature markets like the U.S., Europe, and Japan.

In the U.S., the age-adjusted cancer prevalence is projected to reach approximately 20 million by 2030, translating into heightened demand for supportive care drugs like FULPHILA ([5]).

Revenue Estimation

- Initial Launch (2022-2024): Peaked at modest figures given early market penetration, estimated at $150–200 million for FULPHILA.

- Mid-term Outlook (2025-2028): As adoption accelerates, revenues are projected to surpass $400–500 million annually, contingent on market acceptance and reimbursement policies.

- Long-term Growth: With patent expiries of more biologics and expanded indications, FULPHILA’s revenues could approach $1 billion annually within the next decade ([6]).

Regulatory and Reimbursement Dynamics

Regulatory Strategies

Regulatory approvals in key regions, such as the FDA’s biosimilar pathway, facilitated FULPHILA's rapid market entry. Equivalent regulatory standards in Europe and Japan further amplify regional commercialization prospects.

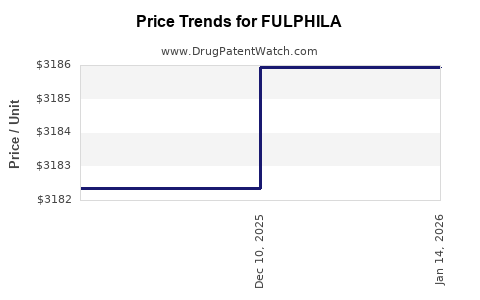

Reimbursement and Pricing

Pricing strategies hinge on negotiations with payers, with optimal market penetration achieved through value-based agreements, cost savings assessments, and inclusion in treatment guidelines. In the U.S., Medicare and private payers are increasingly favoring biosimilars to contain costs.

Commercialization and Market Penetration Strategies

- Partnership Collaborations: Pfizer’s alliances with healthcare providers and pharmacy networks expedite distribution.

- Physician Education: Robust clinical data dissemination enhances prescriber confidence.

- Patient Access Programs: Assistance initiatives improve uptake among underserved populations.

Future Market Trends and Considerations

- Expanded Indications: Additional approvals for conditions like stem cell mobilization could amplify revenues.

- Innovative Delivery: Development of subcutaneous formulations with enhanced convenience may bolster adherence.

- Market Competition: Fierce competition with other biosimilars requires continuous differentiation and strategic pricing.

Key Challenges

- Market Entrenchment of Established Biologics: Persuading clinicians to shift from innovator biologics to biosimilars remains a challenge, despite proven biosimilarity.

- Regulatory Variability: Divergent regional approval standards can complicate global expansion.

- Patent Litigation Risks: Ongoing patent disputes may delay or limit market access in certain geographies.

Conclusion

FULPHILA’s market trajectory exemplifies the expanding role of biosimilars in oncology supportive care, driven by cost pressures, increasing cancer prevalence, and regulatory supportive frameworks. Its long-term success hinges on strategic commercialization, physician acceptance, and navigating competitive and regulatory landscapes. As biosimilar adoption accelerates globally, FULPHILA is poised to carve a meaningful share within a rapidly growing segment, potentially transforming therapeutic paradigms in cancer care while generating substantial financial returns.

Key Takeaways

- Market Expansion: Biosimilars like FULPHILA are crucial drivers of cost savings in oncology, with revenue growth forecasted to reach near or above $1 billion annually within the next decade.

- Regulatory Facilitation: Streamlined approval pathways and regional regulatory alignments accelerate market entry, though market access remains sensitive to patent litigations.

- Competitive Strategies: Differentiation through pricing, clinical confidence, and expanding indications underpin successful commercialization.

- Financial Impact: Early revenues are modest but show exponential growth potential, with mid-term projections positioning FULPHILA as a significant player in the supportive care biologics segment.

- Challenges & Opportunities: Competitive pressures and regional regulatory variability pose hurdles, but continuous innovation and market expansion will drive long-term success.

FAQs

1. What is FULPHILA, and how does it compare to the reference biologic?

FULPHILA is a biosimilar pegfilgrastim developed to match Neulasta in efficacy, safety, and quality. It offers a lower-cost alternative, facilitating broader access to supportive care in oncology patients ([3]).

2. What factors will influence FULPHILA’s long-term market success?

Key factors include physician adoption, reimbursement policies, patent litigation outcomes, geographic expansion, and the development of additional indications.

3. How does the biosimilar approval process impact FULPHILA’s market entry?

Regulatory pathways like the FDA’s biosimilar approval framework allow expedited review based on demonstrating biosimilarity, enabling quicker market access once requirements are met.

4. What are the main challenges faced by FULPHILA in expanding its market share?

Challenges include clinician preference for originator biologics, regional regulatory complexities, patent disputes, and competition from other biosimilars.

5. What is the projected revenue trajectory for FULPHILA over the next decade?

Initial revenues are expected to be around $150–200 million, with potential growth to over $1 billion annually as acceptance broadens and indications expand.

References

[1] Allied Market Research, "Biosimilars Market," 2022.

[2] U.S. Food and Drug Administration, "Biosimilar Guidance," 2022.

[3] Pfizer Press Release, "Fulphila FDA Approval," 2022.

[4] Grand View Research, "Pegfilgrastim Market," 2022.

[5] American Cancer Society, "Cancer Statistics," 2022.

[6] Evaluate Pharma, "Biologics & Biosimilars Market Outlook," 2022.