Last updated: July 28, 2025

Introduction

Zinc sulfate, a vital mineral supplement and industrial chemical, is extensively used in pharmaceutical, agricultural, and industrial applications. The global market for zinc sulfate is poised for growth driven by rising health awareness, increasing demand for dietary supplements, and expanding agricultural applications. This analysis provides an in-depth evaluation of current market dynamics and forecasts future sales trajectories.

Market Overview

Zinc sulfate's primary uses encompass nutritional supplementation, pharmaceutical formulations, agricultural fertilizers, and industrial applications such as galvanization and chemical synthesis. Its role in addressing zinc deficiency—linked to immune function, growth, and development—supports sustained demand in emerging economies.

The global zinc sulfate market was valued at approximately USD 1.2 billion in 2022, with a Compound Annual Growth Rate (CAGR) projected around 5.2% from 2023 to 2030 [1].

Key Market Drivers

-

Rising Zinc Deficiency Globally

A significant segment of the population, particularly in developing nations, suffers from zinc deficiency. With increasing healthcare awareness and fortification programs, demand for zinc supplements like zinc sulfate is expanding.

-

Expanding Pharmaceutical and Nutritional Markets

The rising prevalence of immune-related diseases, malnutrition, and growth deficiencies propels demand for zinc-based formulations. The COVID-19 pandemic further emphasized zinc's role in immune support, elevating its popularity.

-

Growing Agricultural Application

Zinc is an essential micronutrient in crop production, with zinc sulfate serving as a fertilizer additive. The surging global population intensifies food security concerns, stimulating demand for zinc-enriched fertilizers.

-

Industrial Growth

Applications in galvanization and chemical manufacturing sustain steady industrial demand, especially in industrializing regions.

Regional Market Dynamics

North America

- A mature market driven by health supplement consumption and strict industrial standards.

- High awareness and regulatory support favor growth.

Europe

- Similar dynamics as North America, with increased focus on agricultural productivity and food fortification.

Asia-Pacific

- The fastest-growing region owing to extensive agricultural sectors and rising healthcare spending.

- Countries like China, India, and Southeast Asian nations are significant markets, with India leading in zinc supplement consumption.

Latin America and Middle East & Africa

- Growing markets with expanding pharmaceutical and agricultural sectors.

Competitive Landscape

Leading players in zinc sulfate manufacturing include Nutritional companies (e.g., GlaxoSmithKline), chemical producers (e.g., Tessenderlo Group), and regional suppliers. Market entry is facilitated by low-to-moderate barriers, with innovation focusing on eco-friendly production and enhanced bioavailability.

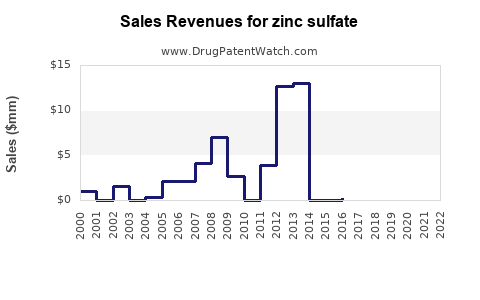

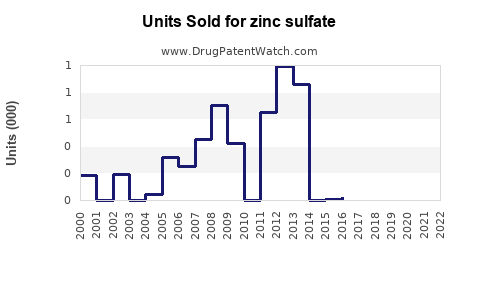

Sales Projections (2023-2030)

Based on current growth rates, the market’s trajectory suggests the following:

- 2023: The market is expected to reach USD 1.3 billion in sales.

- 2024-2025: Growth accelerates, fueled by increased health awareness, reaching approximately USD 1.4 billion by 2025.

- 2026-2030: Sustained CAGR of 5.2% projects the market to surpass USD 1.9 billion by 2030.

This projection accounts for factors such as demographic shifts, increased regulatory focus on nutritional supplementation, and expanding agricultural use.

Forecasting Methodology

The sales forecast applies a compounded growth model derived from historical data and current market trends. Sensitivity analyses account for potential disruptions, including regulatory changes, supply chain bottlenecks, and shifts in consumer health priorities.

Market Challenges and Risks

- Regulatory Constraints: Differing standards and approvals across regions may slow product registration and market entry.

- Supply Chain Disruptions: Fluctuations in zinc ore prices and mining operations impact production costs.

- Environmental Concerns: Eco-regulatory restrictions on chemical manufacturing could necessitate process innovations.

- Competition and Price Pressures: Market saturation and commoditization may limit profit margins.

Strategic Opportunities

- Product Differentiation: Development of bioavailable zinc sulfate variants to meet specialized healthcare needs.

- Market Penetration: Expanding into underpenetrated regions with high zinc deficiency prevalence.

- Regulatory Advocacy: Collaborating with health authorities to facilitate approvals and standardization.

- Sustainable Manufacturing: Eco-friendly production methods to gain compliance and consumer trust.

Conclusion

The zinc sulfate market exhibits promising growth potential over the next decade, driven primarily by health, agricultural, and industrial applications. Companies should monitor regional regulatory developments, invest in sustainable production, and tailor product offerings to emerging consumer and industrial demands to capitalize on this trajectory.

Key Takeaways

- The market is projected to grow from USD 1.2 billion in 2022 to over USD 1.9 billion by 2030.

- Asia-Pacific will be the fastest-growing region, with significant demand in India and China.

- Healthcare and agricultural sectors are the primary growth drivers.

- Innovation in bioavailability and eco-friendly production methods present competitive advantages.

- Regulatory navigation and supply chain resilience are critical to sustaining growth.

FAQs

1. What are the main applications of zinc sulfate?

Zinc sulfate is primarily used as a dietary supplement, in pharmaceutical formulations, agricultural fertilizers, and industrial processes such as galvanization.

2. Which regions offer the most growth opportunities?

The Asia-Pacific region presents the highest growth opportunities due to expanding agricultural activities and increasing health awareness.

3. How does the COVID-19 pandemic influence zinc sulfate demand?

It heightened awareness of zinc’s immune-support role, boosting demand in nutritional supplements and healthcare products.

4. What regulatory challenges does zinc sulfate face?

Regulatory approval varies globally, with some regions imposing strict standards that could delay market entry or increase compliance costs.

5. What are the key factors influencing future sales?

Demographic trends, health awareness, agricultural needs, industrial demand, regulatory landscape, and supply chain stability are critical factors.

Sources

[1] MarketResearch.com, "Global Zinc Sulfate Market Analysis & Forecast," 2023.