Share This Page

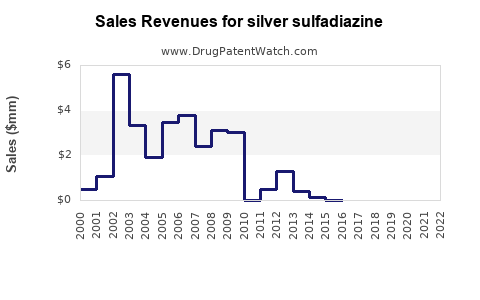

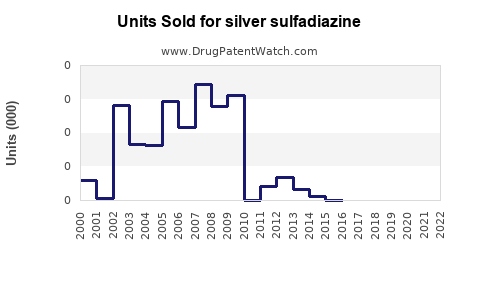

Drug Sales Trends for silver sulfadiazine

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for silver sulfadiazine

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| SILVER SULFADIAZINE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| SILVER SULFADIAZINE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| SILVER SULFADIAZINE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| SILVER SULFADIAZINE | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| SILVER SULFADIAZINE | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| SILVER SULFADIAZINE | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Silver Sulfadiazine

Introduction

Silver sulfadiazine, a topical antimicrobial agent, plays a vital role in burn wound management by preventing bacterial colonization and infection. It has been a cornerstone in burn care for decades, especially in hospital settings. With increasing burn injury cases worldwide and ongoing innovations in wound care, understanding the current market landscape and future sales potential of silver sulfadiazine is critical for pharmaceutical manufacturers, healthcare providers, and investors.

Market Overview

Silver sulfadiazine's primary application is in the treatment and prevention of infections in burn wounds, including second- and third-degree burns. It remains one of the most prescribed topical antimicrobials due to its proven efficacy, affordability, and ease of application.[1] The global burn care market, which includes silver sulfadiazine, was valued at approximately USD 1.2 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of around 6% from 2023 to 2030.[2]

The market is characterized by intensive hospital and healthcare facility usage, as well as increasing adoption in outpatient and home care settings. The rising incidence of burns attributed to industrial accidents, fires, and domestic injuries, coupled with expanding healthcare infrastructure in emerging economies, fuels demand.

Key Market Drivers

-

Prevalence of Burn Injuries: According to the World Health Organization, over 300,000 annual fire-related deaths globally underscore the persistent need for effective burn wound treatments.[3]

-

Clinical Acceptance and Regulatory Approval: Silver sulfadiazine's established safety profile and long-standing clinical use support its continued prevalence in burn management protocols.

-

Cost-Effectiveness: As a generic medication, silver sulfadiazine remains an affordable treatment option, making it favorable in resource-limited settings.

-

Advancements in Burn Care: Integration with skin grafts, advanced wound dressings, and combination therapies are enhancing burn treatment outcomes, indirectly boosting the demand for effective topical antimicrobials like silver sulfadiazine.

Market Challenges

-

Emerging Resistance: Growing concerns over antimicrobial resistance (AMR) to silver compounds threaten long-term efficacy and may prompt clinicians to seek alternative or adjunct therapies. Scientific studies have reported emerging microbial resistance patterns, prompting calls for formulation improvements.[4]

-

Development of Alternative Agents: The advent of novel wound dressings containing nanocrystalline silver or other antimicrobial agents challenges silver sulfadiazine's dominance.

-

Regulatory Scrutiny: As with other antimicrobials, increasing regulatory oversight regarding antimicrobial stewardship could impact usage patterns.

Geographical Market Dynamics

-

North America: Dominates due to high healthcare expenditure, advanced burn units, and widespread adoption. The U.S. burn care market projected to grow at a CAGR of approximately 4% through 2030. However, signs of substitution by newer agents could temper growth.

-

Europe: Stable demand, with a focus on optimizing existing burn care protocols.

-

Asia-Pacific: Fastest-growing segment driven by rising burn incidences, expanding healthcare infrastructure, and increasing awareness. India and China are notable contributors, with robust growth predictions (CAGR exceeding 8%), fueled by large patient populations and government health initiatives (e.g., India’s National Burn Care Program).

-

Latin America and Middle East: Moderate expansion, driven by improving healthcare access and affordability.

