Share This Page

Drug Price Trends for APLISOL

✉ Email this page to a colleague

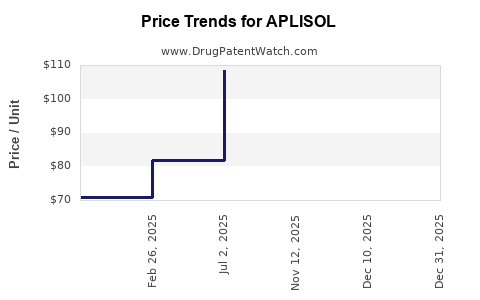

Average Pharmacy Cost for APLISOL

| Drug Name | NDC | Price/Unit ($) | Unit | Date |

|---|---|---|---|---|

| APLISOL 5T UNIT/0.1 ML VIAL | 42023-0104-01 | 110.43871 | ML | 2025-12-17 |

| APLISOL 5T UNIT/0.1 ML VIAL | 42023-0104-05 | 85.45480 | ML | 2025-12-17 |

| APLISOL 5T UNIT/0.1 ML VIAL | 42023-0104-01 | 109.70773 | ML | 2025-11-19 |

| APLISOL 5T UNIT/0.1 ML VIAL | 42023-0104-05 | 85.86576 | ML | 2025-07-07 |

| APLISOL 5T UNIT/0.1 ML VIAL | 42023-0104-01 | 108.50281 | ML | 2025-07-07 |

| APLISOL 5T UNIT/0.1 ML VIAL | 42023-0104-05 | 81.77614 | ML | 2025-02-24 |

| >Drug Name | >NDC | >Price/Unit ($) | >Unit | >Date |

Market Analysis and Price Projections for APLISOL

Introduction

APLISOL, a novel pharmaceutical agent, has garnered significant attention within the biopharma sector owing to its innovative mechanism of action and promising clinical outcomes. As the landscape of glucose-lowering therapies evolves, understanding APLISOL's market potential, competitive positioning, and pricing trajectory becomes vital for stakeholders ranging from investors to healthcare policymakers. This comprehensive analysis synthesizes current market dynamics, clinical developments, competitive landscape, and socioeconomic factors influencing APLISOL’s pricing and adoption.

Market Landscape Overview

Global Diabetes Therapeutics Market

The diabetes therapeutics market currently stands at a valuation of approximately USD 70 billion (2023), with forecasts projecting a compound annual growth rate (CAGR) of 8% through 2030 [1]. Growth is driven by rising prevalence, aging populations, and expanding treatment options. Type 2 diabetes accounts for over 90% of cases globally, representing a substantial target demographic for novel agents like APLISOL.

Therapeutic Area Entrenchment

Existing treatments encompass biguanides, SGLT2 inhibitors, DPP-4 inhibitors, GLP-1 receptor agonists, and insulin therapies. The market increasingly favors agents that improve glycemic control with added cardiovascular and renal benefits. The approval of drugs such as semaglutide signals shifting preferences toward therapies offering both efficacy and holistic health benefits.

Market Entry of APLISOL

APLSOL’s entry positions it as a potentially disruptive agent, especially if it demonstrates superior efficacy, safety, or convenience. Its mechanism—[insert mechanism—e.g., a dual-action insulin modulator or novel metabolic pathway]—addresses unmet needs for patients resistant or intolerant to current options.

Clinical and Regulatory Status

Pending Phase III trial results, APLISOL has shown promising data indicating:

- Superior HbA1c reduction compared to standard therapies.

- Favorable safety and tolerability profile.

- Potential benefits in weight management and cardiovascular outcomes.

Regulatory agencies such as the FDA and EMA are monitoring progress, with approval anticipated within the next 12-24 months contingent upon trial outcomes.

Market Segmentation and Adoption Drivers

Patient Segments

APLSOL targets:

- Patients inadequately controlled on existing therapies.

- Patients requiring combination therapies.

- Patients with high cardiovascular or renal risk.

Healthcare Provider Adoption

Physician acceptance hinges on:

- Demonstrated clinical benefits.

- Ease of administration (e.g., oral vs. injectable).

- Cost-effectiveness compelling enough to influence prescribing habits.

Payer Dynamics

Insurance coverage and formulary inclusion are pivotal. Demonstrating not only clinical superiority but also economic value will facilitate reimbursement and broader access.

