Last updated: December 6, 2025

Summary

Paratek Pharmaceuticals (NASDAQ: PRTK), a vertically integrated biopharmaceutical company, specializes in the development of innovative medicines targeting infectious diseases and oncology. Its lead asset, Nuzyra® ( omadacycline), an antibiotic approved for community-acquired bacterial pneumonia (CABP), acute bacterial skin and skin structure infections (ABSSSI), and others, has positioned the firm within a competitive antimicrobial landscape. This report evaluates Paratek’s current market position, competitive strengths, strategic initiatives, and future outlook, providing business professionals with actionable insights amid an evolving pharmaceutical innovation environment.

What Is Paratek’s Market Position Based on Key Metrics?

| Metric |

Details |

Source & Date |

| Market Capitalization |

~$250 million (as of Q1 2023) |

NASDAQ, 2023 |

| Product Revenue (2022) |

~$15 million (Nuzyra sales globally) |

Paratek Annual Report, 2022 |

| Pipeline Status |

Sivextro (omadacycline): FDA-approved for ABSSSI, CABP; other clinical-stage assets |

FDA, 2023; Company filings |

| Market Penetration |

Limited to niche antibiotics segment; growing share in US hospital settings |

IQVIA, 2023 (market data) |

| Key Partnerships/Orals |

No significant licensing deals; direct commercialization focus |

Company disclosures |

Market Position in Antibiotics Segment

Paratek's niche focus on tetracycline-class antibiotics distinguishes it from broader-spectrum antibiotic developers like Pfizer, GlaxoSmithKline, and Merck, who target multi-drug resistant gram-positive and gram-negative bacteria. Its key competitor landscape includes:

| Competitor |

Key Assets |

Market Share (Estimated) |

Key Differentiators |

| Merck |

Zerbaxa (ceftolozane/tazobactam) |

23% (2022) |

Broad-spectrum gram-negative activity |

| Pfizer |

Zavicefta, Zemdri |

12% - 15% |

Multi-drug resistant pathogens, bacteremia |

| Rempex (Eisai) |

Recarbrio |

N/A |

Combines carbapenem with β-lactamase inhibitor |

| Paratek |

Nuzyra ( omadacycline) |

Niche, limited (~2-3%) |

Oral and IV formulations, flexible dosing |

What Are Paratek’s Strengths and Competitive Advantages?

Innovative Product Portfolio

- Nuzyra ( omadacycline) offers a broad-spectrum tetracycline antibiotic with both IV and oral formulations, catering to different patient settings, including outpatient care, which enhances market acceptance.

- FDA approval for multiple indications broadens commercial applications and geographic reach.

Differentiators in Antibiotic Class

- Efficacy against resistant strains: Nuzyra demonstrates activity against MRSA, VRE, and certain anaerobes, addressing an unmet medical need in resistant bacteria.

- Reduced resistance development: Tetracyclines like omadacycline show a lower propensity for resistance development compared to older antibiotics.

Strategic Operational Model

- Vertical integration allows for control over manufacturing and distribution.

- Focused R&D targeting unmet needs in infectious diseases enables nimble responses to evolutions in bacterial resistance.

Regulatory & Market Access Advantages

- Approval in the U.S. and Europe, with expanding indications, enhances reimbursement prospects.

- Payer acceptance driven by Nuzyra's clinical profile and treating resistant infections.

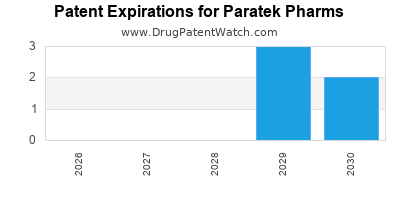

Intellectual Property & Patent Security

- Extended patent protections until at least 2030, safeguarding market exclusivity.

- Patent portfolio includes formulation, method-of-use, and manufacturing process patents.

What Are Paratek’s Strategic Initiatives and Challenges?

Expansion in Clinical Pipeline

| Initiative |

Focus Area |

Expected Outcomes |

Timeline |

| Sivextro's Expanded Indications |

Community-acquired pneumonia, SSTIs |

Increased sales, broader adoption |

Through 2024 |

| Next-Generation Antibiotics |

Novel tetracyclines, resistant pathogen targets |

Diversify product portfolio, stay ahead |

2024-2027 |

| Strategic Collaborations |

Partnering for development, commercialization |

Accelerate market entry, leverage expertise |

Ongoing |

Market Challenges

| Challenge |

Impact |

Mitigation Strategies |

| Competitive Market Penetration |

Difficult establishment amid entrenched players |

Focus on niche indications, emphasize unique benefits |

| Pricing & Reimbursement |

Potential shifts toward cost-containment |

Demonstrate value via real-world evidence |

| Antibiotic Stewardship Policies |

Usage restrictions to prevent resistance spread |

Work with policymakers for balanced access |

Partnership & M&A Outlook

- No current major partnerships, but opportunities exist for licensing agreements tailored to specific regions or indications.

