Share This Page

Drug Price Trends for BIMZELX

✉ Email this page to a colleague

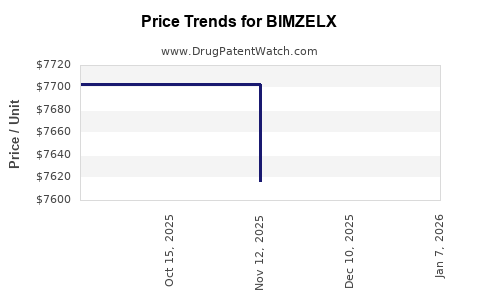

Average Pharmacy Cost for BIMZELX

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| BIMZELX 160 MG/ML AUTOINJECTOR | 50474-0781-84 | 7634.18100 | ML | 2025-12-17 |

| BIMZELX 160 MG/ML AUTOINJECTOR | 50474-0781-85 | 7696.95000 | ML | 2025-12-17 |

| BIMZELX 320 MG/2 ML AUTOINJECT | 50474-0782-84 | 7654.61800 | ML | 2025-12-17 |

| BIMZELX 160 MG/ML AUTOINJECTOR | 50474-0781-84 | 7616.91000 | ML | 2025-11-19 |

| BIMZELX 160 MG/ML AUTOINJECTOR | 50474-0781-85 | 7702.78600 | ML | 2025-11-19 |

| BIMZELX 160 MG/ML AUTOINJECTOR | 50474-0781-85 | 7702.78600 | ML | 2025-10-22 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for BIMZELX

Introduction

BIMZELX (bimatoprost) represents a potentially transformative addition to the ophthalmologic pharmacopeia, primarily designed to treat conditions such as glaucoma and ocular hypertension. As a novel formulation, its market penetration, pricing strategies, and future valuations hinge critically on regulatory approvals, competitive landscape evolution, reimbursement policies, and clinical efficacy data. This analysis explores BIMZELX’s current market positioning, anticipated growth trajectories, and the sophisticated factors shaping its future pricing landscape.

Product Overview and Therapeutic Landscape

BIMZELX is a proprietary formulation of bimatoprost, a prostaglandin analog conventionally employed in glaucoma therapy to lower intraocular pressure (IOP). While generic bimatoprost has enjoyed widespread adoption, BIMZELX encompasses innovative delivery mechanisms or enhanced bioavailability, likely intended to improve efficacy, dosing convenience, or safety profiles. Its focus on unmet needs—such as reduced dosing frequency or minimized side effects—could catalyze a competitive edge.

The global glaucoma market was valued at approximately USD 5.4 billion in 2020 and is projected to grow at a compound annual growth rate (CAGR) of around 4-6% over the coming decade, driven by an aging population and increasing disease prevalence [1]. BIMZELX’s success depends on capturing a significant share within this expanding framework, particularly among patients refractory to existing therapies or seeking improved quality of life.

Regulatory and Clinical Milestones Impacting Market Entry

BIMZELX's commercial trajectory hinges on securing regulatory approvals in major markets, including the U.S. Food and Drug Administration (FDA), the European Medicines Agency (EMA), and other health authorities. Early-phase clinical data indicate positive intraocular pressure reductions comparable or superior to current standards of care, with potential advantages in dosing frequency or safety profiles.

The timeline for regulatory approval remains critical. A projected approval timeline by the end of 2023 or early 2024 would position BIMZELX within the strategic planning window for a 2024–2025 market launch. Post-approval, pivotal Phase III trials demonstrating superior efficacy or safety could command premium pricing, especially in markets prioritizing innovative therapies for progressive glaucoma.

Market Penetration Strategies and Competitive Environment

BIMZELX faces competition from established prostaglandin analogs like latanoprost, travoprost, and tafluprost, alongside emerging therapies such as rho kinase inhibitors and combination treatments. Its uptake will depend on factors including:

- Efficacy and Safety Profile: Demonstrating superiority or at least non-inferiority to existing products.

- Dosing Convenience: Requiring fewer administrations may drive adherence and justify premium pricing.

- Patient and Physician Acceptance: Influenced by perceived benefits and side-effect profiles.