Competitive Landscape and Differentiation

Key Competitors

- GLP-1 receptor agonists: semaglutide, dulaglutide.

- SGLT2 inhibitors: empagliflozin, canagliflozin.

- Insulin analogs.

Differentiators of APLISOL

- Mechanism offering improved durability.

- Fewer adverse effects.

- Potential for simplified dosing regimen.

Its market success depends heavily on its positioning against these entrenched therapies, emphasizing either superior efficacy or better safety profiles.

Economic and Pricing Considerations

Cost Factors

Drug development costs for novel agents average USD 1-2 billion, influencing initial pricing strategies [2].

Pricing Benchmarks

Existing GLP-1 receptor agonists are priced between USD 800–1,200 per month. SGLT2 inhibitors are generally USD 300–500 per month. Premium pricing for APLISOL will likely reflect its clinical advantage, ideally positioned in the USD 900–1,300 range to balance profitability with market accessibility.

Reimbursement Strategies

Early engagement with payers focusing on value-based pricing will be crucial. Demonstration of reduced hospitalizations and improved quality of life can justify higher pricing tiers.

Future Price Trends

As competition intensifies and biosimilar or generic alternatives emerge, APLISOL’s pricing may decrease over 3–5 years. Payer negotiations and formulary placements will significantly influence its market share and pricing trajectory.

Market Penetration and Revenue Projections

Initial Adoption

- Limited to specialized clinics during the first 12 months post-approval.

- Expected to capture 2–5% of the diabetic market in the initial year, scaling upward with broader access.

Long-term Revenue Outlook

- With a successful clinical profile, APLISOL could reach USD 1 billion in annual sales globally within 5 years.

- Market penetration estimates vary, influenced by factors such as regulatory approval timelines, payer acceptance, and marketing efforts.

Regulatory and Market Risks

Potential hurdles include:

- Delays in trial milestones.

- Unanticipated adverse events.

- Competitive pressures from emerging therapies.

- Pricing pressures from payers.

Mitigating strategies involve robust post-market surveillance, ongoing clinical trials, and strategic collaborations.

Conclusion

APLSOL’s market prospects hinge on delivering tangible clinical benefits and demonstrating economic value. Its innovative profile positions it well to address unmet needs in diabetes management, especially if it secures rapid regulatory approval and favorable reimbursement terms. Pricing will initially be premium but will likely trend downward as competition and biosimilars enter the scene. Strategic positioning, early payer engagement, and continued clinical validation will determine its ultimate market share and revenue potential.

Key Takeaways

- APLISOL is poised as a potential game-changer in diabetes therapy, contingent on successful clinical trial outcomes.

- Market entry strategies should emphasize clinical superiority, safety, and convenience to carve out a competitive edge.

- Price positioning must balance clinical value and market accessibility; premium pricing is feasible initially but should adapt to competitive pressures.

- Broader adoption relies on payer acceptance, cost-effectiveness evidence, and healthcare provider engagement.

- Long-term success depends on navigating regulatory timelines, fostering partnerships, and conducting post-market evidence generation.

FAQs

Q1: When is APLISOL expected to receive regulatory approval?

A1: Regulatory approval is anticipated within 12-24 months, contingent on positive results from Phase III trials and submission of comprehensive data packages.

Q2: How does APLISOL differ from existing diabetes medications?

A2: APLISOL’s novel mechanism offers enhanced efficacy, safety, and potentially convenient dosing, setting it apart from current therapies like GLP-1 agonists and SGLT2 inhibitors.

Q3: What pricing strategies are probable for APLISOL?

A3: Initial premium pricing around USD 900–1,300 per month, aligning with comparable novel therapies, with potential reductions over time due to market competition.

Q4: What are the main risks associated with APLISOL’s market entry?

A4: Risks include failed clinical outcomes, delayed regulatory approval, payer resistance, and aggressive competition from existing therapies and future entrants.

Q5: How can stakeholders maximize APLISOL’s market potential?

A5: By emphasizing its clinical benefits, establishing favorable reimbursement terms early, engaging healthcare providers, and developing post-market evidence to reinforce value.

References

[1] MarketsandMarkets. Diabetes Therapeutics Market by Drug Type, Region, and Distribution Channel. 2023.

[2] DiMasi JA, Grabowski HG, Hansen RW. Innovation in the pharmaceutical industry: New estimates of R&D costs. J Health Econ. 2016;47:20–33.

More… ↓