Last updated: August 3, 2025

Introduction

Ligand Pharmaceuticals (NASDAQ: LGND) operates as a leading biotech company specializing in the development and licensing of innovative drug delivery technologies, biopharmaceutical assets, and partnerships with major pharmaceutical firms. Its unique business model centers on acquiring, developing, and monetizing proprietary platform technologies, primarily through licensing agreements rather than traditional drug commercialization. This approach allows Ligand to mitigate risks typical of the pharmaceutical industry while generating steady revenue streams.

As the pharmaceutical landscape becomes increasingly competitive, understanding Ligand’s market position, intrinsic strengths, and strategic pathways is vital for investors, industry stakeholders, and potential partners. This analysis synthesizes Ligand’s current market standing, competitive advantages, and future growth opportunities.

Market Position of Ligand Pharmaceuticals

Ligand’s niche within the pharmaceutical ecosystem positions it uniquely. Unlike traditional pharma companies that focus on in-house drug development and marketing, Ligand functions predominantly as a technology rights owner and partner. Its core revenue derives from licensing its platform technologies—such as CaptureSelect, SAMDi, and Galixy—to global pharmaceutical and biotech companies.

Financial Performance and Market Capitalization

As of 2023, Ligand maintains a market cap of approximately $3 billion, reflecting investor confidence in its diversified licensing revenue model. The firm reported annual revenues exceeding $200 million, with a substantial portion stemming from upfront licensing fees, milestone payments, and royalties. Its revenue streams are predictable, given the nature of licensing agreements, rendering the company relatively resilient amidst industry volatility.

Strategic Focus Areas

Ligand’s focus areas, particularly precision medicine, monoclonal antibody (mAb) technologies, and delivery platform innovations, align with high-growth segments in the pharmaceutical industry. The company's strategic partnerships with luminaries like AbbVie, Hoffmann-La Roche, and Viatris underscore its industry relevance.

Competitive Landscape

Ligand competes indirectly with large pharma firms developing in-house technologies and direct licensing firms like Amgen, Regeneron, and MacroGenics. While its licensing model grants it less control over drug development, the diversified portfolio and royalty streams position it favorably in the licensing space.

Strengths of Ligand Pharmaceuticals

1. Robust Platform Technologies

Ligand’s proprietary platform technologies serve as the backbone of its licensing strategy. Notably:

- CaptureSelect: A platform for high-affinity affinity ligands used in antibody and protein purification, accelerating bioprocessing.

- SAMDi (Synthetic Antibody Mimetic Discovery): Enabling rapid creation of synthetic antibodies for diagnostics and therapeutics.

- Galixy: A small molecule delivery platform for targeted drug delivery.

These technologies add value to partner pipelines, making Ligand an attractive collaborator.

2. Diversified Revenue Through Licensing

Unlike firms reliant on drug sales, Ligand’s licensing model minimizes risks associated with clinical trials and regulatory approvals. Its revenue relies on milestone payments and royalties which, once established, provide recurring income.

3. Strategic Collaborations with Industry Leaders

Partnerships with giants such as AbbVie and Roche expand Ligand's technological reach and validate its offerings. These collaborations facilitate access to diverse therapeutic areas, including oncology, immunology, and rare diseases.

4. Agile Business Model

Ligand’s focus on licensing allows rapid scaling without the capital expenditures typical of in-house drug development. This model ensures flexibility and adaptability to market shifts, especially in emerging fields like biologics and personalized medicine.

5. Intellectual Property Portfolio

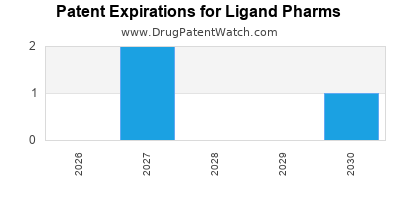

An extensive suite of patents underpins Ligand’s platform technologies, providing a competitive moat. The firm’s ability to enforce its IP rights deters infringement and sustains licensing viability.

Strategic Insights and Future Outlook

1. Capitalizing on Biologics and Precision Medicine

The global shift toward biologics and tailored therapies creates new licensing opportunities for Ligand’s proprietary platforms. Technologies like CaptureSelect and SAMDi are positioned to benefit from expanding bioprocessing and diagnostics markets.

2. Mergers, Acquisitions, and Strategic Alliances

To bolster its technological portfolio and market penetration, Ligand could pursue targeted acquisitions or deepen collaborations. Partnerships that offer access to emerging therapeutic modalities or geographic expansion are critical.

3. Expanding into Emerging Markets

Growth in Asia-Pacific and emerging biotech ecosystems presents opportunities for licensing and collaboration. Strategic localization and adaptation could unlock new revenue streams.

4. Enhancing Platform Commercialization

Investing in the commercialization of its platforms—via co-development or joint ventures—could transition Ligand from a predominantly licensing firm to a more integrated participant in product development.

5. Navigating Regulatory and Patent Challenges

Maintaining a strong patent portfolio and navigating changing intellectual property regulations are vital to safeguarding its licensing revenues and technological rights.

Challenges and Risks

While Ligand’s business model offers stability, certain challenges merit attention:

- Patent Litigation and IP Risks: Intense competition and patent disputes in biotech could threaten its licensing agreements.

- Dependence on Partner Success: Revenue hinges on partner commercialization efforts; failures could impact income.

- Market Saturation: As more competitors develop analogous platforms, Ligand must innovate continuously to sustain its edge.

- Potential for Technology Obsolescence: Rapid technological advances could dilute the value of existing platforms unless consistently updated.

Conclusion

Ligand Pharmaceuticals has carved a distinctive niche within the biotech sphere, leveraging proprietary technologies and strategic collaborations to generate steady licensing revenue. Its strengths in platform innovation, diversified income streams, and industry partnerships position it well within the evolving biologics and personalized medicine landscape. However, proactive strategic initiatives—focused on market expansion, platform commercialization, and IP protection—are essential to sustain and enhance its competitive edge.

Key Takeaways

- Ligand’s licensing-centric business model offers stability amid biotech industry volatility.

- Proprietary platforms like CaptureSelect underpin its revenue streams and competitive moat.

- Strategic collaborations with top pharma companies validate its technological relevance.

- Opportunities exist in biologics, precision medicine, and emerging markets.

- Ongoing risks include patent disputes, market saturation, and partner-dependent revenues.

FAQs

1. How does Ligand Pharmaceuticals generate its revenue?

Ligand primarily earns through licensing its proprietary platform technologies, with revenue derived from upfront licensing fees, milestone payments, and recurring royalties based on partner product sales.

2. What are the main platform technologies Ligand offers?

Key platforms include CaptureSelect (affinity ligands for bioprocessing), SAMDi (synthetic antibody mimetics for diagnostics/therapeutics), and Galixy (targeted small molecule delivery).

3. Who are Ligand’s major partners?

Major partners include AbbVie, Hoffmann-La Roche, and Viatris, collaborating on various therapeutic and diagnostic platforms.

4. What are the growth prospects for Ligand?

Growth prospects are driven by its ability to capitalize on biopharmaceutical trends, expand into emerging markets, and deepen platform commercialization through strategic alliances.

5. What are the main risks facing Ligand Pharmaceuticals?

Risks include patent litigation, dependence on partner success, technological obsolescence, and potential saturation of the licensing market.

Sources

[1] Ligand Pharmaceuticals Investor Relations, 2023.

[2] MarketWatch, Ligand Pharmaceuticals Financials, 2023.

[3] Biotech Industry Reports, 2023.

[4] Company Press Releases and Partner Announcements, 2022-2023.