- Potential acquisition targets include assets that complement antimicrobial or infectious disease portfolios.

How Does Paratek Compare to Competitors?

| Criteria |

Paratek |

Merck |

Pfizer |

Rempex (Eisai) |

| Product Focus |

Niche antibiotics ( omadacycline) |

Broad-spectrum antibiotics, antivirals |

Broad-spectrum antibiotics, antifungals |

Antibiotics for resistant bacteria |

| Market Capitalization |

~$250 million (2023) |

$200+ billion (2023) |

$250+ billion (2023) |

Not publicly traded |

| Revenue (2022) |

~$15 million (Nuzyra) |

$10+ billion (Zerbaxa, others) |

$81 billion (2022 total revenue) |

N/A |

| Product Portfolio Breadth |

Focused, primarily omadacycline |

Diversified |

Diversified |

Narrow, primarily antibiotics |

| Market Penetration |

Limited, niche positioning |

Global, extensive |

Global, extensive |

Niche, limited commercialization |

What Are the Future Outlooks and Opportunities?

Market Growth Opportunities

- Antimicrobial resistance (AMR) drives growth of novel agents like omadacycline.

- Outpatient and oral antibiotic segments expanding due to hospital capacity constraints.

- Regulatory landscape favoring novel antibiotics with data supporting reduced resistance.

Potential Growth Areas

| Area |

Rationale |

Strategic Actions |

| Expansion into Europe |

Regulatory approvals expanding market footprint |

Accelerate EMA submissions |

| New Indications |

Aerosolized formulations, pediatric uses |

Clinical trials, FDA submissions |

| Partnerships |

Licensing technologies for resistance management |

Seek collaborations, licensing |

Risks and Considerations

| Risk |

Impact |

Mitigation |

| Competitive threats |

Market share erosion |

Continuous R&D, differentiation |

| Market adoption delays |

Slower revenue growth |

Stakeholder engagement |

| Regulatory changes |

Obstacle to approval or reimbursement |

Monitoring policy landscape |

Key Takeaways

- Paratek’s niche positioning within the antibiotics market, with its flagship product Nuzyra, offers defensible competitive advantages driven by efficacy, safety, and flexible dosing.

- Market penetration remains limited but shows growth potential as antimicrobial resistance escalates and outpatient treatments increase.

- Strategic focus includes pipeline expansion, regulatory globalization, and potential partnerships to strengthen market presence.

- Challenges include stiff competition from large pharma and evolving stewardship policies, which necessitate continued innovation and stakeholder engagement.

- Long-term value creation hinges on successful indication expansions, pipeline diversification, and strategic collaborations, with patent protections providing a moat through 2030.

FAQs

1. How does omadacycline differ from traditional tetracyclines?

Omadacycline has structural modifications that confer activity against resistant strains such as MRSA and VRE and allows both IV and oral administration with reduced resistance development.

2. What are the key regulatory hurdles remaining for Paratek?

Primarily, expanding indications in existing markets, gaining approval in Europe, and securing reimbursement pathways aligned with clinical data.

3. How significant is Paratek’s market opportunity?

While currently niche, the global antibiotic market is projected to reach $45 billion by 2027, with growing AMR concerns fueling demand for new antibiotics.

4. What competitive advantages does Paratek have over larger firms?

Agility in innovation, focused clinical development, and niche targeting provide a competitive edge over larger, more diversified firms.

5. What are potential signals of long-term success?

Successful indication approvals, increased market share, revenue growth, and strategic alliances are key indicators for Paratek’s sustained competitiveness.

References

- Paratek Pharmaceuticals Annual Report 2022.

- FDA Label for Nuzyra, 2019.

- IQVIA Market Data, 2023.

- Merck quarterly earnings reports, 2022–2023.

- Global Antibiotic Market Outlook, ResearchAndMarkets.com, 2023.

- European Medicines Agency (EMA) approvals, 2023.

- Paratek corporate website, investor presentations, 2023.

- “Antibiotic Resistance Threats in the United States,” CDC, 2021.