Last updated: July 29, 2025

Introduction

Aadi Sub, a prominent player within the pharmaceutical industry, has carved out a niche through its targeted portfolio in specialized therapeutic areas. As global competition intensifies, understanding Aadi Sub’s market position, strengths, and strategic direction becomes vital for stakeholders seeking to gauge future growth prospects and competitive viability. This analysis delineates Aadi Sub’s current standing, explores its core competencies, and offers strategic insights for sustained success within the dynamic pharmaceutical landscape.

Market Position Overview

Market Segmentation and Focus Areas

Aadi Sub primarily operates within the cardiovascular, neurology, and rare disease segments, areas witnessing rapid innovation and high unmet medical needs. Its focus on niche therapeutics allows for a specialized market footprint with minimal direct competition but increased regulatory scrutiny.

Global and Regional Footprint

While Aadi Sub maintains a robust domestic presence, particularly in India where the pharmaceutical industry is burgeoning, its international footprint remains in expansion phases. The company’s strategic licensing deals and collaborations aim to penetrate key emerging markets, leveraging local manufacturing capabilities and tailored product development.

Competition Landscape

Major competitors include multinational pharmaceutical giants such as Novartis, Pfizer, and Roche, alongside local players like Sun Pharma and Cadila Healthcare. Aadi Sub differentiates through rapid drug development cycles, cost-effective manufacturing, and targeted niche therapies that address specific patient populations.

Strengths Analysis

Innovative R&D Pipeline

Aadi Sub’s commitment to innovation is reflected in its robust R&D pipeline, with a focus on biologics and biosimilars. The company has invested substantially in cutting-edge research for personalized medicine, giving it a competitive edge in developing high-value therapeutics with differentiated claims.

Regulatory Expertise

Navigating complex regulatory environments, particularly in India and key emerging markets, Aadi Sub has demonstrated agility and expertise. Its proactive approach to compliance accelerates product approvals, enabling faster time-to-market.

Cost Leadership and Manufacturing Efficiency

The company’s integrated manufacturing facilities, based in strategic locations, optimize costs without compromising quality. This advantage enables competitive pricing strategies, making therapies accessible in price-sensitive markets.

Strategic Collaborations

Aadi Sub’s alliances with academic institutions and biotech firms foster innovation and access to novel technologies. Such collaborations expand its R&D capabilities and facilitate entry into advanced therapeutic areas.

Market Agility

The company’s flexibility in swiftly adjusting its portfolio to emerging health threats (e.g., pandemic responses) positions it as a resilient player capable of navigating market volatility.

Strategic Insights for Future Growth

Leveraging Niche Therapeutic Areas

Aadi Sub should deepen its focus on rare diseases and personalized medicine, areas with high growth potential and relatively less competition. Developing orphan drugs and expanding their indication spectrum can substantially enhance market exclusivities.

International Expansion and Localized Strategies

Building a stronger international presence through strategic partnerships and licensing agreements can accelerate revenue streams. Tailoring products to local regulatory standards and patient needs will improve acceptance in diverse markets.

Investing in Biologics and Digital Health

Expanding biologics R&D will capitalize on global shifts towards targeted therapies. Integrating digital health solutions can improve patient adherence and real-world evidence collection, fostering data-driven decision-making.

Enhancement of Regulatory and Market Access Capabilities

Proactive engagement with regulatory authorities and payers will facilitate smoother approvals and reimbursement pathways. Establishing early dialogue enhances strategic planning and reduces market entry risk.

Operational Synergies and Cost Optimization

Streamlining supply chain operations, adopting sustainable manufacturing practices, and leveraging digital transformation can further reduce costs after initial investments, ensuring competitive pricing.

Challenges and Risks

- Regulatory Delays — Slower approvals in stringent markets could impede growth trajectories.

- Intense Competition — Larger players’ resources for innovation and marketing may threaten Aadi Sub’s market share.

- Pricing Pressures — Price caps and reimbursement restrictions, notably in emerging markets, could constrain margins.

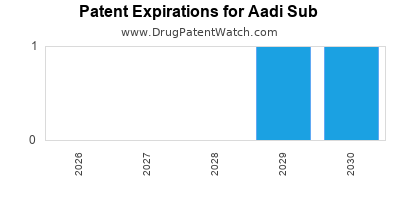

- Intellectual Property Risks — Patent challenges and biosimilar competition necessitate strategic patent management.

Conclusion

Aadi Sub’s strategic focus on niche therapeutic segments, coupled with its innovation, regulatory acumen, and operational efficiency, positions it favorably within the competitive landscape. To sustain growth, the company must capitalize on emerging global health trends, expand its international footprint, and deepen its expertise in personalized and biologic therapeutics. Proactive adaptation to regulatory environments and competitive dynamics will be essential for maintaining its market position.

Key Takeaways

- Specialized Focus: Aadi Sub’s concentration on niche markets such as rare diseases and biosimilars offers high-growth opportunities with competitive barriers.

- Innovation & R&D: Prioritizing biologics and personalized medicine will unlock new revenue streams and enhance therapeutic exclusivity.

- Global Expansion: Strategic licensing and joint ventures in emerging markets will accelerate international growth.

- Operational Efficiency: Cost-effective manufacturing and digital solution integration underpin competitive pricing and market access.

- Proactive Regulatory Strategy: Early engagement and compliance agility are critical to mitigate delays and streamline product approvals.

FAQs

-

What are Aadi Sub’s core therapeutic areas?

Aadi Sub specializes in cardiovascular, neurology, and rare disease treatments, with strategic expansion into biologics and personalized medicine.

-

How does Aadi Sub differentiate itself from larger competitors?

Its niche focus, cost-effective manufacturing, and innovative R&D pipeline enable agility and tailored therapies with less direct competition.

-

What are the primary growth opportunities for Aadi Sub?

Expanding into rare diseases, biologics, and emerging markets via strategic partnerships and localized strategies.

-

What challenges could impact Aadi Sub’s growth?

Regulatory delays, intense competition, pricing pressures, and intellectual property risks pose significant hurdles.

-

How can Aadi Sub enhance its global presence?

Through licensing, joint ventures, and product localization, coupled with investments in R&D and market access strategies.

Sources:

[1] Industry reports on emerging pharmaceutical markets.

[2] Company press releases and annual reports.

[3] Regulatory guidelines and market access analyses.