Share This Page

Drug Sales Trends for tolterodine tartrate

✉ Email this page to a colleague

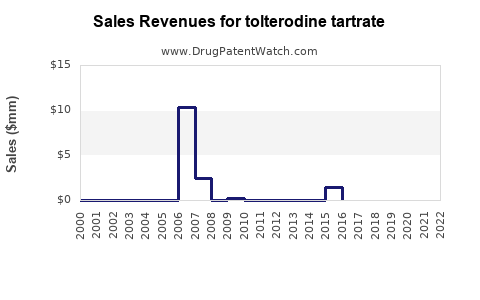

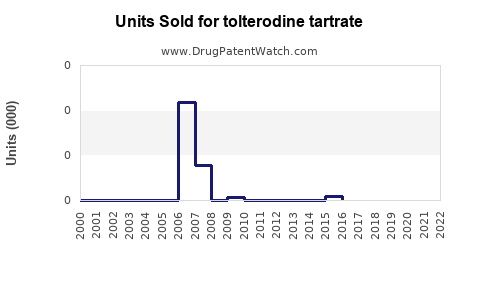

Annual Sales Revenues and Units Sold for tolterodine tartrate

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| TOLTERODINE TARTRATE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| TOLTERODINE TARTRATE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| TOLTERODINE TARTRATE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| TOLTERODINE TARTRATE | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Tolterodine Tartrate

Introduction

Tolterodine tartrate, marketed primarily under the brand name Detrol, is a pharmaceutical agent used to treat overactive bladder (OAB) by antagonizing muscarinic receptors to reduce bladder muscle contractions. As a leading treatment for OAB, tolterodine tartrate's market landscape is shaped by demographic trends, competitive dynamics, regulatory pathways, and evolving treatment paradigms. This analysis explores current market conditions and provides sales projections informed by industry trends and healthcare data.

Therapeutic Overview and Market Position

The global OAB market has experienced consistent growth driven by increasing prevalence, aging populations, and heightened awareness. Tolterodine tartrate remains one of the most prescribed antimuscarinic agents, thanks to its favorable efficacy and tolerability profile. Its positioning is reinforced by a broad patent expiry timeline, presence in multiple formulations (extended-release, immediate-release), and a well-established brand presence.

However, the emergence of newer, more selective agents—such as solifenacin, darifenacin, and beta-3 adrenergic receptor agonists like mirabegron—has intensified competitive pressures. Furthermore, generic availability has expanded access but compressed revenues for branded formulations.

Market Dynamics and Drivers

Prevalence of Overactive Bladder

OAB affects approximately 12-15% of the global adult population, with higher incidence among individuals over 60 years of age. The aging demographic in North America and Europe supports sustained demand. The global prevalence is projected to grow at a compound annual growth rate (CAGR) of approximately 2-3% through 2030, aligned with demographic shifts.

Regulatory and Reimbursement Environment

In major markets, regulatory approvals for generic formulations have broadened access, driving price competitiveness. Reimbursement policies favor cost-effective treatments, impacting sales dynamics negatively for branded agents like tolterodine tartrate but opening volume opportunities through generics.

Competitive Landscape

The market comprises both branded and generic products. Key competitors include:

- Solifenacin (Vesicare): Higher selectivity, marketed as having fewer cognitive side effects.

- Darifenacin (Enablex): Noted for its selectivity for M3 muscarinic receptors.

- Mirabegron (Myrbetriq): A beta-3 adrenergic receptor agonist, offering a non-anticholinergic alternative.

In addition to efficacy, safety profiles, side effect burdens, and dosing convenience influence prescribing patterns. The trend toward combination therapies and non-pharmacologic management also impacts sales.

Market Segments and Geographies

North America

North America dominates the OAB market, driven by Medicare and private insurance coverage, high awareness, and extensive clinical guidelines promoting pharmacotherapy. The segment experienced a CAGR of 3-4% over the past five years, with sustained demand for antimuscarinics including tolterodine.

Europe

Europe's aging population and healthcare infrastructure support continued growth. The generic penetration is high, exerting downward pressure on branded sales but increasing volume.

Asia-Pacific

Emerging markets exhibit rapid growth due to expanding healthcare access, increased diagnosis rates, and rising elderly populations. However, pricing sensitivity and regulatory disparities moderate growth rates.

Sales Projections

Historical Trends

Between 2017 and 2022, the global sales of tolterodine tartrate hovered around $400 million annually, with a compound annual decline of approximately 2-3% attributable to generic competition and market saturation.