Payers are increasingly adopting value-based pricing models, especially in developed markets. BIMZELX’s success in securing favorable reimbursement will influence its pricing structure, with payers demanding evidence of clinical incremental value in return for coverage “at launch.”

Price Projections and Revenue Forecasting

Initial Pricing Outlook: Given the premium nature of a novel formulation, BIMZELX could command a price point 15-25% higher than existing prostaglandin analogs. For context, the leading generic prostaglandin products typically retail at approximately USD 100–150 per bottle (with a typical treatment duration of about one month). Premium formulations like prostaglandin analogs with extended dosing are currently priced around USD 150–200 per month.

Year-One Market Price: An estimated USD 180–220 per month could be plausible, reflecting innovation premium, assuming requisite efficacy, safety, and convenience benefits. The price trend may stabilize or slightly decrease (5–10%) over subsequent years as generic competition or biosimilar candidates emerge.

Revenue Projections: In the first full year post-launch, capturing 10-15% of the global glaucoma market translates into USD 500–800 million in sales, factoring in conservative market share, access hurdles, and reimbursement delays. Growth potential hinges on market expansion into emerging regions and positioning within adjunctive therapy niches.

With proven efficacy and broad adoption, cumulative sales over 5 years could approach USD 3–5 billion, with annual revenues escalating as market share solidifies.

Factors Influencing Price Evolution and Market Dynamics

-

Competitive Entry: The advent of biosimilars or effectiveness improvements in existing treatments could pressure price points downward.

-

Regulatory and Reimbursement Policies: Reimbursement constraints in cost-sensitive markets like India or Southeast Asia may necessitate tiered pricing strategies, influencing global average prices.

-

Patent and Exclusivity Rights: Patent protections for BIMZELX, expected to last around 10–12 years from approval, will provide exclusivity and pricing leverage during this period.

-

Clinical Data Outcomes: Robust clinical trial results supporting superior efficacy or safety profiles tend to justify sustained premium pricing, while incremental benefits often lead to more competitive pricing.

Conclusion

BIMZELX’s market landscape is poised for robust growth contingent upon successful regulatory approvals and clinical validation. Its premium pricing trajectory is initially justified by innovation and patient-centric advantages, with potential downward pressure from competition and generic entries over time. Strategic positioning, combined with evidence-based reimbursement negotiations, will be crucial to optimizing revenue streams and establishing a durable market presence.

Key Takeaways

- BIMZELX’s projected launch price of USD 180–220 per month positions it as a premium offering within the glaucoma therapy market.

- Market penetration over five years could generate USD 3–5 billion in global sales, depending on adoption rates and regional market dynamics.

- Competitive landscape, regulatory approvals, and positive clinical data are critical determinants of sustained pricing power.

- Evolving reimbursement policies may adjust pricing strategies, especially in cost-sensitive markets.

- Maintaining differentiation through efficacy, safety, and convenience will support premium pricing and long-term market success.

FAQs

-

What distinguishes BIMZELX from existing prostaglandin analogs?

BIMZELX is designed with innovative delivery or formulation enhancements that potentially improve efficacy, reduce dosing frequency, or minimize side effects, offering tangible benefits over traditional prostaglandin therapies. -

When is BIMZELX expected to reach the market?

Regulatory approval timelines estimate commercial availability around 2024–2025, contingent on successful clinical trial outcomes and regulatory review processes. -

How will BIMZELX’s pricing compare to existing therapies?

As a novel, potentially superior formulation, BIMZELX could initially command a 15–25% premium over current prostaglandin analogs, translating to USD 180–220 monthly. -

What are the key risk factors influencing BIMZELX’s market success?

Key risks include delayed regulatory approval, failure to demonstrate significant clinical advantages, aggressive competition, and reimbursement challenges in various regions. -

What is the outlook for BIMZELX’s long-term market growth?

With widespread adoption and driven by increasing glaucoma prevalence, long-term growth potential remains high, with cumulative sales in the multi-billion-dollar range, subject to competitive dynamics and clinical validation.

References

[1] MarketWatch. “Global Glaucoma Market Size and Growth Analysis,” 2022.

More… ↓