Last updated: July 27, 2025

Introduction

Abraxis Pharm, a prominent entity in the pharmaceutical industry, has carved out a specialized niche within the oncology and radiology sectors. Known for its innovative drug delivery platforms and proprietary formulations, the company operates in a highly competitive environment characterized by rapid technological advancements, regulatory hurdles, and evolving patient needs. This analysis explores Abraxis Pharm’s current market standing, core strengths, competitive advantages, and strategic pathways to bolster its future position amidst global industry dynamics.

Market Position of Abraxis Pharm

Global Footprint and Product Portfolio

Abraxis Pharm positions itself as a leader in targeted cancer therapies, notably with its flagship drug, Abraxane (nab-paclitaxel). Abraxane has garnered significant market share due to its formulation technology that enhances drug solubility and reduces hypersensitivity reactions associated with traditional chemotherapies. The drug is approved for multiple indications, including metastatic breast cancer, non-small cell lung cancer (NSCLC), and pancreatic cancer, fostering a diversified revenue stream.

The company's strategic alliances and licensing agreements also extend its reach into emerging markets, including Asia, Latin America, and Eastern Europe, with localized manufacturing and distribution channels. As of the latest fiscal reports, Abraxis Pharm’s revenue from Abraxane constitutes approximately 60-70% of its total sales, underscoring its dependence on this flagship product.

Market Share and Competitive Position

In the broad oncology drug market, Abraxis Pharm holds a strong position, particularly within the nanoparticle albumin-bound paclitaxel segment. According to IQVIA data, Abraxane retains a leading market share in advanced breast cancer in the United States and Europe, competing primarily against generic paclitaxel formulations and other nanoparticle-based chemotherapies.

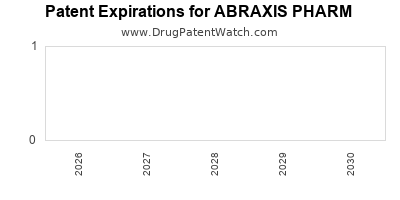

Despite competition from generics and biosimilars, Abraxis Pharm’s emphasis on clinical efficacy, improved safety profile, and patent protections has maintained its differentiated positioning. However, patent expirations scheduled over the next five years pose a strategic challenge, necessitating continuous innovation and pipeline expansion.

Core Strengths of Abraxis Pharm

Innovative Drug Delivery Platform

Abraxis Pharm’s proprietary nanoparticle technology underpins its core strength. The solubilization of paclitaxel within albumin nanoparticles allows for higher drug concentrations without requiring toxic solvents like Cremophor EL, reducing adverse reactions and enabling higher dosing. This technological edge enhances patient tolerability and adherence, vital factors in oncology.

Robust Clinical Evidence and Regulatory Approvals

The company boasts a comprehensive dossier of pivotal trials demonstrating the safety and efficacy of Abraxane. Regulatory approvals from the U.S. Food and Drug Administration (FDA), European Medicines Agency (EMA), and other authorities establish credibility and facilitate commercialization worldwide. These approvals serve as barriers to entry for competitors seeking to replicate its formulations.

Strong Intellectual Property Portfolio

Abraxis Pharm’s patents extend beyond Abraxane, encompassing manufacturing processes, additional formulation technologies, and new therapeutic indications. Such intellectual property hedges against patent cliff risks and provides avenues for life-cycle extensions through new clinical applications.

Strategic Collaborations and Market Access

Partnerships with pharmaceutical giants like Celgene (now part of Bristol-Myers Squibb) have strengthened market access and distribution channels. Besides, the company’s local manufacturing units, regulatory expertise, and strategic alliances facilitate accelerated approval pathways and reimbursement negotiations in diverse markets.

Strategic Insights for Future Growth

Pipeline Development and Diversification

To mitigate patent expiration risks, Abraxis Pharm must expand its pipeline beyond Abraxane. This includes investing in next-generation nanoparticle platforms and developing formulations for other therapeutic areas, such as immuno-oncology and gene therapy. Partnering with biotech firms specializing in novel modalities can facilitate rapid innovation.

Focus on Biosimilars and Generics

As key patents expire, entering the biosimilar market segment can generate new revenue streams. Leveraging its formulation expertise, Abraxis Pharm can develop biosimilar chemotherapeutics or expand into bioconjugates, ensuring sustained relevance in a competitive landscape.

