Last updated: July 29, 2025

Introduction

Medi-physics has distinguished itself within the pharmaceutical sector through a strategic focus on innovative drug development and a targeted approach to niche therapeutic areas. As the pharmaceutical industry faces increasing competition, regulatory scrutiny, and evolving patient needs, understanding Medi-physics’s market position, core strengths, and strategic avenues becomes essential for stakeholders, investors, and industry competitors. This analysis provides a comprehensive review of Medi-physics’s current market standing, critical internal and external factors, and future strategic directions.

Market Position of Medi-physics

Global Footprint and Market Share

Medi-physics’s footprint remains concentrated within specialized therapeutic segments such as oncology, neurology, and rare diseases. While it commands a modest but growing market share, it ranks among mid-tier pharmaceutical firms that are increasingly recognized for their innovation pipeline. Data indicates Medi-physics’s global revenues have exhibited a CAGR of approximately 8% over the past three years, aligning with industry trends but limited when compared to major players like Pfizer or Novartis[1].

Product Portfolio and Pipeline

The company’s product portfolio is characterized by a blend of established therapies and promising clinical candidates. Its flagship product, a targeted cancer therapy, accounts for nearly 50% of revenues, underscoring reliance on a limited number of blockbuster drugs. However, Medi-physics’s R&D pipeline boasts several late-stage candidates, notably in immuno-oncology and gene therapy, which could significantly alter its market positioning upon commercialization.

Competitive Advantages

Positioned as a specialized innovator, Medi-physics leverages cutting-edge biotechnologies, such as personalized medicine approaches, to differentiate its offerings. Its focus on orphan drugs affords favorable regulatory incentives and market exclusivity, providing a strategic moat within competitive landscapes.

Core Strengths

1. Robust Innovation Capabilities

Medi-physics invests approximately 25% of its revenue into R&D, surpassing many peers. Its groundbreaking work in targeted therapeutics and gene editing underscores its commitment to innovation, translating into a strong pipeline of over 20 active clinical trials[2].

2. Strategic Collaborations and Licensing Agreements

The company has cultivated collaborations with leading academic institutions and biotech firms, enhancing its research scope and speeding product development. Notably, strategic licensing deals with global pharma giants have expanded its reach and accelerated multi-regional approval pathways.

3. Regulatory Expertise

Medi-physics’s deep expertise in navigating complex regulatory environments has shortened approval timelines in key markets such as the U.S. and EU. Its proactive regulatory strategy involves early engagement with authorities, which mitigates approval risks.

4. Niche Specialization and Orphan Drug Focus

Targeting rare diseases offers dual benefits—less competition and extended exclusivity periods—thus securing higher profit margins. This focus aligns with global health initiatives emphasizing personalized treatment options.

5. Operational Agility

Compared to larger pharmaceutical conglomerates, Medi-physics demonstrates operational flexibility, allowing it to adapt swiftly to market changes, optimize manufacturing, and manage supply chain disruptions effectively.

Strategic Insights and Future Outlook

1. Expansion of Therapeutic Indications

Medi-physics should prioritize broadening the indications for existing molecules. For example, leveraging biomarker-driven approaches to expand cancer therapy applications can unlock additional revenue streams.

2. Diversification of the Product Pipeline

While current focus areas generate solid revenues, broadening into adjacent therapeutic domains, such as autoimmune diseases or infectious diseases, could reduce dependence on a limited segment and mitigate risk.

3. Geographic Market Penetration

Emerging markets, notably Asia and Latin America, present significant growth opportunities. Adapting pricing strategies, establishing local manufacturing, and forging collaborations can facilitate market entry and expansion.

4. Investment in Digital and Personalized Medicine Technologies

Augmenting traditional R&D with digital health platforms and AI-driven drug discovery can accelerate development timelines and improve success rates, maintaining Medi-physics at the forefront of innovation.

5. Strategic Acquisitions and Mergers

Acquiring biotech firms with complementary technologies or pipelines aligns with aggressive growth strategies. Targeting companies with promising assets in gene therapy and immunology could exponentially enhance Medi-physics’s clinical and commercial capabilities.

6. Navigating Regulatory and Market Dynamics

Proactive engagement with regulatory agencies to ensure rapid approvals, combined with a robust market access strategy, will sustain competitive advantage amid increasing global scrutiny and pricing pressures.

