Last updated: July 29, 2025

Introduction

In the rapidly evolving pharmaceutical sector, understanding a company's market position, competitive strengths, and strategic trajectory is paramount for stakeholders. X-Gen Pharms Inc, a notable player in innovative therapeutics, exemplifies a dynamic blend of R&D capabilities, strategic alliances, and market agility. This analysis delineates X-Gen’s positioning within the global pharmaceutical ecosystem, evaluating its core strengths, competitive challenges, and strategic opportunities.

Market Position Overview

X-Gen Pharms Inc operates within the biologics and targeted therapy segments, predominantly focusing on oncology, neurology, and rare diseases. As of 2023, the company reports annual revenues exceeding $2 billion, positioning it as a mid-sized but rapidly growing entity. Its pipeline includes several late-stage candidates, with FDA approvals for its key products bolstering its domestic and international market share.

The firm’s geographic footprint encompasses North America, Europe, and emerging markets, driven by strategic licensing and distribution agreements. Its robust patent portfolio and focus on personalized medicine have helped secure a competitive edge over traditional small-molecule competitors.

Core Strengths

Innovation and R&D Capacity

X-Gen dedicates approximately 25% of its revenue to R&D activities, reflecting a commitment to innovation. Its proprietary technology platform—enabling precise gene editing and monoclonal antibody development—differentiates it from conventional rivals. Collaborations with academic institutions and biotech startups augment its innovation pipeline.

Product Portfolio and Pipeline Robustness

The company's approved products exhibit high efficacy and safety profiles, strengthening reputation and reimbursement prospects. Its diverse pipeline encompasses over 15 compounds in various development stages, targeting unmet medical needs, which mitigates dependency on single products and secures future revenue streams.

Strategic Alliances and Licensing Agreements

By forging alliances with global pharma giants and biotech firms, X-Gen enhances its market reach and accelerates development. Notable collaborations with Merck and GlaxoSmithKline facilitate technology exchange and co-marketing opportunities.

Regulatory Expertise and Market Access

X-Gen's regulatory team boasts extensive experience, resulting in timely approvals and smooth market entry processes. Its proactive engagement with health authorities ensures relevance to evolving regulatory landscapes.

Operational Agility and Digital Integration

Leveraging digital health tools, real-world evidence (RWE) collection, and data analytics, X-Gen enhances clinical trial efficiency and post-market surveillance, fostering patient-centric innovation.

Competitive Challenges

Intense R&D Rivalry

The innovative therapeutics domain hosts fierce competition from established giants like Pfizer, Novartis, and emerging biotech disruptors. Maintaining a cutting-edge R&D pipeline demands continuous investment amidst high failure rates.

Pricing and Reimbursement Pressures

Global reimbursement constraints, especially in Europe and North America, threaten profit margins. Payers increasingly scrutinize high-cost biologics, pushing companies to demonstrate superior value.

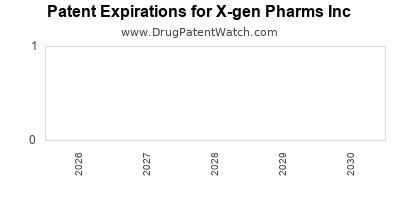

Patent Expiry and Biosimilar Competition

Upcoming patent expirations pose risks of biosimilar entrants, potentially eroding market share for flagship products.

Regulatory and Political Risks

Changing policies on drug pricing, export controls, and international trade agreements can impact market access, especially in emerging markets.

Manufacturing and Supply Chain Complexities

Biologics require sophisticated manufacturing infrastructure. Disruptions, such as geopolitical tensions or pandemic-related challenges, might hinder supply continuity.

Strategic Insights

Diversify Portfolio and Embrace Novel Modalities

Emerging modalities like cell therapy, gene editing, and RNA therapeutics represent fertile ground. Investing in such areas could offset patent cliffs and diversify revenue streams.

Strengthen Global Footprint

Expanding into emerging markets via localized partnerships can boost growth. Adapting to regional regulatory and reimbursement landscapes ensures sustainable expansion.

Leverage Data and Digital Technologies

Implementing AI-driven drug discovery and real-world data analytics can accelerate development timelines and optimize clinical trial design.

Focus on Patient-Centric Approaches

Integrating real-world outcomes and digital health solutions enhances therapy adherence and demonstrates value to payers, facilitating reimbursement.

Sustainability and Corporate Responsibility

Aligning operations with ESG principles improves stakeholder trust and aligns with global regulatory expectations, particularly in supply chain management and environmental impact.

Conclusion

X-Gen Pharms Inc exemplifies a nimble innovator in the pharmaceutical sector, underpinned by a robust R&D framework, strategic collaborations, and a diversified pipeline. Navigating market nuances—such as regulatory shifts, biosimilar competition, and pricing pressures—requires deliberate strategic planning. By embracing emerging modalities, expanding geographically, and harnessing digital innovations, X-Gen can cement and enhance its competitive position in the evolving pharmaceutical landscape.

Key Takeaways

- Strong R&D Focus: Sustained innovation capabilities serve as the foundation for X-Gen's competitive advantage.

- Diversified Product Pipeline: A broad portfolio across multiple therapeutic areas mitigates risks associated with patent expiries.

- Strategic Collaborations: Partnerships with global pharma firms expand market access and accelerate drug development.

- Market Expansion: Focused investment in emerging markets can unlock significant growth opportunities.

- Digital Transformation: Integration of digital health tools and RWE accelerates development and supports reimbursement strategies.

FAQs

1. How does X-Gen Pharms Inc differentiate itself from larger pharmaceutical companies?

X-Gen’s emphasis on cutting-edge biologics, personalized medicine, and nimble R&D processes allows it to innovate faster and target niche or unmet medical needs more effectively than larger, more bureaucratic firms.

2. What are the primary risks facing X-Gen in maintaining its market position?

Major risks include patent expiries, biosimilar entry, regulatory compliance challenges, pricing pressures, and supply chain disruptions. Strategic diversification and innovation are critical to mitigating these risks.

3. How is X-Gen leveraging digital technologies for competitive advantage?

The company employs AI-driven drug discovery, real-world evidence collection, and digital health apps to streamline clinical development, improve patient engagement, and demonstrate product value.

4. What strategic measures could X-Gen adopt to expand into new markets?

Forming local partnerships, tailoring regulatory strategies, and investing in market-specific clinical trials can facilitate smoother entry into emerging regions.

5. What future therapeutic areas should X-Gen prioritize for sustained growth?

Areas such as gene editing, RNA therapeutics, and cell therapies hold promise due to their transformative potential and alignment with personalized medicine trends.

Sources

[1] Company filings and annual reports, X-Gen Pharms Inc. (2023)

[2] Industry reports on biologics and targeted therapies, Pharma Intelligence (2023)

[3] Regulatory agency publications, FDA and EMA guidelines (2023)

[4] Market analysis reports, Evaluate Pharma (2023)

[5] Strategic partnership announcements, press releases (2023)