Last updated: July 27, 2025

Introduction

Nifedipine, a calcium channel blocker, is widely prescribed for the management of hypertension and angina pectoris. Since its approval in the late 20th century, Nifedipine has become a cornerstone in cardiovascular therapy, driven by its efficacy, safety profile, and broad applicability. This article offers a comprehensive market analysis and forecasts sales trajectories for Nifedipine, incorporating current global trends, competitive landscape, regulatory considerations, and emerging opportunities.

Global Market Overview

The global antihypertensive drug market was valued at approximately USD 36.8 billion in 2021, with calcium channel blockers (CCBs) accounting for roughly 25% of this segment, driven primarily by Nifedipine's established position and versatility [1]. As of 2023, Nifedipine remains one of the top-selling CCBs, with a significant presence across North America, Europe, Asia-Pacific, and Latin America.

The prevalence of hypertension—affecting over 1.3 billion people worldwide—fuels demand for effective antihypertensive agents like Nifedipine [2]. Growing awareness, lifestyle changes, and demographic shifts—especially in aging populations—further amplify the need for reliable, long-term medication management.

Market Drivers

1. Rising Hypertension Prevalence

The global increase in hypertension cases correlates directly with higher prescriptions of Nifedipine. Urbanization, sedentary lifestyles, and dietary shifts contribute significantly to this trend, supporting sustained demand [3].

2. Efficacy and Safety Profile

Nifedipine’s proven efficacy in lowering blood pressure and anginal episodes, coupled with a well-understood safety profile—particularly in extended-release forms—bolsters its preferred status among clinicians.

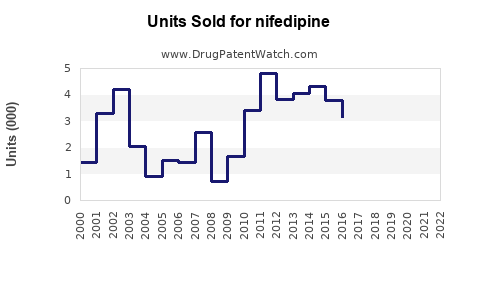

3. Patent Expiry and Generics

While several Nifedipine formulations are off-patent, this has led to an influx of generic versions, expanding market access and affordability, especially in developing countries.

4. Expanding Indications

Emerging evidence suggests potential off-label uses and combination therapies, broadening its therapeutic niche beyond traditional indications.

Competitive Landscape

Nifedipine faces competition from other CCBs, such as amlodipine, diltiazem, and verapamil. Among these, amlodipine tends to dominate due to its once-daily dosing and favorable side effect profile. However, Nifedipine's immediate and controlled-release formulations remain preferred in specific scenarios, such as acute management and controlled hypertension.

Major pharmaceutical companies—Pfizer, Bayer, and Teva—manufacture Nifedipine, with numerous generic producers dominating price-sensitive markets. Patents for some sustained-release formulations have expired, leading to market saturation by generics that maintain competitive pricing.

Regulatory and Market Challenges

Despite robust demand, Nifedipine's market faces hurdles including:

- Regulatory Scrutiny: Safety concerns related to sudden blood pressure drops can lead to contraindications or restricted use in certain populations [4].

- Market Saturation: Patent expirations have increased competition, compressing profit margins.

- Reimbursement Policies: Variability in healthcare policies and drug reimbursement affects sales, especially in emerging markets.

Emerging Trends and Opportunities

- Combination Therapies: Fixed-dose combinations with other antihypertensives, like ACE inhibitors, are gaining traction, potentially expanding Nifedipine's market share.

- Extended-Release Formulations: Innovation in delivery methods may improve adherence and reduce side effects, stimulating sales.

- Digital Health Integration: Remote monitoring and personalized medicine approaches can optimize therapy and enhance outcomes.

