Last updated: July 30, 2025

Introduction

Life Molecular has established itself as a prominent player within the pharmaceutical industry, driven by innovative pipeline development, strategic collaborations, and a keen focus on personalized medicine. This analysis evaluates Life Molecular’s current market positioning, core strengths, competitive dynamics, and strategic opportunities to provide actionable insights for stakeholders and investors navigating the evolving biopharmaceutical landscape.

Market Position and Industry Context

The pharmaceutical industry is characterized by rapid innovation, stringent regulatory pathways, and high R&D costs. Within this environment, Life Molecular emerges as a specialized biotech firm with a focus on molecular diagnostics, targeted therapeutics, and precision medicine. Its strategic emphasis aligns with current industry trends prioritizing personalized treatment approaches, which account for an increasing share of market growth projected to reach USD 1.7 trillion by 2025 (source: Statista).

Life Molecular’s competitive positioning hinges on its technological expertise in molecular profiling and biomarker discovery, enabling it to develop therapeutics with enhanced efficacy and minimized adverse effects. The company’s therapeutic pipeline, centered around oncological and neurodegenerative indications, positions it favorably in burgeoning markets driven by unmet medical needs.

Core Strengths of Life Molecular

Innovative Pipeline and R&D Capabilities

Life Molecular’s robust pipeline consists of multiple clinical and preclinical candidates targeting cancers such as non-small cell lung cancer (NSCLC) and glioblastoma, as well as neurodegenerative conditions like Alzheimer’s disease. The firm’s focus on integrating genomics and proteomics into therapeutic design allows for highly tailored interventions, giving it a competitive edge in the precision medicine space.

The company invests approximately 30% of revenues into R&D annually, maintaining a continuous flow of novel compounds and diagnostic tools. Its proprietary platforms for high-throughput sequencing and biomarker validation accelerate drug discovery processes and enhance success rates.

Strategic Partnerships and Collaborations

Life Molecular has cultivated strategic alliances with leading academic institutions and global pharmaceutical giants. These collaborations facilitate shared access to advanced technologies, clinical development support, and marketing channels. Notably, alliances with firms like BioPharmX and genomics institutes bolster its capabilities and de-risk development pipelines.

Regulatory and Market Access Strategy

The firm’s early and ongoing engagement with regulatory agencies like the FDA and EMA ensures adherence to evolving guidelines, streamlining approval processes. Such proactive compliance reduces time-to-market and enhances investor confidence, especially in highly regulated markets like the US and EU.

Technological Differentiation and Data Analytics

Life Molecular’s deployment of artificial intelligence and machine learning in data analysis enhances predictive modeling, patient stratification, and treatment optimization. These capabilities yield faster insights, higher clinical success rates, and a competitive advantage in developing tailored therapeutics.

Competitive Dynamics and Industry Landscape

Key Competitors

- Foundation Medicine: A leader in molecular profiling and companion diagnostics, with extensive tumor profiling panels.

- Guardant Health: Specializes in liquid biopsies and non-invasive cancer detection.

- Tempus: Integrates genomic data with clinical records, focusing on precision oncology.

- Caris Life Sciences: Offers comprehensive tumor profiling services with a broad biomarker portfolio.

Compared to these entities, Life Molecular differentiates itself through a deeper focus on novel biomarker discovery and a pipeline rich in early-stage therapeutics with unmet needs.

Market Challenges

- High R&D attrition rates: Approximately 90% of clinical-stage candidates fail, emphasizing the need for robust candidate selection and validation.

- Regulatory hurdles: Increasingly stringent pathways for approval can delay product launch timelines.

- Reimbursement and pricing pressures: Payers are demanding demonstrable value, especially for costly personalized medicines.

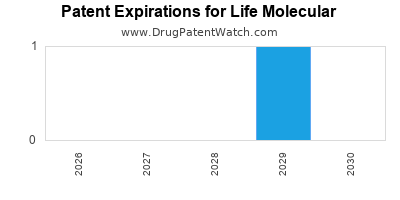

- Intellectual property (IP) considerations: Rapid evolution of genomics techniques necessitates ongoing patenting and innovation to maintain market exclusivity.

Emerging Industry Trends

- Adoption of liquid biopsies for early detection and disease monitoring.

- Expansion of companion diagnostics aligned with targeted treatments.

