Last updated: July 30, 2025

Introduction

Sunovion Pharmaceuticals Inc. stands as a prominent entity in the global pharmaceutical landscape, primarily known for its focus on central nervous system (CNS) disorders, respiratory conditions, and rare diseases. Operating as a subsidiary of Sumitomo Dainippon Pharma, the company has demonstrated robust growth through strategic acquisitions, innovative drug development, and a targeted portfolio. This analysis delineates Sunovion's market position, core strengths, and strategic outlook within a fiercely competitive environment.

Market Position and Industry Overview

Sunovion operates within a multibillion-dollar pharmaceutical industry characterized by rapid innovation, regulatory rigor, and pricing pressures. Its primary markets include North America, Asia, and select European regions, with a substantial portion of revenue derived from neurological and respiratory medications. The company's flagship products, such as Lunesta (eszopiclone) and Aptiom (eszopiclone), establish its foothold in sleep and psychiatric disorders, while newer entrants like Kynmobi (apomorphine) and Zepzelca (lurbinectedin) expand its oncology and neurology divisions.

Market aging demographics, the rising prevalence of CNS disorders, and increased emphasis on personalized medicine position Sunovion favorably for sustained growth. However, intensifying competition from bioequivalent generics, emerging biotech firms, and blockbuster drug pipelines of peers like Biogen, Pfizer, and Novartis challenge Sunovion’s market share.

Core Strengths

Innovative Product Portfolio

Sunovion’s pipeline emphasizes CNS disorders, notably schizophrenia, depression, and sleep disorders. The company's commitment to R&D led to Qelbree (viloxazine extended-release), approved for ADHD treatment in children and adolescents, exemplifying its ability to develop novel therapies in a niche market segment. Moreover, its focus on precision medicine enables tailored treatments that address unmet needs and improve patient outcomes.

Strategic Acquisition and Collaboration Framework

Sunovion’s expansion strategy hinges on key acquisitions and alliances. The acquisition of the US rights to Lunesta from Sepracor increased its psychiatric portfolio. Additionally, collaboration with biotech firms accelerates drug development, as seen with partnerships in rare disease therapies, enhancing its innovation pipeline.

Strong Regulatory and Commercial Footprint

Having successfully navigated complex regulatory pathways globally, Sunovion leverages an established distribution network, especially in North America. Its commercialization expertise ensures effective launch strategies, robust sales infrastructure, and high market penetration for its key offerings.

Financial Resilience

With steady revenue streams and a commitment to reinvestment in R&D, Sunovion maintains financial stability. Its backing by Sumitomo Dainippon Pharma provides additional capital resources to fuel strategic growth initiatives and pipeline diversification.

Strategic Insights

Focus on Niche Therapeutic Areas

Sunovion's emphasis on CNS and respiratory disorders positions it as a specialized player, less exposed to the commoditization risks faced by broader-spectrum pharmaceutical companies. Investing further in rare diseases and personalized therapies can secure premium positioning.

Innovation and R&D Investment

Prioritizing precision medicine, biomarkers, and novel delivery mechanisms will be essential to stay competitive. The company's current pipeline suggests a strategic pivot toward unmet needs, including neurodegenerative and psychiatric conditions, which promise high therapeutic value and market exclusivity.

Market Expansion via Digital and Contract Manufacturing

Expanding into emerging markets through digital marketing channels and localized manufacturing presents growth opportunities. Strategic collaborations to facilitate access and meet regional regulatory standards are imperative.

Navigating Competitive and Regulatory Challenges

To mitigate generic competition, Sunovion should accelerate lifecycle management strategies and explore patents for proprietary formulations. Engaging proactively with regulatory agencies ensures timely approval and market access for innovative therapies.

Sustainability and Pricing Strategies

Balancing innovation with affordability necessitates transparent pricing policies and stakeholder engagement. Aligning product value propositions with payer expectations can help sustain revenue streams amid cost-containment pressures.