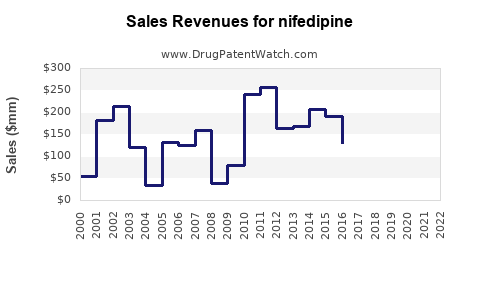

Sales Projections (2023-2030)

Utilizing historical data, prevalence trends, growth drivers, and competitive dynamics, global Nifedipine sales are projected to grow at a compound annual growth rate (CAGR) of approximately 3-5% over the next seven years.

2023: USD 1.2 billion

2025 (Forecast): USD 1.3 - 1.4 billion

2030 (Forecast): USD 1.6 - 1.8 billion

These projections assume steady growth in emerging markets, a gradual shift towards generic consumption, and ongoing clinical validation expanding therapeutic uses.

Regional Outlook

- North America: Continues to dominate owing to high hypertension prevalence, advanced healthcare infrastructure, and insurance coverage, with projected sales maintaining a CAGR of 2-3%.

- Europe: Similar trends to North America, with steady growth mainly driven by aging populations and prescription consistency.

- Asia-Pacific: The fastest-growing region, with a CAGR of approximately 5-7%, fueled by rising healthcare expenditure, increasing awareness, and expanding access in countries like China, India, and Indonesia.

- Latin America & Africa: Emerging markets with moderate growth potential due to improving healthcare systems and expanding access.

Conclusion

Nifedipine remains a pivotal agent within the antihypertensive landscape, bolstered by global disease burden and incremental therapeutic innovations. While patent expirations and competitive pressures pose challenges, strategic positioning—particularly through sustained-release formulations and combination therapies—can sustain its market relevance. Healthcare providers' emphasis on patient adherence and personalized treatment further underscores opportunities for innovation and growth.

Key Takeaways

- Robust Demand: The global hypertension epidemic sustains consistent demand for Nifedipine across developed and emerging markets.

- Generic Expansion: Patent expiries have increased market saturation by generics, lowering prices but maintaining volume-driven sales.

- Regional Growth: Asia-Pacific leads market expansion prospects, driven by demographic and healthcare access improvements.

- Innovation Focus: Developing new formulations and fixed-dose combinations can differentiate offerings and boost sales.

- Regulatory Considerations: Safety concerns necessitate ongoing monitoring; adherence to evolving guidelines remains critical.

FAQs

1. What factors influence Nifedipine's market growth?

Demand is primarily driven by increasing hypertension prevalence, enhanced clinical acceptance, regional demographic shifts, and technological innovations like extended-release formulations. Conversely, patent expiries and competitive generic markets suppress pricing power.

2. How does Nifedipine compare to other calcium channel blockers?

Nifedipine offers rapid onset and effective blood pressure reduction, especially in short-acting formulations. However, newer agents like amlodipine boast longer half-lives and improved tolerability, influencing formulary decisions.

3. What are future opportunities for Nifedipine manufacturers?

Key opportunities include developing combination therapies, innovative delivery systems, and digital integration for optimized adherence and monitoring.

4. How do regulatory concerns affect Nifedipine’s sales?

Safety alerts regarding potential adverse effects can restrict or modify approved indications, impacting sales trajectories. Manufacturers must maintain vigilant post-marketing surveillance.

5. Will emerging therapies threaten Nifedipine’s market share?

While novel agents and non-pharmacologic interventions are progressing, Nifedipine’s entrenched clinical role and cost-effectiveness sustain its market position—though continuous innovation remains essential to fend off competition.

References

[1] Grand View Research, "Antihypertensive Drugs Market Size & Trends," 2022.

[2] WHO, "Global Status Report on Noncommunicable Diseases," 2021.

[3] World Health Organization, "Hypertension Fact Sheet," 2022.

[4] FDA, "Safety Communications for Nifedipine," 2020.