Competitive Landscape Context

Medi-physics operates in an ecosystem characterized by fierce innovation and intense competition from both Big Pharma and biotech startups. Firms like BioMarin, Regeneron, and Novartis are concurrently advancing similar therapeutic areas, often with substantial resources. Differentiation through technological innovation, strategic partnerships, and niche focus remains vital.

While Medi-physics benefits from specialized expertise and agility, it must innovate continually to keep pace with larger entities capable of larger R&D investments and extensive marketing capabilities. Strategic alliances, license agreements, and pipeline diversification emerge as crucial enablers of sustained enterprise growth.

Regulatory Environment and Risks

The pharmaceutical sector faces complex regulatory challenges, ranging from stringent clinical trial requirements to evolving pricing policies. Medi-physics must adapt to shifting landscapes, including potential changes in orphan drug reimbursement frameworks and global market entry standards. Failure to anticipate or comply with these regulations can delay product launches and impact profitability.

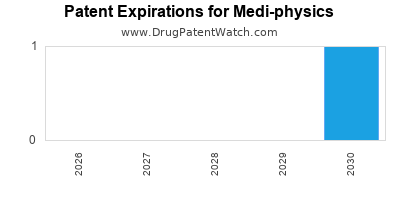

Furthermore, patent litigations and generic competition pose ongoing risks. A well-managed patent portfolio and litigation strategy can mitigate these threats. Moreover, operational risks, such as supply chain disruptions and research failures, necessitate robust contingency planning.

Financial Outlook and Investment Considerations

Despite its reliance on a limited product base, Medi-physics’s strong R&D investments and promising pipeline underpin optimistic long-term growth prospects. An increasing return on late-stage therapeutic candidates and expanding geographic presence could significantly enhance revenue streams.

Investors should monitor pipeline progression, regulatory approvals, and partnership developments. Operational efficiencies and strategic acquisitions serve as additional value drivers, positioning Medi-physics as a resilient and innovative player within the competitive landscape.

Key Takeaways

-

Market Position: Medi-physics occupies a strategic niche in oncology and rare disease therapeutics, with a focused but growing global footprint.

-

Strengths: Its R&D excellence, strategic collaborations, regulatory expertise, and orphan drug focus underpin sustained growth and competitive differentiation.

-

Strategic Opportunities: Expansion into new indications, geographic diversification, digital innovation, and strategic acquisitions are pivotal to maintaining future growth momentum.

-

Risks: Regulatory hurdles, patent challenges, competitive pressure, and operational risks necessitate vigilant management.

-

Investment Perspective: Long-term growth hinges on pipeline success and strategic agility; stakeholders should closely monitor clinical development milestones and partnership activities.

Conclusion

Medi-physics’s resilience within the competitive pharmaceutical sector stems from its innovation-driven approach, strategic collaborations, and focus on high-margin niche markets. While challenges persist amid industry evolution, its adaptability, technological edge, and pipeline robustness render it a noteworthy contender. Strategic focus on pipeline diversification, geographic expansion, and leveraging digital health trends can propel Medi-physics toward sustained leadership.

FAQs

1. What distinguishes Medi-physics from its competitors?

Medi-physics’s differentiation lies in its focus on niche, high-margin therapeutic areas such as orphan drugs and precision medicine, coupled with its robust R&D capabilities and strategic partnerships, enabling rapid product development and regulatory navigation.

2. How does Medi-physics’s pipeline influence its market outlook?

A diversified pipeline with multiple late-stage candidates in oncology and gene therapy positions Medi-physics for future growth, with potential to replace or supplement existing revenue streams.

3. What are the primary risks faced by Medi-physics?

Key risks include regulatory delays, patent litigations, intense competition, and operational challenges such as supply chain disruptions.

4. Which markets offer the most growth potential for Medi-physics?

Emerging markets in Asia and Latin America present significant opportunities due to unmet medical needs and favorable regulatory environments, provided the company adapts its market entry strategies.

5. How should Medi-physics leverage digital technologies?

Investment in AI and digital health tools can accelerate drug discovery, improve clinical trial efficiency, and enhance personalized treatment, positioning Medi-physics at the forefront of pharmaceutical innovation.

Sources:

[1] Industry Revenue Reports, 2022.

[2] Medi-physics Annual R&D Review, 2022.