Last updated: September 29, 2025

Introduction

BIMZELX, a newly emerging biologic therapy, is capturing attention within the pharmaceutical industry due to its innovative approach to treating autoimmune conditions. As a monoclonal antibody targeting specific immune pathways, BIMZELX faces a complex landscape shaped by evolving market needs, competitive forces, regulatory considerations, and technological advancements. This analysis delineates the current market dynamics and projects BIMZELX’s financial trajectory, offering vital insights for stakeholders strategizing in this high-stakes environment.

Market Landscape and Competitive Positioning

The biologic drug market is characterized by rapid growth, driven by the increasing prevalence of autoimmune diseases such as rheumatoid arthritis, psoriatic arthritis, and inflammatory bowel disease. According to IQVIA’s data, the biologics sector reached approximately $250 billion globally in 2022, with an expected compound annual growth rate (CAGR) of 8.5% from 2023 through 2028.[1] BIMZELX enters a competitive field populated by established drugs such as Humira (adalimumab), Enbrel (etanercept), and newer entrants like Skyrizi (risankizumab).

BIMZELX’s differentiation hinges on its targeted mechanism of action, potentially offering improved efficacy and safety profiles. Its niche positioning could enable rapid adoption among specialists, particularly if clinical data demonstrate substantial benefits. However, market entry barriers—such as the high costs associated with biologics, complex manufacturing, and stringent regulatory hurdles—present significant challenges.

Regulatory and Commercialization Dynamics

The regulatory landscape for biologics has become increasingly rigorous, demanding comprehensive data on safety, efficacy, and manufacturing consistency. BIMZELX has progressed through Phase III trials, with preliminary results indicating promising clinical outcomes. The pivotal filings submitted to agencies like the FDA and EMA are under review, with approval timelines expected within 12-18 months.

Post-approval, commercialization strategies involve extensive marketing efforts, establishing supply chains, and forging partnerships with healthcare providers. The high cost of biologics (~$30,000–$50,000 per patient annually) influences payer negotiations and formulary placements, directly impacting revenue potential. Managed care organizations’ increasing emphasis on value-based pricing models impacts revenue projections, requiring BIMZELX to demonstrate clear cost-effectiveness.

Market Acceptance and Adoption Drivers

Key factors influencing BIMZELX’s market uptake include:

- Clinical Advantages: Superior efficacy, reduced adverse events, or convenient administration routes can accelerate adoption.

- Physician and Patient Acceptance: Education and awareness campaigns influence prescriber behavior.

- Pricing and Reimbursement: Competitive pricing strategies aligned with payer expectations are crucial for widespread adoption.

- Market Penetration Timeline: Early access programs and physician champions facilitate rapid prescriber confidence.

In addition, the expanding biologic pipeline and biosimilar entries pose ongoing competitive threats, necessitating ongoing innovation and lifecycle management for BIMZELX.

Financial Trajectory Projections

Revenue Forecasts

Based on current understanding, BIMZELX’s revenue trajectory is optimistic given its clinical promise and market demand. Assuming regulatory approval occurs by late 2024, revenue streams could unfold as follows:

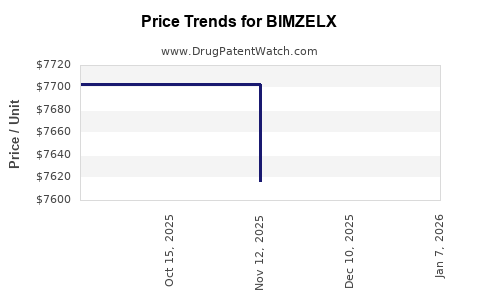

- Year 1 post-launch (2025): Estimated sales volume of 50,000 treated patients, with an average annual price of $40,000, yielding roughly $2 billion in gross revenue.

- Year 2 (2026): Adoption expansion to 100,000 patients, driven by increased physician familiarity, with revenue reaching approximately $4 billion.

