Share This Page

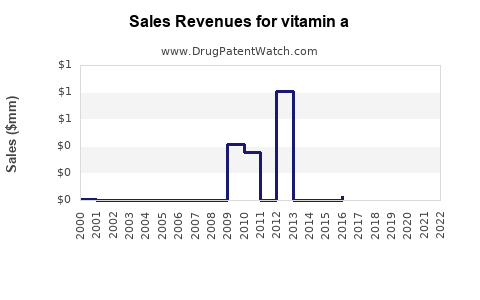

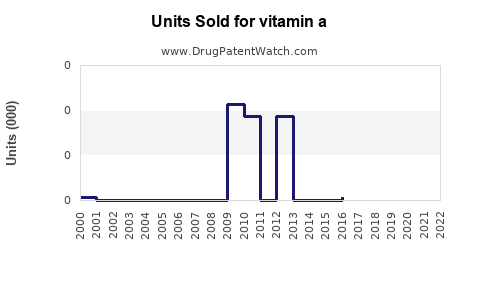

Drug Sales Trends for vitamin a

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for vitamin a

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| VITAMIN A | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| VITAMIN A | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| VITAMIN A | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| VITAMIN A | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| VITAMIN A | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| VITAMIN A | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| VITAMIN A | ⤷ Get Started Free | ⤷ Get Started Free | 2016 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Vitamin A

Introduction

Vitamin A, a fat-soluble vitamin essential for vision, immune function, and cellular growth, remains a cornerstone of both pharmaceutical and nutraceutical markets. With a broad application spectrum spanning dietary supplements, prescription medications, fortification programs, and emerging therapeutic uses, understanding its market dynamics and future sales trajectory is vital for stakeholders. This report provides a comprehensive market analysis and sales forecast for Vitamin A, integrating current trends, regulatory environments, competitive landscape, and consumer behaviors.

Market Overview

Global Market Size and Growth

The global Vitamin A market was valued at approximately USD 700 million in 2022, with a compound annual growth rate (CAGR) of 5.8% projected through 2030 (source: Grand View Research). Its growth is driven by expanding health awareness, rising prevalence of vitamin deficiencies, and increasing product penetration in developing economies.

Key End-Use Segments

- Nutritional Supplements: The majority share, driven by consumer wellness trends and pediatric supplementation programs.

- Fortification: Used extensively in dairy products, cereals, and oils to combat deficiency, particularly in regions with limited dietary diversity.

- Pharmaceuticals: Prescribed for treating deficiency states, immune support, and certain dermatological conditions.

- Cosmetics: Utilized in anti-aging and skin health formulations.

Regional Dynamics

- North America: Mature market with high per capita supplementation and robust R&D investments.

- Europe: Stabilized, with increasing focus on purity and regulatory compliance.

- Asia-Pacific: Fastest-growing sector due to rising awareness, increasing disposable incomes, and government nutrition initiatives, notably in China and India.

- Latin America and Africa: Emerging markets with substantial growth potential attributed to public health campaigns and fortification programs.

Market Drivers and Challenges

Drivers

- Rising Nutritional Deficiency Concerns: Vitamin A deficiency affects an estimated 250 million preschool children globally, prompting fortified foods and supplements (WHO, 2021).

- Preventive Healthcare Emphasis: Growing consumer predilection for health maintenance supplements.

- Advancements in Extraction and Formulation: New methods improve bioavailability and stability, expanding product applications.

- Governmental & NGO Initiatives: Campaigns and subsidies to combat deficiency bolster market demand.

Challenges

- Regulatory Hurdles: Stringent approval and quality standards across regions can delay product launches.

- Potential Toxicity: Hypervitaminosis A poses health risks, leading regulators to set safe upper limits, impacting formulation and sales.

- Market Competition: Presence of generic and private label brands increases price competition.

- Supply Chain Constraints: Raw material sourcing, especially for carotenoids, can be affected by agricultural variability.

Competitive Landscape

Major players include Pfizer Inc., DSM Nutritional Products, BASF SE, Rogers International, and Natrol LLC. These firms differentiate via product purity, bioavailability enhancements, and extensive distribution networks. Market entry barriers remain high due to the need for specialized manufacturing facilities and regulatory approvals.

Innovative firms are focusing on natural and plant-derived sources such as beta-carotene and other carotenoids, which serve as precursors to Vitamin A. This trend aligns with consumer preferences for "clean-label" and plant-based products.

Sales Projections (2023-2030)

Assumptions

- Continued growth in supplement consumption, driven by health awareness.

