Last updated: July 28, 2025

Introduction

The pharmaceutical industry remains one of the most dynamic sectors globally, characterized by rapid innovation cycles, regulatory complexity, and intense competition. Among emerging players, Tripoint Pharmaceuticals has garnered attention for its strategic positioning, innovative pipeline, and growth trajectory. This analysis provides a comprehensive overview of Tripoint’s market position, competitive strengths, and strategic outlook, equipping stakeholders with nuanced insights into its industry standing and future potential.

Company Overview

Tripoint Pharmaceuticals was established in 2015, focusing on innovative therapeutics targeting rare diseases and oncology. The company's core competencies include advanced R&D capabilities, strategic collaborations, and a focus on unmet medical needs. Its primary headquarters is located in Boston, Massachusetts, a hub for biotech and pharma innovation.

With an active pipeline comprising multiple Phase II and III candidates, Tripoint emphasizes personalized medicine and biologics. Its revenue model combines proprietary drug sales, licensing agreements, and strategic partnerships with large pharmaceutical firms.

Market Positioning

Market Segment Focus

Tripoint has carved out a niche in the rare disease and oncology sectors, sectors witnessing exponential growth due to ongoing clinical developments and unmet healthcare needs. Its flagship products target rare genetic disorders, with subsequent expansion into personalized cancer immunotherapies. The company’s strategic focus aligns with global shifts toward precision medicine, positioning it favorably for long-term growth.

Competitive Standing

Tripoint’s competitive positioning is strengthened by its robust pipeline, innovative technology platforms (notably its proprietary gene-editing and biologic manufacturing technologies), and strategic alliances with academic institutions and biotech firms. It currently holds a modest but rapidly expanding market share in targeted specialty therapeutics within North America and parts of Europe.

In terms of market valuation, Tripoint’s enterprise value approximates $2.5 billion, reflective of high investor confidence in its growth prospects and technological differentiators. The company's strategic entry into emerging markets also offers long-term growth opportunities, although it faces competition from established players like Novartis, Roche, and smaller biotech firms specializing in personalized medicine.

Strengths

Innovative R&D

Tripoint’s investment in cutting-edge research has resulted in a diversified portfolio of candidates utilizing novel mechanisms of action. Its proprietary platforms facilitate rapid drug development cycles, reducing time-to-market and increasing competitive advantage.

Strategic Collaborations

The firm has established strong collaborations with leading academic institutions in genomics and bioinformatics, leveraging external expertise to accelerate pipeline development. Notable agreements with multinational pharma companies allow access to global distribution networks, regulatory support, and co-marketing capabilities.

Regulatory Acumen

Tripoint boasts a robust regulatory strategy, having successfully secured Fast Track and Orphan Drug Designations from agencies such as FDA and EMA. These designations provide pathway efficiencies for approval and offer market exclusivity benefits, vital for competitive differentiation.

Patient-Centric Approach

A focus on rare diseases and oncology ensures Tripoint targets high unmet need segments with potential for premium pricing. Its emphasis on personalized medicine enhances treatment efficacy and patient outcomes, aligning with evolving payer expectations and health policies.

Agile Organization

Small but nimble organizational structure allows rapid decision-making and adaptability, fostering innovation and responding swiftly to market developments or scientific breakthroughs.

Strategic Insights

Pipeline Diversification and Expansion

Tripoint’s strategy involves expanding its pipeline toward broader therapeutic areas, including autoimmune and neurodegenerative diseases. Prioritization of candidate compounds with clear unmet needs and strong clinical data is central to upcoming milestones.

Global Market Penetration

Emerging markets such as Asia-Pacific present growth opportunities. Tripoint is undertaking targeted market entry strategies, including local partnerships and adaptations for regional regulatory requirements, to capitalize on these expanding healthcare systems.

Digital Transformation

The integration of digital health tools, such as AI-driven biopsy analysis and real-time patient monitoring, enhances clinical trial efficiency and precision medicine delivery. Emphasizing digital capabilities will be vital for maintaining competitive advantage.

