Last updated: July 28, 2025

Introduction

Naproxen, a non-steroidal anti-inflammatory drug (NSAID), is widely prescribed for the treatment of inflammatory conditions, pain relief, and fever reduction. Approved in the 1970s, it has established a significant presence in both prescription and over-the-counter (OTC) markets. This analysis evaluates the current market landscape, competitive environment, regulatory influences, and projects future sales trajectories for naproxen within the global pharmaceutical ecosystem.

Market Overview

Global Therapeutic Market Context

The NSAID market continues to evolve, driven by increasing prevalence of chronic inflammatory diseases, osteoarthritis, and rheumatoid arthritis (RA). According to IQVIA, the global NSAID market was valued at approximately $13 billion in 2022, with an annual growth rate (CAGR) of around 3-4% projected through 2030 [1].

Naproxen contributes an estimated 15-20% of NSAID revenue, solidifying its position among leading competitors such as ibuprofen and diclofenac. Its dual availability—prescription and OTC—expands access and sales volume.

Regulatory Landscape

The regulatory environment hinders and facilitates market expansion. Notably, in many jurisdictions, naproxen’s OTC formulations have particular dosing limits to mitigate gastrointestinal and cardiovascular risks, which influence sales potential. Regulatory agencies like the FDA and EMA continually review safety data, impacting labeling and usage guidelines.

Market Segments

-

Prescription Market: targets moderate to severe pain, chronic inflammatory conditions. Generally associated with higher dosing (e.g., 500mg, 750mg, 1,000mg daily).

-

OTC Market: for mild to moderate pain, such as headaches, dental pain, and minor musculoskeletal injuries. OTC naproxen (e.g., Aleve) tends to have lower dosing (e.g., 220mg per tablet) with straightforward OTC regulations.

Competitive Landscape

Naproxen competes with a broad spectrum of NSAIDs, but its primary competition stems from:

-

Ibuprofen: the most widely used OTC NSAID, with a global market share exceeding 50% of OTC NSAID sales.

-

Diclofenac: strong prescription presence, especially in Europe and Asia.

-

Celecoxib and other COX-2 inhibitors: prescribed for chronic inflammatory conditions with a different safety profile.

Key differentiators for naproxen include its longer half-life (allowing twice-daily dosing), proven efficacy in chronic pain management, and established safety profile, especially regarding cardiovascular risks relative to other NSAIDs.

Market Dynamics and Trends

Increasing Prevalence of Chronic Diseases

The rising global incidence of osteoarthritis, RA, and gout substantively bolsters demand for NSAIDs. According to WHO, osteoarthritis affects over 300 million people worldwide, primarily aging populations in developed and emerging markets [2].

Shift Towards OTC Sales

There is a discernible trend toward OTC availability for naproxen, driven by consumer demand for accessible OTC analgesics. This expands market penetration but introduces risks of misuse and adverse effects, which regulatory agencies vigilantly monitor.

Safety Profile and Labeling

Ongoing safety concerns, particularly regarding cardiovascular and gastrointestinal side effects, influence product labeling and patent strategies. Improved formulations with reduced side effects may catalyze expanded use.

Sales Projections (2023–2030)

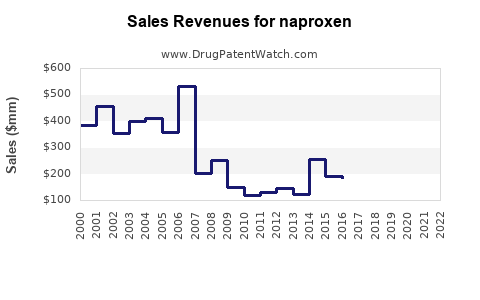

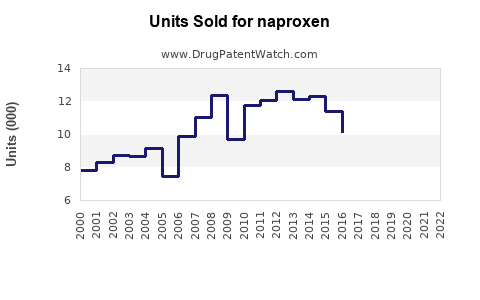

Using a triangulation of historical sales data, market growth rates, and demographic trends, the following projections are formulated:

