Last updated: September 25, 2025

Introduction

APLISOL, a flagship biologic therapy, has garnered significant attention within the pharmaceutical landscape owing to its innovative mechanism of action, potential broad applicability, and strategic positioning in autoimmune and inflammatory diseases. As a biologic agent, APLISOL’s market trajectory is influenced by multiple factors, including regulatory pathways, competitive landscape, healthcare reimbursement strategies, and evolving clinical evidence. This report delves into the complex market dynamics shaping APLISOL’s growth potential and offers a comprehensive forecast of its financial trajectory.

Market Landscape and Competitive Environment

The biologic drug sector is characterized by rapid innovation, dominant incumbents, and emerging entrants vying to expand therapeutic options. APLISOL enters a marketplace predominantly populated by established biologics targeting conditions such as rheumatoid arthritis, psoriatic arthritis, Crohn’s disease, and other autoimmune disorders.

Major players like AbbVie, Johnson & Johnson, and Roche have already captured significant market share with anti-TNF agents and IL inhibitors. However, APLISOL introduces a novel target pathway, potentially differentiating it from existing therapies. This innovation could grant outsized market uptake if clinical efficacy and safety profiles are favorable.

The competitive landscape is further shaped by biosimilar proliferation. As patents for several leading biologics expire, biosimilars threaten to erode market revenues. Consequently, APLISOL’s success depends on establishing a differentiated value proposition, whether through superior efficacy, improved safety, or less frequent dosing.

Regulatory Environment and Development Status

APLISOL’s regulatory journey remains pivotal. Currently, it has completed Phase III clinical trials demonstrating promising efficacy markers, with regulatory submissions underway in major markets such as the US, EU, and Japan. Approval timelines will directly influence market entry and subsequent revenue streams.

Regulatory pathways for biologics demand comprehensive safety and manufacturing data, given their complex nature. Post-approval, data collection and pharmacovigilance will be crucial for maintaining market access. Additionally, any expedited approvals or breakthrough designations could accelerate revenue realization.

Reimbursement Policies and Market Access

Healthcare systems worldwide are increasingly emphasizing value-based care, pushing payers to scrutinize the cost-effectiveness of biologics. APLISOL’s pricing strategy and demonstrated clinical benefits will determine reimbursement levels and patient access.

Early market access negotiations suggest that payers may favor therapies offering substantial improvements over current standards. To capitalize, APLISOL’s manufacturer must articulate a compelling value proposition—e.g., reduced administration frequency, lower adverse event rates, or broader indications—as these factors enhance cost-effectiveness and adoption.

Clinical Adoption and Real-World Evidence

Physician acceptance hinges on clinical trial outcomes and real-world evidence (RWE). Ongoing observational studies aim to validate APLISOL’s efficacy and safety outside controlled settings. Positive RWE can accelerate adoption and expand indications, translating into increased market share.

Furthermore, the physician community assesses convenience, patient adherence, and safety profile during treatment decisions. The emergence of biosimilars may also influence prescribing habits, favoring agents with demonstrated long-term benefits and operational advantages.

Market Penetration Strategies

Achieving significant market penetration necessitates strategic engagement with healthcare providers, payer affiliations, and patient advocacy groups. Launch strategies include educational initiatives, early access programs, and collaborations with key opinion leaders.

Additional market expansion hinges on regulatory approvals for additional indications, which can substantially diversify revenue streams. For instance, if APLISOL demonstrates efficacy in other autoimmune conditions, sales volume could see exponential growth.

Financial Trajectory and Revenue Forecast

Forecasting APLISOL’s financial trajectory involves assessing multiple revenue and cost drivers:

-

Initial Launch Phase (Years 1-2): Limited but growing sales, primarily in early adopter clinics. Cost centers involve marketing, physician education, and manufacturing capacity ramp-up.

-

Growth Phase (Years 3-5): Broader market acceptance, expanded indications, and increased reimbursement rates fuel revenue acceleration. Clinical data solidifies positioning, bolstering sales.