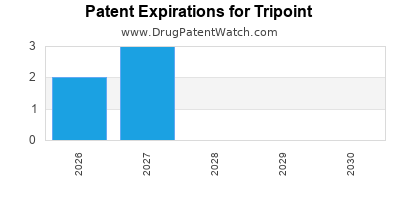

Intellectual Property Strength

Tripoint maintains a robust portfolio of patents protecting its novel therapeutics and technology platforms. Continued patent filings and legal protections are fundamental to safeguarding its innovations against generic competition.

Investment in Manufacturing Capabilities

Scaling manufacturing capacity through strategic alliances and in-house capabilities minimizes supply chain risks and supports large-scale commercialization. Investing in biologics manufacturing innovation enhances cost efficiency and product quality.

Challenges and Risks

Despite its strengths, Tripoint confronts several challenges:

- Regulatory Hurdles: Complex approval pathways and evolving regulations can delay product launches.

- Intense Competition: Larger firms with established market presence may outpace Tripoint in commercialization and market penetration.

- Funding Requirements: Sustained R&D and manufacturing investments require significant capital, posing liquidity risks.

- Market Acceptance: High cost and personalized nature of therapies could face payer resistance, impacting reimbursement.

Competitive Landscape

Tripoint operates within a highly competitive ecosystem featuring players such as Novartis, Roche, and emerging biotech startups. Its differentiator lies in its innovative platforms and strategic partnerships. Collaborations with tech firms and academic institutions facilitate rapid innovation, while its focus on rare diseases offers a niche advantage.

Key competitors are leveraging AI, gene therapy, and biologics to expand their portfolios, often surpassing Tripoint in market share. Nonetheless, Tripoint’s agility and focused pipeline position it as an emerging leader in precision medicine niches.

Future Outlook and Strategic Recommendations

- Focus on Data-Driven Innovation: Harness digital tools and AI in drug discovery, clinical trials, and patient engagement to accelerate development and improve outcomes.

- Enhance Global Commercial Footprint: Prioritize market entry into high-growth regions with tailored regulatory and reimbursement strategies.

- Strengthen Intellectual Property Portfolio: Continue extensive patent filings and legal protections to defend innovations.

- Secure Strategic Funding: Engage with investors and partners to ensure sufficient capital for pipeline advancement and manufacturing scale-up.

- Expand Therapeutic Portfolio: Invest in disease areas aligned with current trends and unmet needs, ensuring diversification and resilience.

Key Takeaways

- Strategic Position: Tripoint’s focus on rare diseases and oncology, coupled with innovative platforms, positions it favorably for niche leadership in precision medicine.

- Growth Drivers: Its robust pipeline, strategic alliances, and regulatory pathways accelerate product development and commercialization.

- Challenges: Intense competition, regulatory complexities, and funding demands require strategic navigation.

- Opportunities: Emerging markets, digital health integration, and pipeline expansion offer substantial growth avenues.

- Actionable Strategy: Prioritize innovation, protect intellectual property, and expand global footprint to enhance competitiveness.

FAQs

1. How does Tripoint differentiate itself from larger pharmaceutical companies?

Tripoint leverages innovative, proprietary platforms and focuses on high unmet needs in rare diseases and oncology, allowing rapid development and personalized treatments. Its nimble organizational structure facilitates faster decision-making compared to large, bureaucratic firms.

2. What are the main risks associated with investing in Tripoint?

Key risks include regulatory delays, high R&D costs, competitive pressures from established players, and reimbursement challenges for personalized therapies.

3. What strategic partnerships has Tripoint formed to enhance growth?

Tripoint has partnered with academic institutions in genomics and bioinformatics, as well as multinational pharma firms for co-development and commercialization, facilitating technology access and market expansion.

4. How is Tripoint leveraging digital transformation?

The company employs AI-driven analytics, real-time patient monitoring, and digital biomarkers to speed up clinical trials, refine drug targeting, and improve patient outcomes.

5. What are the future growth prospects for Tripoint?

With a diversified pipeline, strategic alliances, focus on emerging markets, and ongoing innovation, Tripoint is well-positioned for sustained growth in the personalized medicine space.

Citations

[1] Company Website and Investor Relations Reports

[2] Market Intelligence Reports on Rare Disease and Oncology Therapeutics

[3] Regulatory Agency Publications (FDA and EMA designations)

[4] Industry Analysis from Biotech and Pharma Market Reports