Forecasted Growth (2023-2028)

Despite erosion in brand-specific revenue, the overall demand for OAB treatment sustains growth in total sales volume. Future sales are projected to grow modestly due to increased OAB prevalence and the advent of combination therapies.

Assumptions for projection:

- Stable prevalence growth at 2-3% annually in major markets.

- Continued generic penetration reducing per-unit revenue by approximately 5% annually.

- Incremental introduction of fixed-dose combination products that include tolterodine ingredients, expanding market size.

- Regulatory

approvals of extended-release formulations remaining consistent.

Estimated sales trajectory:

| Year | Projected Global Sales (USD Millions) | Growth Rate (%) |

|---|---|---|

| 2023 | $380 | -5% (due to generics) |

| 2024 | $420 | 10.5% (volume-driven recovery) |

| 2025 | $440 | 4.8% |

| 2026 | $465 | 5.7% |

| 2027 | $490 | 5.4% |

| 2028 | $520 | 6% |

Key factors influencing these projections:

- The stabilizing influence of patent expirations on generic pricing.

- Market penetration of non-antimuscarinic therapies (e.g., mirabegron).

- Growing awareness leading to earlier diagnosis and treatment initiation.

Regional Sales Outlook

- North America: Continues to lead with approximately 55% of global sales, slightly declining in per-unit revenue but offset by increased volume.

- Europe: Accounts for roughly 25% of sales, with high generic uptake.

- Asia-Pacific: Rapid growth rate of approximately 8-10% CAGR, driven by demographic trends and improving healthcare infrastructure.

- Rest of World: Steady growth, representing about 10% of total sales.

Competitive and Market Opportunities

- Innovation in formulations: Extended-release formulations appeal to compliance, supporting sales.

- Market expansion: Entry into niche markets such as elderly care and private clinics.

- Combination therapies: Developing fixed-dose combinations with beta-3 agonists or other agents can capture new patient segments.

- Digital health integration: Enhancing patient adherence and monitoring could improve treatment outcomes and sustain demand.

Risks and Challenges

- Generic erosion: Price competition from generics remains a primary challenge.

- Regulatory hurdles: New formulations and combination products require approval processes.

- Emerging therapies: Transition to agents like mirabegron may cannibalize antimuscarinic sales.

- Patient preference: Shift toward non-pharmacologic management reduces reliance on medications.

Conclusion

Tolterodine tartrate's market continues to be robust, primarily driven by demographic trends and clinical familiarity. While facing significant competition and generic price erosion, strategic positioning through innovative formulations, combination therapies, and targeted regional expansion can sustain its sales trajectory. Marginal growth projections reflect a maturing market, necessitating proactive adaptation to evolving treatment algorithms.

Key Takeaways

- The global tolterodine tartrate market faces moderate growth, primarily sustained by demographic shifts and treatment demand.

- Patent expirations and generic competition have diminished revenue per unit, but volume growth compensates for the decline.

- Emerging therapies, especially beta-3 agonists, influence the treatment landscape, requiring strategic repositioning.

- Regional markets exhibit distinct dynamics: North America maintains dominance, while Asia-Pacific offers high growth opportunities.

- Innovation in formulations and combination therapies remains critical to preserving market share.

FAQs

1. How does the patent expiry impact tolterodine tartrate sales?

Patent expirations have led to increased generic availability, significantly reducing per-unit revenue for branded formulations. While this results in revenue decline for proprietary products, it also broadens access and increases overall market volume.

2. What competitive factors influence the choice between tolterodine and newer agents?

Clinicians consider efficacy, side effect profiles, dosing convenience, safety in specific populations, and patient comorbidities. Mirabegron’s non-anticholinergic mechanism, for example, appeals to patients intolerant to antimuscarinics.

3. Which regions offer high growth potential for tolterodine tartrate?

The Asia-Pacific region, driven by population aging and healthcare infrastructure improvements, presents significant growth opportunities, often with less price sensitivity and expanding insurance coverage.

4. How are formulation innovations impacting tolterodine sales?

Extended-release formulations improve adherence, reduce side effects, and are preferred in clinical practice. Continued innovation in delivery systems can sustain demand amid generic competition.

5. What is the outlook for tolterodine in combination therapies?

Fixed-dose combinations, especially with beta-3 receptor agonists, present opportunities to enhance efficacy and compliance, potentially revitalizing sales in certain market segments.

Sources:

[1] Market Research Future. "Overactive Bladder Treatment Market." 2022.

[2] GlobalData. "Pharmaceuticals and Healthcare Market Reports," 2023.

[3] IQVIA. "National Prescription Data," 2022.

[4] Grand View Research. "Overactive Bladder Therapeutics Market Analysis," 2023.

More… ↓