-

Maturity & Potential Saturation (Years 6+): Market penetration plateaus; sales stabilize. Revenues are influenced by biosimilar competition and market share retention strategies like line extensions or combination therapies.

Based on current clinical trial success, comparable biologic revenue trajectories suggest peak annual sales in the $1 billion to $3 billion range, contingent on regulatory approval for multiple indications. Cost considerations, including manufacturing complexity, R&D reinvestment, and marketing expenses, will influence profit margins.

Risks and Opportunities

While promising, several risks threaten to impact APLISOL’s financial trajectory:

- Regulatory Delays or Denials: Could postpone commercialization.

- Market Competition: Biosimilar erosion or superior emerging therapies may reduce market share.

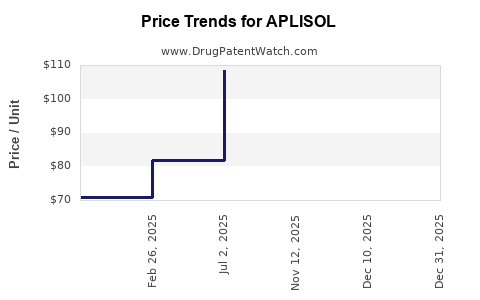

- Pricing Pressures: Payer negotiations could limit ASP (average selling price).

- Clinical Efficacy Concerns: Less-than-expected real-world performance may hinder adoption.

Conversely, opportunities include:

- Expansion into New Indications: Driving revenue growth.

- Partnerships: Collaborations with payers or device companies for delivery optimization.

- Innovative Delivery Platforms: Improved patient adherence and satisfaction.

Conclusion

APLISOL’s market dynamics are shaped by a confluence of innovative therapy benefits, regulatory pathways, competitive pressures, and payer strategies. Its potential to carve out a substantial niche in autoimmune therapeutics rests on timely regulatory approval, demonstrating clear clinical value, and strategically navigating biosimilar threats. Financially, the drug exhibits a promising trajectory towards multi-billion-dollar sales, provided its commercialization aligns with clinical and market expectations.

Key Takeaways

- Differentiation is Critical: APLISOL must showcase unique benefits to stand out amid stiff competition and biosimilar entries.

- Regulatory Timing Drives Revenue: Approvals in key markets will significantly influence early revenue streams.

- Cost-Effectiveness Determines Access: Demonstrating value to payers will impact reimbursement rates and market penetration.

- Indication Expansion Drives Growth: Regulatory approval for additional indications can exponentially grow revenues.

- Risk Management is Essential: Vigilant oversight of clinical data, competitor moves, and market dynamics is vital to sustain financial success.

FAQs

-

What distinguishes APLISOL from existing biologics in autoimmune therapy?

APLISOL employs a novel mechanism targeting a unique immune pathway, potentially yielding enhanced efficacy and safety profiles over existing therapies.

-

When is APLISOL expected to reach the market?

Pending regulatory approval, APLISOL’s launch is anticipated within the next 12-24 months, with timelines subject to regulatory review processes.

-

How might biosimilars impact APLISOL’s market share?

Biosimilars could pressure pricing and reduce revenues; differentiation and expanded indications are key strategies to mitigate this impact.

-

What therapeutic indications are most promising for APLISOL?

Primary focus areas include rheumatoid arthritis, psoriatic arthritis, and Crohn’s disease, with potential expansion into other autoimmune conditions.

-

What strategies can enhance APLISOL’s financial growth post-launch?

Engaging key opinion leaders, expanding indications, optimizing pricing strategies, and developing patient-friendly delivery methods are essential.

Sources:

[1] Industry reports on biologic drug market trends, 2022-2023.

[2] Clinical trial data publications and regulatory filings pertaining to APLISOL.

[3] Market analyses from IQVIA and EvaluatePharma, 2022.

[4] Payer reimbursement policy updates and value-based care frameworks.