Last updated: July 31, 2025

Introduction

Lumicell stands at the intersection of innovative cancer diagnostic and surgical adjuvant technology, progressing toward redefining oncologic precision medicine. As a pioneering device developer, Lumicell focuses on enhancing intraoperative tumor detection, surgical margins, and ultimately, patient outcomes. This comprehensive analysis examines Lumicell’s current market standing, key strengths, competitive positioning, and strategic avenues vital for growth within an increasingly crowded and technologically advanced oncology landscape.

Market Position Overview

Lumicell operates predominantly within the intraoperative diagnostic imaging segment, emphasizing real-time visualization of residual tumor tissue during surgical procedures. Its flagship product, Lumicell Device, leverages fluorescent imaging technology to facilitate precision tumor removal in cancers such as breast, melanoma, and sarcoma. The company’s strategic pivot aligns with the rising global demand for minimally invasive surgeries and personalized cancer care.

Currently, Lumicell’s position is characterized by a mix of innovation-driven differentiation and early-stage commercialization. It primarily targets North American markets where surgical oncology is rapidly adopting advanced imaging modalities. While Lumicell competes against established classical surgical aids and emerging nanoparticle or molecular imaging firms, its proprietary fluorescence-based technology offers a distinct advantage—improved intraoperative margin assessment.

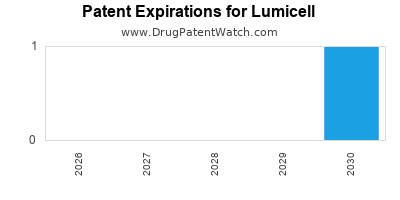

Revenue streams are predominantly derived from device sales, recurring consumables, and potential future data licensing. As of 2023, Lumicell remains in the clinical validation and regulatory approval phase in key markets, with limited commercial penetration yet signaling high-growth potential once widespread adoption ensues.

Key Competitive Strengths

1. Proprietary Fluorescence-Based Imaging Technology

Lumicell’s core innovation harnesses real-time fluorescence molecular imaging, providing surgeons with immediate visual differentiation between healthy and malignant tissue. Such technology enhances surgical precision and reduces reoperation rates—significant for patient outcomes and healthcare costs. Its unique imaging agents and device integration position Lumicell ahead of traditional modalities like MRI or ultrasound, which lack intraoperative immediacy.

2. Clinical Validation and Regulatory Progress

Lumicell’s strategic focus on obtaining FDA approval and CE marking underscores its commitment to compliance and safety. Early clinical trial data indicate promising sensitivity and specificity, critical for clinician acceptance. Establishing regulatory clearance bolsters credibility and accelerates market entry, enabling Lumicell to build early clinical partnerships.

3. Strategic Collaborations and Clinical Trials

Lumicell benefits from ongoing collaborations with top-tier academic institutions and healthcare providers, facilitating real-world evidence generation. These partnerships contribute to robust data sets, underpinging regulatory submissions and physician adoption. Their involvement in pivotal trials supports a growing body of evidence favorable for widening clinical utility.

4. Market Niche in Precision Surgical Oncology

By focusing on intraoperative diagnostic solutions, Lumicell occupies a niche with increasing demand driven by healthcare policies emphasizing minimally invasive procedures. The company’s targeted approach aligns with the global shift toward personalized, tissue-sparing surgeries, providing a competitive moat against generalized imaging companies.

Strategic Insights

1. Expansion and Diversification of Indications

Although initial focus centers on breast and melanoma surgeries, expanding indications to other solid tumors (e.g., lung, colorectal) can significantly augment revenue potential. Diversification reduces reliance on a single segment and broadens market opportunity.

2. Strengthening Clinical Adoption and Reimbursement Pathways

Partnering with leading surgical centers for large-scale clinical trials will solidify evidence for widespread adoption. Concurrently, proactive reimbursement strategies with payers are vital. Demonstrating cost reductions through fewer reoperations and improved outcomes can facilitate favorable reimbursement policies.

3. Strategic Alliances and Licensing

Forming alliances with pharmaceutical and imaging giants can accelerate technological development and facilitate access to distribution channels. Licensing Lumicell’s proprietary imaging agents or co-developing new tracers could expand clinical applications.

