Last updated: July 31, 2025

Introduction

Verrica Pharmaceuticals (NASDAQ: VRCA) operates within the dermatology sector, focusing on innovative treatments for cutaneous conditions. With a portfolio centered on the development and commercialization of proprietary drugs, Verrica aims to address unmet medical needs in dermatology, benefitting from a niche but expanding market. As the dermatological pharmaceutical landscape becomes increasingly competitive with established players and emerging biotech entrants, understanding Verrica's market position, core strengths, and strategic trajectory offers critical insights for investors, industry analysts, and healthcare strategists.

Market Position Overview

Verrica’s primary commercial asset, YVP01 (cantharidin topical), is approved for the treatment of molluscum contagiosum, a contagious pediatric viral skin disease. The company has also advanced VP-102, a proprietary formulation of cantharidin, seeking patent protections and regulatory approvals for broader indications such as warts and other dermatological conditions.

Strategic Niche Focus

Verrica has carved a niche within dermatology by developing proprietary formulations targeting benign skin conditions with significant patient and parental demand. Its focus on molluscum contagiosum, a condition with limited approved treatments, positions the company uniquely against larger pharmaceutical competitors requiring more complex and costly development pathways.

Competitive Positioning

Compared to competitors like Pfizer, Sanofi, and Leadiant Biosciences, Verrica benefits from:

- Specialization: Dedicated dermatology pipeline targeting specific conditions with unmet needs.

- Regulatory Progress: Approval milestones and ongoing Phase III trials demonstrate a clear strategy toward market entry.

- Differentiation: Proprietary formulation offering potential advantages over off-label or compounding treatments.

However, Verrica faces stiff competition from established dermatological drug developers and over-the-counter (OTC) options, necessitating strategic differentiations and market penetration initiatives to expand its footprint.

Strengths of Verrica Pharmaceuticals

1. Proprietary and Differentiated Product Portfolio

Verrica's flagship, VP-102, leverages a novel cantharidin formulation, offering a convenient, safe, and effective topical treatment. Its specificity and ease of use present advantages over traditional treatments like cryotherapy, which require clinical visits and have multiple side effects.

2. Clinical and Regulatory Progress

Verrica has a successful track record of advancing its pipeline, with regulatory approvals for YVP01 in molluscum contagiosum and ongoing trials for VP-102 in wart management. This progress underpins its strategic credibility and provides multiple pathways to commercialization.

3. Focused Market Strategy

By targeting pediatric patients and caregivers, Verrica taps into a high-demand segment with limited current therapeutic options. Its focus aligns with increasing outpatient dermatology treatments and consumer preferences for quick, non-invasive remedies.

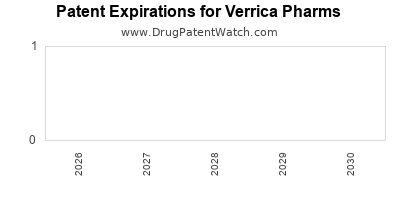

4. Intellectual Property and Patent Portfolio

Verrica holds robust patent protections on its formulations, providing a competitive moat and extending market exclusivity. Strong IP rights are vital for safeguarding investments and establishing pricing power.

5. Strategic Partnerships and Licensing

Potential collaborations with larger pharmaceutical firms, dermaceutical companies, or distribution partners could accelerate market penetration and provide additional revenue streams.

Strategic Challenges and Risks

1. Competitive Market Dynamics

Major pharmaceutical firms possess broader portfolios and greater marketing resources, creating barriers against Verrica's entry or expansion. Over-the-counter alternatives also pose competitive threats, especially in low-acuity conditions.

2. Limited Market Penetration Experience

As a relatively new and small player, Verrica faces challenges in gaining healthcare provider awareness and consumer trust, which are critical for market adoption.

3. Regulatory and Reimbursement Uncertainties

Pending approvals for additional indications and reimbursement pathways remain uncertain, potentially impacting revenue growth and profitability.

4. Manufacturing and Supply Chain Risks

Scaling production for commercialization and ensuring consistent quality are pivotal, particularly given the topical nature of products demanding strict stability standards.