- Year 3 (2027): Market maturation, projected at 150,000 patients, with revenues in the vicinity of $6 billion.

These projections are contingent on successful market penetration, competitive dynamics, and payer acceptance. The company's ability to secure favorable reimbursement terms and demonstrate superior value will significantly influence revenue growth.

Profitability and Cost Considerations

Manufacturing biologics involves substantial costs, including cell culture, purification, and quality assurance. Initial investments in manufacturing facilities, especially if outsourced, can impact margins. However, economies of scale and process optimization are expected to improve gross margins over time.

Research and development (R&D) expenditures, post-launch marketing, and patient support programs contribute to operating costs. Nevertheless, high-priced biologics typically sustain profit margins of 20-30%, assuming market acceptance and efficient cost management.

Investment and Market Valuation

Considering market expectations, investors might value BIMZELX using discounted cash flow (DCF) models, incorporating projected revenues, operating margins, and risk adjustments. A conservative discount rate of 10-12% would be appropriate, reflecting industry-specific risks. Early investor interest suggests potential valuations in the multibillion-dollar range, contingent on regulatory approval and sales performance.

Market Risk Factors and Challenges

- Competitive Risks: Biosimilars and new biologic entrants can erode market share.

- Regulatory Delays: Unanticipated review hurdles may delay commercialization and revenue realization.

- Pricing Pressures: Payers' push for lower drug prices could constrain profit margins.

- Manufacturing Risks: Biologics’ complex production processes pose risks of contamination and delays.

Mitigating these risks requires strategic partnerships, continuous innovation, and proactive stakeholder engagement.

Emerging Trends and Future Outlook

Advancements in personalized medicine, biomarker-driven therapy, and digital health integration help sustain BIIMZELX’s competitive edge. Additionally, expanding indications beyond the initial approved condition can diversify revenue sources.

The shift toward biosimilars may threaten revenue streams over the next decade, prompting a focus on lifecycle management strategies such as formulation improvements and new indications. Furthermore, the potential for combination therapies positions BIMZELX within a broader therapeutic landscape, opening additional avenues for growth.

Key Takeaways

- BIMZELX’s success hinges on clinical differentiation, regulatory approval, and market acceptance.

- Early post-launch revenues could reach several billion dollars annually if adoption proceeds as projected.

- Competitive pressures from biosimilars and pricing negotiations necessitate strategic foresight.

- Ongoing investment in manufacturing and innovation is essential to sustain growth and profitability.

- The biologic market’s robust expansion offers a promising backdrop, but risk management and adaptive strategies are crucial.

Conclusion

BIMZELX exemplifies the transformative potential of targeted biologics within autoimmune therapeutics. While promising, its financial trajectory depends on navigating regulatory pathways, establishing market credibility, and executing effective commercialization strategies. Stakeholders should maintain vigilant assessment of evolving market dynamics, competitive threats, and technological developments to capitalize on BIMZELX’s prospects.

FAQs

1. When is BIMZELX expected to receive regulatory approval?

Regulatory submissions are under review, with approval anticipated within 12-18 months, pending safety and efficacy data review by the FDA and EMA.

2. What are the primary competitive challenges facing BIMZELX?

The main challenges include biosimilar entrants, pricing pressures from payers, and competition from established biologics with entrenched market share.

3. How does BIMZELX’s pricing strategy influence its market penetration?

A competitive, value-driven pricing approach, coupled with strong reimbursement negotiations, will be critical to securing broad formulary inclusion and patient access.

4. What factors could impact BIMZELX’s long-term profitability?

Manufacturing complexities, regulatory hurdles, biosimilar competition, and payer cost-containment measures could materially affect profitability.

5. What indications are currently targeted for BIMZELX, and are there plans for expansion?

Initial indications focus on specific autoimmune disorders; future expansion into other inflammatory conditions is anticipated, contingent upon clinical trial data.

Sources

[1] IQVIA, “Global Biologics Market Report,” 2022.