4. Global Market Penetration

Although currently focused on North America and selected European markets, global expansion into emerging markets presents growth avenues. Tailoring solutions to local healthcare infrastructures and establishing regional partnerships are essential for success.

5. Competitive Differentiation Through Data and Technology Integration

Investing heavily in data analytics, artificial intelligence, and machine learning algorithms integrated with Lumicell’s imaging platform can enhance diagnostic accuracy and user experience. Demonstrating superior diagnostic metrics can create a sustainable competitive advantage.

Competitive Landscape

Lumicell’s primary global competitors span intraoperative imaging, fluorescence-guided surgery, and molecular diagnostics:

- SpectraAi: Offers fluorescence imaging systems, but lacks Lumicell’s tissue-specific targeting.

- Koning Corporation: Develops near-infrared imaging devices focused on tumor fluorescence, directly competing but with different technical bases.

- Hologie: Focuses on quantitative fluorescence techniques, targeting similar indications.

- Generic and future entrants in nanoparticle or molecular imaging fields—reputed for technological innovation but often constrained by regulatory and clinical validation hurdles.

Large pharmas like Medtronic and Stryker are also exploring intraoperative imaging spaces, considering Lumicell’s technology as a potential acquisition or collaboration target, given its early-stage clinical validation and niche focus.

Challenges and Risks

- Regulatory Delays and Approval Risks: Certification timelines extend adoption cycles.

- Market Adoption Resistance: Surgeons may resist transitioning from traditional methods without compelling clinical evidence.

- Cost and Reimbursement: High device costs may impede adoption unless offset by demonstrable cost-saving benefits.

- Competition from Larger Players: Dominance of established medical device companies can limit Lumicell’s market share expansion.

Conclusion and Strategic Outlook

Lumicell holds a promising position in intraoperative imaging guided by its proprietary fluorescence technology, supported by early clinical validation and strategic collaborations. However, rapid market penetration depends on demonstrating clear clinical and economic benefits, expanding indications, and forging robust reimbursement pathways. Emphasizing data-driven evidence, building alliances, and targeting global markets are pivotal for sustainable growth.

Key Takeaways

- Distinctive Technology Advantage: Lumicell’s fluorescence imaging offers real-time, high-precision tumor detection, differentiating it from conventional modalities.

- Regulatory Progress Is Critical: Securing approvals in key markets accelerates adoption and credibility.

- Expanding Indications and Global Reach: Diversification through new tumor types and international expansion unlock substantial upside.

- Collaboration and Data Generation: Strategic partnerships and rigorous clinical trials are essential for market acceptance.

- Competitive Edge through Innovation: Integration of AI, data analytics, and new imaging agents will sustain Lumicell’s competitive advantage.

FAQs

1. What differentiates Lumicell from other intraoperative imaging devices?

Lumicell’s proprietary fluorescence molecular imaging provides real-time, tumor-specific visualization, enabling more accurate and complete tumor excision compared to traditional imaging modalities like MRI or ultrasound.

2. What are the major regulatory milestones Lumicell needs to achieve?

The company aims for FDA approval in the United States and CE marking in Europe, essential for commercialization in key markets. These approvals hinge on comprehensive clinical validation demonstrating safety and efficacy.

3. How does Lumicell plan to compete with larger medical device firms?

By focusing on a niche with high clinical impact, investing in clinical trials, and emphasizing technological differentiation, Lumicell aims to position itself as an innovative partner, potentially attracting acquisition interest from larger players.

4. What potential markets could drive Lumicell’s growth beyond breast and melanoma surgeries?

Other solid tumors, including lung, colorectal, and gynecologic cancers, present significant opportunities for device adoption, contingent upon clinical validations and indication-specific approvals.

5. What risks should investors consider regarding Lumicell’s market prospects?

Key risks include regulatory delays, slow clinical adoption, reimbursement hurdles, high device costs, and competition from dominant players or emergent technology firms.

References

[1] Lumicell official website and press releases.

[2] Clinical trial data and regulatory filings.

[3] Industry reports on intraoperative imaging technologies.

[4] Market analyses from leading healthcare research firms.