Competitive Landscape Positioning

| Company |

Market Focus |

Key Products |

Strengths |

Challenges |

| Sunovion |

CNS, respiratory, rare diseases |

Lunesta, Qelbree, Kynmobi |

Niche focus, innovation, strong pipeline |

Patent cliffs, competition from generics |

| Biogen |

Neurodegeneration |

Aduhelm, Tysabri |

Pioneering biologics, robust R&D |

Regulatory hurdles, pipeline dependence |

| Pfizer |

Broad pharma |

Comirnaty, Prevnar |

Market diversification, financial strength |

Patent expirations, regulatory scrutiny |

| Novartis |

Oncology, neuroscience |

Gilenya, Kisqali |

Diversified portfolio, innovative R&D |

Pricing pressures |

| Lupin, Teva |

Generics |

Multiple generic formulations |

Cost leadership |

Limited innovation, patent risks |

Sunovion’s position within this landscape is characterized by its niche specialization, innovative product strategy, and strong regional presence, positioning it as a focused player in high unmet medical need areas.

Key Challenges and Opportunities

Challenges

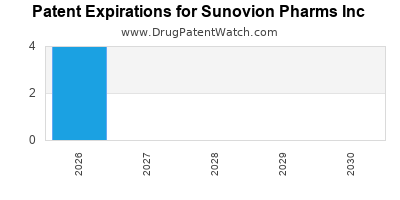

- Patent Expirations & Generic Competition: Loss of exclusivity for products like Lunesta threatens revenue stability.

- Pipeline Risks: High dependency on a limited number of high-value therapies; failure to commercialize new drugs could impact growth.

- Pricing and Reimbursement Pressures: Health systems' push for cost containment may limit market access and profit margins.

- Global Regulatory Variability: Navigating diverse regulatory environments complicates international expansion.

Opportunities

- Emerging Market Expansion: Growing healthcare infrastructure in Asia and Latin America presents new revenue streams.

- Innovative Delivery Platforms: Developing injectable, oral, or implant formulations can capture niche segments.

- Rare Disease Focus: Orphan drug designations can provide exclusivity and premium pricing.

- Partnerships and M&A: Strategic alliances can accelerate pipeline development and geographic reach.

Conclusion

Sunovion’s strategic positioning hinges on its niche expertise in CNS and respiratory therapeutics, complemented by a focused innovation pipeline and regional strength. By continuing to invest in groundbreaking research, expanding market access, and managing patent life cycles effectively, Sunovion can sustain competitiveness against both traditional pharmaceutical giants and emerging biotech firms.

Key Takeaways

- Sunovion has carved a specialized niche within CNS and respiratory markets, leveraging targeted innovation.

- Its growth is supported by strategic acquisitions, strong regulatory expertise, and a robust regional presence.

- To mitigate patent expiration risks, Sunovion must accelerate pipeline innovation and secure new product launches.

- Expanding into emerging markets and adopting digital commercialization strategies offer significant growth potential.

- Maintaining a focus on high unmet medical needs and orphan drugs maximizes revenue and market influence.

FAQs

1. How does Sunovion differentiate itself from its competitors?

Sunovion distinguishes itself through its strong focus on CNS and respiratory therapies, innovation in niche markets such as sleep disorder medications and rare diseases, and its strategic use of collaborations and acquisitions to bolster its pipeline and market presence.

2. What are the primary growth drivers for Sunovion in the coming years?

Key drivers include the successful commercialization of new therapies like Qelbree, expansion into emerging markets, pipeline advancements in neurodegeneration and rare diseases, and leveraging digital channels for broader market penetration.

3. How vulnerable is Sunovion to patent expirations?

While patent expirations for flagship products like Lunesta create revenue challenges, Sunovion’s focus on novel therapies and orphan drugs helps mitigate these risks by creating new revenue streams and maintaining market exclusivity for niche products.

4. What strategic moves should Sunovion consider to strengthen its market position?

Sunovion should prioritize pipeline innovation, accelerate approvals for emerging therapies, deepen its presence in high-growth regions, and explore alliances that enhance technological capabilities and market access.

5. How does Sunovion manage its R&D pipeline amid regulatory and market uncertainties?

The company invests heavily in targeted research, collaborates with biotech partners, and emphasizes regulatory planning to align clinical trials with approval requirements, reducing risks and expediting time-to-market.

Sources:

[1] Sunovion Pharmaceuticals Inc. Official Website.

[2] MarketWatch. "Pharmaceutical Industry Report 2023."

[3] IBISWorld. "Global Pharmaceuticals Industry."

[4] Evaluate Pharma. "2023 Pipeline & Market Trends."

[5] Company Financial Disclosures and SEC Filings.