Strategic Insights and Recommendations

Expansion of Indications and Market Reach

Verrica should prioritize expanding its product label to include common warts, plantar or anogenital warts, leveraging data from ongoing Phase III trials. Broadening indications increases addressable patient populations and revenue streams.

Building Clinical and Consumer Awareness

Investing in targeted marketing campaigns, physician education, and patient advocacy programs can accelerate adoption. Collaborations with dermatology clinics and pediatric practices will enhance visibility.

Partnership and Licensing Strategies

Partnering with established dermatology or infectious disease pharmaceutical firms can leverage their sales channels, regulatory expertise, and manufacturing capabilities.

Digital and Direct-to-Consumer Strategies

Implementing digital marketing efforts tailored to caregivers and pediatricians, including teledermatology integration, could enhance outreach and streamline patient access.

Robust Intellectual Property Management

Continuous innovation to extend patent life cycles and prevent generic competition is vital. Development of next-generation formulations or combination therapies should be strategically pursued.

Future Outlook and Market Trends

The dermatology pharmaceutical market is poised for growth, driven by aging populations, rising skin condition prevalence, and increasing demand for minimally invasive treatments. Verrica’s tailored approach aligns with trends favoring targeted, safe, and physician-preferred therapies. Strategic investments in R&D and commercial infrastructure will determine Verrica’s capacity to capitalize on these growth opportunities.

Key Takeaways

- Niche Focus with Growth Potential: Verrica’s targeted approach in dermatology, particularly its focus on benign skin conditions like molluscum contagiosum, allows it to establish a foothold in a specialized market with limited direct competition.

- Innovation and IP as Critical Assets: Proprietary formulations and strong patent protections offer significant competitive advantages, enabling Verrica to sustain exclusivity and command premium pricing.

- Strategic Partnerships as Catalysts: Collaborations with larger pharmaceutical companies can accelerate penetration, expand indications, and optimize commercialization resources.

- Market Expansion and Education: Customer-awareness campaigns targeting physicians and caregivers are essential to maximize product adoption and market share.

- Competitive Landscape Dynamics: While Verrica leverages differentiation, it must navigate significant competitive pressures from established players and OTC alternatives.

- Regulatory and Reimbursement Strategy: Continued progress in regulatory approvals and favorable reimbursement pathways are pivotal to financial success.

FAQs

1. How does Verrica differentiate its products from existing dermatological treatments?

Verrica’s products, such as VP-102, utilize proprietary formulations of cantharidin, offering non-invasive, safe, and effective topical options for conditions like molluscum contagiosum. Unlike cryotherapy, these treatments can be administered at home or in-office, reducing discomfort and clinic visits, thus providing a patient-centric advantage.

2. What are Verrica’s key growth catalysts in the next 12 to 24 months?

Key catalysts include obtaining regulatory approval for VP-102 in additional indications like warts, executing commercialization strategies, forging strategic partnerships, and expanding clinical trials to support broader label extensions.

3. What competitive threats does Verrica face?

Verrica faces threats from large pharmaceutical corporations with established dermatology portfolios, OTC treatments in benign skin conditions, and potential generic entrants post-patent expiry. Market share expansion relies on sustained innovation and effective marketing.

4. How significant is Verrica’s patent portfolio?

Verrica’s patents around its formulations bolster its market exclusivity, safeguarding against generic competition for a designated period. Intellectual property rights are central to its strategic value and valuation.

5. What strategic moves should Verrica prioritize to enhance its market presence?

Verrica should focus on expanding its product indications, strengthening clinical data, fostering strategic partnerships, investing in marketing and physician education, and maintaining robust patent protections to optimize long-term growth.

References

[1] Verrica Pharmaceuticals Inc. Company Website. https://www.verrica.com

[2] U.S. Food & Drug Administration (FDA). FDA Approves Verrica’s VP-102 for Molluscum Contagiosum. 2020.

[3] MarketWatch. Verrica Pharmaceuticals Inc. Financial Data and Analyst Ratings.

[4] GlobalData. Dermatology Market Trends & Competitive Landscape Analysis, 2023.

[5] Bloomberg Industry Reports. Pharmaceutical Market Strategies and Competitive Dynamics, 2023.