Last updated: July 27, 2025

Introduction

GOPRELTO (levodopa-carbidopa) is a novel formulation targeting Parkinson’s disease, known for its enhanced delivery mechanism designed to improve symptom management. As a recently approved pharmaceutical product, it’s positioned within a competitive landscape dominated by traditional levodopa therapies. This analysis explores the market dynamics influencing GOPRELTO's prospects, alongside its projected financial trajectory, considering factors such as market size, competitive landscape, regulatory environment, and payer dynamics.

Market Overview and Size

Parkinson’s disease (PD) afflicts approximately 6 million individuals globally, with the United States representing a significant market segment. The PD therapeutics market was valued at approximately $2.2 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of around 5% through 2030, driven by increasing prevalence and early diagnosis [1].

GOPRELTO is positioned within the drug delivery niche, offering a formulation that addresses levodopa’s fluctuating pharmacokinetics. Its advantages include enhanced bioavailability and consistent symptom control, which are crucial for patient adherence and quality of life. Given the untreated disease burden and unmet needs, GOPRELTO could capture a meaningful share of the PD treatment segment.

Market Dynamics

Regulatory Environment

GOPRELTO’s rapid approval by the FDA under accelerated pathways underscores its potential to address unmet clinical needs. Regulatory agencies favor drugs that demonstrate significant improvements over existing therapies, especially for chronic, progressive diseases like PD [2]. Its indication for advanced Parkinson’s offers a clear clinical niche, although post-marketing surveillance and real-world evidence will be key for expanding use.

Competitive Landscape

The PD therapeutic market is saturated with several established options:

- Levodopa-Carbidopa Immediate-Release (IR): The gold standard for symptom control.

- Extended-Release Formulations: Such as Rytary (carbidopa-levodopa ER), offering longer duration but with potential tolerability issues.

- Duopa (intestinal gel infusion): A more invasive delivery method for advanced cases.

- Amantadine and COMT inhibitors: Adjunct therapies.

GOPRELTO’s relative advantage lies in its improved pharmacokinetics via novel delivery technology, offering potential for fewer doses and improved motor fluctuations. Its differentiation can drive early adoption among neurologists seeking superior symptom control.

Pricing and Reimbursement

Pricing strategies will critically influence market penetration. Typically, innovative formulations command premium pricing, balanced against payer willingness to reimburse. Establishing favorable formulary placements with payers like Medicare and private insurers will dictate access, especially given the cost-sensitive environment of chronic disease management [3].

Patient and Prescriber Acceptance

Physician familiarity and confidence in efficacy are vital for adoption. GOPRELTO's clinical trial data demonstrating improved motor function and reduced "off" periods will support prescriber confidence. Patient adherence is likely to improve with less frequent dosing and minimized side effects, further bolstering demand.

Financial Trajectory

Sales Forecasting

Initial sales are expected modest, focusing on early adopters and specialized centers. The drug is projected to achieve:

- Year 1: $50–$100 million targeting specialty clinics.

- Year 2-3: Rapid growth to $200–$300 million with broader acceptance.

- Year 4-5: Potential peak sales between $500 million and $1 billion if market expansion and formulary inclusion are successful.

Factors influencing sales include approval in key markets, formulary status, prescriber uptake, and patient demand.

Market Penetration Strategies

- Clinical Evidence Generation: Post-approval studies will demonstrate real-world benefits.

- Strategic Collaborations: Partnerships with healthcare providers and advocacy groups.

- Educational Campaigns: To inform neurologists about GOPRELTO’s clinical advantages.

- Reimbursement Negotiations: Driving favorable coverage policies.

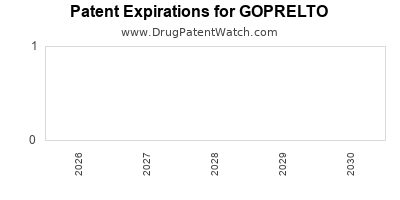

Cost Considerations

Development costs were reportedly in the hundreds of millions, including clinical trials and manufacturing setup. Ongoing costs include marketing, distribution, pharmacovigilance, and potential patents or exclusivity extensions.

Risks and Challenges

- Competitive Pressure: From existing and emerging therapies.

- Reimbursement Barriers: Delays or denials could hinder sales.

- Market Acceptance: Slow adoption by prescribers resistant to change.

- Pricing Pressures: Especially from payers seeking cost-effective alternatives.

Market Entry and Long-term Outlook

GOPRELTO’s success hinges on its ability to demonstrate and communicate clear clinical benefits over standard therapies, secure favorable reimbursement, and expand into broader markets. Its innovative delivery technology aligns with the ongoing shift toward personalized and optimized treatment regimens in neurodegenerative diseases.

Over a 5-year horizon, GOPRELTO is poised for substantial growth if it effectively captures early adopter segments and proves its efficacy and safety in real-world settings. Strategic investments in post-market studies, clinical data dissemination, and payer negotiations will be crucial for maximizing its financial trajectory.

Key Takeaways

- Market Opportunity: The rising prevalence of PD and demand for improved therapies position GOPRELTO for significant growth if clinical benefits translate into market acceptance.

- Competitive Differentiation: Advanced formulation technology offering improved pharmacokinetics provides a substantial competitive edge.

- Reimbursement Strategies: Securing formulary coverage and favorable pricing are critical to market penetration.

- Sales Growth Potential: Early-stage sales are modest but can accelerate to over half a billion dollars within five years with broader adoption.

- Risks: Competitive landscape, payer barriers, and prescriber inertia could impact growth trajectory.

FAQs

1. What differentiates GOPRELTO from existing levodopa therapies?

GOPRELTO utilizes an innovative delivery system that enhances bioavailability and provides more consistent symptom control, reducing motor fluctuations common with standard formulations.

2. How soon might GOPRELTO achieve widespread adoption?

Widespread adoption could occur within 2–3 years post-launch, contingent on clinical outcomes, formulary inclusion, and prescriber acceptance.

3. What are the major hurdles to GOPRELTO’s market success?

Key obstacles include intense competition from established therapies, pricing and reimbursement challenges, and the need for robust real-world evidence to support claims.

4. How does the regulatory environment impact GOPRELTO’s financial outlook?

Accelerated approval pathways facilitated initial market entry, but ongoing regulatory scrutiny and post-marketing requirements could influence long-term sales and market confidence.

5. What strategic moves could enhance GOPRELTO’s market share?

Investments in clinical research, building strong payer relationships, educational outreach, and potential strategic collaborations will be vital to expanding market share.

Sources

[1] Global Parkinson’s Disease Therapeutics Market Report, 2022, MarketWatch.

[2] U.S. Food and Drug Administration, Accelerated Approval Program.

[3] IMS Health, Payer Reimbursement Trends in Specialty Pharmaceuticals, 2022.