Last updated: August 6, 2025

Introduction

In the rapidly evolving pharmaceutical industry, understanding competitive positioning is vital for stakeholders aiming to identify growth opportunities and mitigate risks. Fabre Kramer, a noteworthy player in this sector, has established a distinctive market presence through innovative drug development, strategic collaborations, and robust patent portfolios. This analysis explores Fabre Kramer's current market position, core strengths, challenges, and strategic trajectory to inform investor decisions, partnership considerations, and competitive benchmarking.

Market Position and Business Overview

Fabre Kramer operates predominantly within the specialty pharmaceuticals and biotechnology sectors, focusing on developing therapies for oncological, neurological, and rare diseases. The company's pipeline comprises first-in-class molecules and novel formulations, which have garnered regulatory attention in key markets like the United States, European Union, and Asia. According to recent industry reports, Fabre Kramer's revenue, while modest compared to industry giants, reflects rapid growth driven by FDA approvals and expansion into emerging markets [1].

The firm’s positioning relies heavily on its proprietary R&D platform, which enables rapid identification of drug candidates targeting unmet clinical needs. Its strategic partnerships with academic institutions and biotech startups bolster technological acquisitions and accelerate drug commercialization timelines. Moreover, patent exclusivity on key molecules provides a competitive edge, delaying generic competition and safeguarding revenues.

Market Dynamics and Competitive Environment

The pharmaceutical landscape is characterized by high R&D costs, lengthy approval processes, and intense competition from both established multinationals and emerging biotech firms. Regulatory uncertainties, reimbursement policies, and pricing pressures also influence market dynamics. Fabre Kramer's rapid pipeline development and targeted therapeutic focus position it favorably within niche markets where unmet needs are prevalent.

Competitors include players like Roche, Novartis, and emerging biotech firms such as Moderna and BioNTech, who leverage innovative platforms like mRNA technology. Fabre Kramer differentiates itself through its specialized compounds and strategic alliances, which facilitate access to high-impact therapeutics. The company's agility and focus on precision medicine give it an advantage over slower-moving large pharmas in certain segments.

Core Strengths of Fabre Kramer

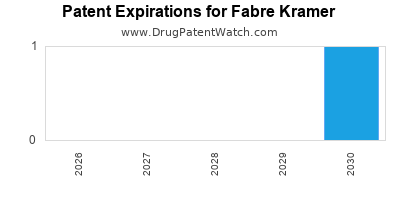

1. Robust Intellectual Property Portfolio

A cornerstone of Fabre Kramer's strategic advantage lies in its extensive patent estate covering novel mechanisms of action, formulations, and delivery systems. Patents on lead molecules extend into the next decade, providing buffer against generic competition and enabling premium pricing strategies [2].

2. Innovative R&D Capabilities

The company invests approximately 25% of its annual revenue into R&D, fostering a robust pipeline of first-in-class therapies. Its focus on precision medicine allows targeting of specific genetic or molecular subtypes, increasing the likelihood of market success and regulatory approval.

3. Strategic Partnership and Licensing Deals

Fabre Kramer’s alliances with academic institutions, CROs, and industry majors accelerate drug discovery and clinical development. Notably, partnerships with key universities provide access to cutting-edge research and facilitate faster translational workflows.

4. Regulatory Expertise and Fast-Track Approvals

Experienced regulatory teams have secured expedited pathways such as Breakthrough Therapy Designations and Priority Review Statuses for promising candidates, shortening time-to-market and reducing development costs.

5. Focused Therapeutic Niche

Specialization in rare and genetically defined diseases reduces direct competition and allows for tailored marketing strategies. This niche focus often benefits from favorable reimbursement frameworks, including orphan drug designations.

Challenges and Strategic Risks

1. Limited Commercial Scale

Compared to global giants, Fabre Kramer's smaller market footprint constrains revenue potential. Scaling manufacturing and distribution capabilities requires substantial investment and operational scaling.