- Expansion of fortification programs in emerging markets.

- Regulatory stability and proactive health policies.

Forecast

| Year | Estimated Market Value (USD Millions) | CAGR |

|---|---|---|

| 2023 | 750 | 5.8% |

| 2024 | 794 | 5.9% |

| 2025 | 840 | 6.0% |

| 2026 | 890 | 6.0% |

| 2027 | 943 | 6.0% |

| 2028 | 998 | 6.0% |

| 2029 | 1,055 | 6.0% |

| 2030 | 1,116 | 6.0% |

Projected cumulative sales reach approximately USD 8.4 billion over this period, with growth driven predominantly by the Asia-Pacific and Latin American regions, while mature markets maintain steady expansion through innovation and consumer engagement.

Future Growth Opportunities

- Natural & Plant-Based Sources: As consumers increasingly prefer natural products, sourcing Vitamin A from beta-carotene-rich vegetables such as carrots and sweet potatoes offers growth avenues.

- Therapeutic Applications: Emerging research on Vitamin A derivatives in dermatology and infectious disease treatment suggests potential for pharmaceutical expansion.

- Personalized Nutrition: Increasing adoption of customized supplement regimens could stimulate demand for targeted Vitamin A formulations.

- Fortification Innovations: New delivery mechanisms, including microencapsulation and functional foods, enhance stability and bioavailability, expanding market reach.

Regulatory Environment Impact

Regulatory agencies such as the FDA (U.S.), EFSA (Europe), and CFDA (China) enforce strict standards regarding supplement potency, purity, and claims. Ongoing regulatory harmonization facilitates international trade but may introduce compliance complexities.

Global efforts to eliminate vitamin A deficiency include programs like UNICEF’s Vitamin A supplementation campaigns, which support demand sustainability, particularly in low-income regions.

Risks and Mitigation

- Regulatory Changes: Companies should invest in compliance and quality assurance to prevent market access disruptions.

- Supply Chain Disruptions: Diversification of raw material sourcing and strategic stockpiling can mitigate risks.

- Market Saturation: Differentiation through innovation and branding is critical, especially in developed regions approaching market maturity.

- Health Risks: Clear labeling and adherence to safe dosing guidelines mitigate toxicity concerns.

Conclusion

The Vitamin A market exhibits steady growth prospects underpinned by increasing global health consciousness, public health initiatives addressing deficiency, and technological innovations enhancing product efficacy. Asia-Pacific and emerging economies represent the primary growth engines, whereas mature markets continue expanding through product differentiation and innovative formulations. Stakeholders must navigate regulatory landscapes diligently while capitalizing on trends toward natural and personalized nutrition.

Effective market strategies will leverage regional opportunities, focus on product innovation, and prioritize compliance to capture a significant share of the USD 8.4 billion cumulative sales forecasted by 2030.

Key Takeaways

- The global Vitamin A market is projected to grow at approximately 6% annually, reaching over USD 1.1 billion by 2030.

- Major growth drivers include nutritional deficiency mitigation, rising health awareness, and fortified food demand, especially in developing markets.

- Innovation in sourcing, formulation, and delivery mechanisms remains critical for competitive differentiation.

- Regulatory compliance and quality assurance are vital to maintaining market access and consumer trust.

- Geographically, Asia-Pacific and Latin America offer the most significant expansion opportunities.

FAQs

1. What is driving the growth of Vitamin A in emerging markets?

Increasing public health efforts to combat vitamin deficiency, rising disposable incomes, and government-sponsored fortification programs are the primary growth drivers in emerging markets.

2. How does regulatory policy affect Vitamin A sales?

Stringent safety and quality standards influence formulation, manufacturing, and marketing, impacting product availability, especially in regions like Europe and North America.

3. Are natural sources of Vitamin A gaining popularity?

Yes, consumers favor plant-based and natural extraction sources like beta-carotene, fostering growth in "clean-label" products and dietary supplements.

4. What are the main challenges facing the Vitamin A market?

Regulatory complexities, supply chain disruptions, potential toxicity concerns, and market saturation in developed regions pose ongoing challenges.

5. What future trends could impact the Vitamin A market?

Advancements in personalized nutrition, microencapsulation technologies, and therapeutic applications could open new revenue streams and market segments.

Sources

[1] Grand View Research, "Vitamin A Market Size, Share & Trends Analysis Report," 2022.

[2] World Health Organization, "Vitamin A deficiency," 2021.

More… ↓