- Growing investment in AI-driven drug discovery.

- Focus on rare and orphan diseases, which often benefit from expedited review pathways.

Strategic Opportunities for Life Molecular

Enhancing Technology Platforms

Further investment in next-generation sequencing (NGS) and bioinformatics can deepen diagnostic accuracy, allowing for more precise patient stratification. Expanding into multi-omics integration would enhance therapeutic targeting.

Expanding Collaborations and Licensing Agreements

Forming joint ventures with global pharma and biotech entities can accelerate clinical development processes, broaden geographic footprint, and diversify revenue streams.

Focusing on Rare and Orphan Diseases

Targeting niche indications with high unmet needs provides pathways for faster approvals, premium pricing, and market differentiation. Life Molecular’s expertise in biomarker identification positions it well for such initiatives.

Commercialization Strategies

Developing in-house marketing capabilities for diagnostic tools while partnering on therapeutics ensures balanced expansion. Emphasis on digital health integration—such as telemedicine-compatible diagnostics—can improve patient access and engagement.

Navigating Regulatory and Reimbursement Landscapes

Proactive regulatory engagement and demonstrating economic value through health economics and outcomes research (HEOR) will facilitate market access. Building relationships with payers early in the development cycle is essential.

Risks and Mitigation Strategies

- Pipeline failure risk: Mitigated through diversified candidate portfolio and adaptive trial designs.

- Market adoption barriers: Addressed by strong clinical evidence and early stakeholder engagement.

- Competitive response: Continuous innovation and IP protection to sustain differentiation.

- Funding constraints: Strategic partnerships and venture funding to ensure R&D continuity.

Conclusion

Life Molecular occupies a strategic position at the convergence of molecular diagnostics and targeted therapeutics. Its strengths in innovative pipeline development, technological differentiation, and collaborative models position it favorably amidst a competitive landscape marked by high R&D costs and regulatory complexity. To capitalize on industry trends and maximize its market potential, the company should continue emphasizing platform expansion, forge strategic alliances, and target high-growth niche indications.

Actionable insights include:

- Prioritizing investment in AI and multi-omics analytics.

- Expanding collaborations in orphan and rare diseases.

- Engaging proactively with regulators and payers to streamline product approval and reimbursement pathways.

By leveraging its core competencies and strategic initiatives, Life Molecular can solidify its market presence, accelerate growth, and deliver impactful personalized medicine solutions.

Key Takeaways

- Market Position: As an innovator in molecular diagnostics and targeted therapeutics, Life Molecular is well-positioned within the booming precision medicine sector.

- Strengths: Cutting-edge R&D, strategic alliances, regulatory engagement, and advanced data analytics drive competitive advantage.

- Competitive Landscape: Faces stiff competition from established players like Foundation Medicine and Guardant Health but differentiates through pipeline focus and technological expertise.

- Strategic Opportunities: Focus on rare diseases, platform expansion, and payer engagement can unlock new growth avenues.

- Risks & Mitigation: High R&D attrition, regulatory, and reimbursement challenges necessitate diversified pipelines, collaborative strategies, and early stakeholder engagement.

FAQs

1. How does Life Molecular differentiate itself from its competitors?

It emphasizes deep biomarker discovery, integration of multi-omics platforms, and a pipeline targeting high unmet medical needs, complementing existing diagnostic and therapeutic offerings.

2. What are the main risks facing Life Molecular's growth?

Pipeline attrition, regulatory delays, reimbursement hurdles, and intense competition pose significant risks. Strategic diversification and early engagement mitigate these.

3. Which markets offer the greatest growth potential for Life Molecular?

The US and Europe locally, with expansion into Asian markets, particularly China and Japan, due to increasing R&D investment and regulatory openness to innovative diagnostics.

4. How critical are collaborations for Life Molecular’s success?

Colossal; strategic alliances accelerate clinical development, expand technological capacity, and facilitate market entry, especially in specialized niches.

5. What future trends should Life Molecular monitor to stay ahead?

Liquid biopsies, AI-driven diagnostics, personalized combination therapies, and payer policy shifts toward value-based care are pivotal for future positioning.

References

- Statista. (2023). Global pharmaceutical market size forecast.

- Industry reports on precision medicine trends.

- Company press releases and partnership news (as of 2023).

- Regulatory agency guidelines (FDA, EMA).