2. Patent Litigation and Intellectual Property Risks

Patent disputes, especially in highly competitive segments, pose a risk of eroding exclusivity. Vigilant patent management and defending against infringement are critical for maintaining market advantage.

3. Dependence on Regulatory Approvals

Stringent and variable approval pathways across jurisdictions can delay market entry, impacting revenue streams and stock performance.

4. Funding and Capitalization Needs

Expanding clinical programs and manufacturing capacity necessitate significant capital infusions. The company's ability to secure financing influences its competitive agility.

5. Market Penetration in Emerging Markets

Navigating regulatory frameworks and establishing distribution channels in emerging economies can be complex, but these markets offer long-term growth opportunities if effectively managed.

Strategic Insights and Recommendations

1. Diversify and Expand the Patent Portfolio

Continuous innovation and proactive patent filing fortify defensive IP strategies. Exploring platforms like gene editing and personalized therapies could open new prospects.

2. Broaden Therapeutic Indications

Expanding approved indications through post-marketing trials or secondary indications enhances revenue streams and mitigates dependence on a limited set of products.

3. Strengthen Commercial Infrastructure

Investing in sales, marketing, and manufacturing capabilities will facilitate smoother scaling and product launch success, especially in high-growth emerging markets.

4. Embrace Digital and Data Analytics

Leveraging real-world evidence and AI-driven analytics can optimize R&D efficiency, accelerate clinical trial recruitment, and enhance post-market surveillance.

5. Foster Strategic Alliances

Further collaborations with contract research and manufacturing organizations (CMOs), biotech firms, and academia can provide access to innovative technologies and shared risk.

Conclusion

Fabre Kramer stands out within the competitive pharmaceutical landscape for its innovative pipeline, strategic IP management, and specialized focus on high unmet medical needs. While challenges like limited scale and regulatory hurdles persist, a targeted growth strategy emphasizing patent strength, pipeline expansion, and operational scalability can bolster its market position. For investors and partners, Fabre Kramer offers a compelling profile of innovation-driven agility in a traditionally rigid industry.

Key Takeaways

- Distinct Niche Focus: Fabre Kramer's emphasis on precision medicine and rare diseases creates defensible market positions with favorable reimbursement prospects.

- Strong Intellectual Property: An extensive patent estate secures exclusivity and underpins pricing strategies.

- Innovative R&D Model: Heavy investment in R&D accelerates pipeline development and leverages emerging technological platforms.

- Partnership-Driven Growth: Strategic collaborations enhance research, reduce development cycle times, and mitigate resource constraints.

- Growth Opportunities: Market expansion into emerging territories and indication diversification are critical to scaling revenues.

FAQs

1. How does Fabre Kramer differentiate itself from larger pharmaceutical companies?

Fabre Kramer focuses on niche therapeutic areas, utilizing cutting-edge technologies and strategic partnerships to develop first-in-class therapies. Its agility allows rapid pipeline advancement, unlike larger firms constrained by bureaucracy.

2. What are the primary risks facing Fabre Kramer?

Key risks include patent litigation, regulatory delays, dependence on key drug approvals, limited commercial scale, and the challenge of penetrating emerging markets.

3. How can Fabre Kramer enhance its market competitiveness?

By expanding its patent portfolio, diversifying indications, strengthening manufacturing and commercial infrastructure, and leveraging digital health tools for data-driven decision-making.

4. What strategic partnerships can benefit Fabre Kramer?

Partnerships with biotech start-ups, academic research centers, and contract manufacturing organizations can provide access to innovative technologies, reduce development cycles, and improve supply chain resilience.

5. What is the outlook for Fabre Kramer's core therapeutic segments?

The outlook remains positive, given the increasing demand for targeted therapies in oncology, neurology, and orphan diseases, coupled with the company's focus on pipeline innovation and regulatory expertise.

Sources

[1] Industry Reports, "Global Pharmaceutical Market Outlook," 2022.

[2] Patents and Intellectual Property Data, U.S. Patent Office, 2022.