Geographic Expansion and Local Partnerships

Emerging markets offer significant growth potential due to rising cancer incidence rates and improving healthcare infrastructure. Establishing alliances with local pharmaceutical firms and regulatory authorities will enable faster market penetration and improved access.

Digital Transformation and Market Analytics

Utilizing advanced analytics and real-world evidence can inform strategic decisions related to product positioning, patient adherence programs, and personalized medicine approaches. Digital tools can also streamline manufacturing, supply chain management, and post-market surveillance.

Regulatory Strategy and Lifecycle Management

Proactive engagement with regulatory authorities ensures timely approvals for new indications and formulations. Life-cycle management strategies, including line extensions and combination therapies, will prolong the commercial viability of existing products.

Competitive Environment and Key Players

Major Competitors

- Roche/Genentech: Pioneers in nanoparticle formulations, with their portfolio of targeted therapies and biosimilars.

- Johnson & Johnson: Offering branded and generic oncology products, with extensive marketing and distribution networks.

- Pfizer and Novartis: Focused on expanding targeted cancer treatment options and biosimilars.

- Boehringer Ingelheim and Teva: Holding a significant share in generic and biosimilar spaces, intensifying price competition.

Competitive Differentiation

Abraxis Pharm’s differentiation hinges on its proprietary formulation technologies, proven clinical efficacy, and strategic alliances. Nonetheless, competitors’ aggressive pipeline development and patent strategies demand continuous innovation and market agility.

Regulatory and Market Challenges

- Patent Cliff Risks: Expiry of key patents threatens revenues; necessitates pipeline diversification.

- Pricing Pressures: Increasing emphasis on cost-effectiveness and biosimilar entry puts downward pressure on prices.

- Regulatory Hurdles: Stringent approval processes in emerging markets may delay product launches.

- Market Access Barriers: Reimbursement policies and healthcare resource constraints impact product adoption.

Conclusion

Abraxis Pharm’s strategic success is rooted in its innovative nanoparticle technology, clinical credibility, and global market access strategies. While its dependence on Abraxane presents inherent risks, proactive pipeline expansion, diversification into biosimilars, and geographic penetration can reinforce its competitive positioning. Navigating patent expirations and market pressures will require agility, robust R&D investment, and strategic partnerships. With these measures, Abraxis Pharm can sustain growth and maintain its stature as a leading innovator in targeted oncology therapies.

Key Takeaways

- Market Leadership: Abraxis Pharm dominates the nanoparticle paclitaxel market with Abraxane, supported by clinical evidence and regulatory approvals.

- Core Strengths: Proprietary drug delivery technology, extensive IP portfolio, and strategic alliances underpin its competitive advantage.

- Growth Strategies: Pipeline diversification into novel formulations, biosimilars, and expanding into emerging markets are critical to future growth.

- Challenges: Patent expirations, pricing pressures, and regulatory complexities necessitate strategic agility and innovation.

- Competitive Edge: Maintaining differentiation through innovation, global partnerships, and lifecycle management strategies will secure Abraxis Pharm’s position in a dynamic industry landscape.

FAQs

1. How does Abraxis Pharm’s nanoparticle technology provide a competitive edge?

It enhances drug solubility, reduces hypersensitivity reactions, and allows higher dosing, resulting in improved safety and efficacy profiles that differentiate its products from traditional formulations.

2. What are the primary growth opportunities for Abraxis Pharm?

Expanding its pipeline into immuno-oncology, developing biosimilars, and entering emerging markets offer significant growth avenues, especially as patent protections for key products expire.

3. How secure is Abraxis Pharm’s market position amid patent expirations?

While reliance on a flagship product poses risks, diversification strategies, ongoing innovation, and lifecycle extensions help maintain market relevance.

4. What challenges does the company face in global expansion?

Regulatory approval processes, reimbursement policies, and local market competition present hurdles that necessitate strategic partnerships and tailored market entry approaches.

5. How does Abraxis Pharm compare to competitors in the biosimilars space?

Current focus remains on its proprietary nanoparticle formulations; expansion into biosimilars requires leveraging existing technology platforms and strategic alliances to compete effectively.

Sources:

[1] IQVIA. (2022). Oncology Market Report.

[2] U.S. Food and Drug Administration. (2012). Abraxane approval documentation.

[3] Abraxis Pharm Annual Report 2022.

[4] MarketWatch. (2023). Oncology drug market analysis.