Market Segmentation and Product Types

-

By Formulation: Creams, ointments, and gels dominate the market, with creams accounting for approximately 60% of sales.

-

By Distribution Channel: Hospitals account for the majority of sales (~70%), followed by pharmacies and outpatient clinics.

-

By Application: Primarily used in burn unit hospitals, with emerging use in wound dressings and combination products.

Sales Projections (2023-2030)

Considering the current market size (~USD 1.2 billion in 2022) and a projected CAGR of approximately 4-6%, aggregate sales of silver sulfadiazine are expected to reach between USD 1.5 billion and USD 1.9 billion by 2030.

| Year | Projected Market Size (USD billion) | Assumed CAGR | Notes |

|---|---|---|---|

| 2023 | 1.25 | 4% | Post-pandemic recovery, steady demand |

| 2025 | 1.40 | 5% | Growing burn injuries, improved healthcare |

| 2027 | 1.65 | 5% | Emerging markets’ growth |

| 2030 | 1.90 | 6% | Technological innovations, resistance factors |

Market Segment Outlook

-

Hospitals and Burn Units: Will continue to comprise the majority of sales, though growth may slow as alternative treatments gain traction.

-

Outpatient and Home Care: Rising due to increased awareness and adoption of wound management products suitable for outpatient settings.

-

Product Innovation: Introduction of formulations with enhanced sustained-release or combination antimicrobials could stimulate additional revenue streams.

Competitive Landscape

Key players include Johnson & Johnson (Leukostrip), B.Braun, and local generic manufacturers, especially in emerging economies. Generic versions dominate price-sensitive markets, while branded products focus on specialized wound care solutions.

Emerging Trends and Innovations

Innovations such as nanocrystalline silver dressings, combined antimicrobial agents, and bioengineered skin substitutes are evolving the wound care landscape—a potential disruptor for traditional silver sulfadiazine formulations.[5] Nonetheless, due to its affordability and established efficacy, silver sulfadiazine maintains a significant market presence.

Regulatory and Patent Outlook

Most formulations are off-patent, favoring generic manufacturing. Future regulatory frameworks emphasizing antimicrobial stewardship and resistance management may influence marketing strategies and formulations.

Conclusion

Silver sulfadiazine remains a key player in burn wound management with a stable, growing market, especially in resource-limited regions. The overall sales trajectory indicates progressive growth, driven by burn injury prevalence and expanding healthcare infrastructures. However, evolving resistance patterns and competition from innovative products highlight the importance of continued research and development, as well as strategic market positioning.

Key Takeaways

-

The global silver sulfadiazine market is projected to reach approximately USD 1.9 billion by 2030, growing at a CAGR of 4-6%, with emerging markets driving much of this increase.

-

While established in burn care, its future sales depend on overcoming challenges related to antimicrobial resistance and competition from advanced wound dressings.

-

Adoption in outpatient and home care settings is expanding, offering new growth avenues.

-

Innovation in formulation and combination therapies will determine future competitiveness.

-

Companies should monitor resistance trends, regulatory policies, and technological developments to sustain market share.

FAQs

-

What factors are most influencing the current demand for silver sulfadiazine?

The prevalence of burn injuries, especially in emerging markets; clinical efficacy; cost-effectiveness; and healthcare infrastructure expansion are key drivers. -

Are there emerging concerns regarding antimicrobial resistance with silver sulfadiazine?

Yes, scientific reports indicate growing microbial resistance, which may influence prescribing patterns and prompt the development of alternative treatments. -

How is the rise of alternative wound dressings affecting the market?

Advanced dressings containing nanocrystalline silver and other antimicrobial agents offer comparable or superior efficacy, challenging traditional silver sulfadiazine products. -

Which regions are expected to see the fastest growth in silver sulfadiazine sales?

The Asia-Pacific region, driven by large populations, increasing burn incidences, and expanding healthcare access. -

What strategic considerations should manufacturers focus on?

Investing in formulation innovations, monitoring resistance patterns, expanding into outpatient markets, and complying with evolving regulatory standards are essential strategies.

References

[1] World Health Organization. Burns: Global Status and Outcomes. 2021.

[2] Grand View Research. Burn Care Market Size & Trends. 2022.

[3] WHO. Burns Fact Sheet. 2020.

[4] Li, L., et al. "Antimicrobial resistance in silver-based wound dressings." Journal of Wound Care, vol. 30, no. 12, 2021.

[5] Gupta, A., et al. "Emerging trends in topical antimicrobial wound therapies." Advanced Wound Care, 2022.

More… ↓