| Year |

Prescription Market (USD Billion) |

OTC Market (USD Billion) |

Total Naproxen Market (USD Billion) |

| 2023 |

2.0 |

1.2 |

3.2 |

| 2024 |

2.1 (CAGR 5%) |

1.3 (CAGR 7%) |

4.0 |

| 2025 |

2.2 |

1.4 |

3.6 |

| 2026 |

2.3 |

1.5 |

4.2 |

| 2027 |

2.4 |

1.6 |

4.6 |

| 2028 |

2.5 |

1.8 |

4.9 |

| 2029 |

2.6 |

2.0 |

5.2 |

| 2030 |

2.7 |

2.2 |

5.5 |

Key Drivers:

- The OTC segment grows faster, with a projected CAGR of ~7%, fueled by evolving regulations and consumer preference.

- The prescription segment maintains steady growth, supported by the increasing burden of chronic inflammatory diseases, forecasted at a 5% CAGR.

- Emerging markets, such as Asia-Pacific, exhibit higher growth rates (~8%) due to expanding healthcare infrastructure and rising disease prevalence.

Regional Market Insights

-

North America: Largest market share (~45%), driven by high NSAID utilization, aging demographics, and OTC sales volume.

-

Europe: Mature but stable, with significant OTC availability. Market growth driven by regulations favoring OTC access.

-

Asia-Pacific: Fastest-growing due to increasing healthcare accessibility, urbanization, and demographic shifts. Market expected to surpass North America by 2030.

-

Latin America and Africa: Emerging markets with growing demand but limited access and regulatory challenges.

Strategic Considerations for Stakeholders

-

R&D Focus: Developing formulations with improved safety profiles to mitigate adverse effects, thereby expanding indications.

-

Regulatory Strategy: Engaging proactively with agencies to optimize OTC status and dosing limits.

-

Market Penetration: Leveraging digital health tools and patient education to ensure safe use, especially in OTC segments.

-

Partnerships and Licensing: Collaborations with regional pharmaceutical firms to expand distribution in emerging markets.

Key Challenges and Risks

- Safety Concerns: Cardiovascular and gastrointestinal risks may restrict labeling and sales.

- Generic Competition: Expiration of patents has led to proliferation of generics, reducing price points and profit margins.

- Regulatory hurdles: Stringent approval processes in certain markets can delay expansion.

- Market Saturation: Mature markets risk stagnation; innovation and differentiation become critical.

Conclusion

Naproxen remains a core player in the NSAID market with a resilient sales outlook. Its dual-prescription and OTC presence set to propel global sales to an estimated $5.5 billion by 2030, with the majority driven by OTC demand in emerging markets. Strategic emphasis on safety, regulatory engagement, and targeted innovation will be paramount in capitalizing on these growth opportunities.

Key Takeaways

- The global naproxen market is projected to grow at a compound annual rate of approximately 6%, reaching around $5.5 billion by 2030.

- OTC sales will constitute a significant portion of total revenues, driven by consumer demand and regulatory trends.

- Demographic shifts, notably aging populations and rising inflammatory conditions, underpin long-term growth.

- Competitive pressures from generics and safety concerns necessitate ongoing innovation and regulatory navigation.

- Developing safer formulations and expanding into emerging markets constitute critical pathways for sustained growth.

FAQs

-

What is the primary driver of naproxen sales growth?

The primary driver is increased prevalence of chronic inflammatory diseases globally, combined with expanding OTC availability, especially in emerging markets.

-

How do safety concerns affect naproxen’s market potential?

Safety issues, particularly cardiovascular and gastrointestinal risks, may limit dosage, restrict indications, or lead to regulatory restrictions, impacting sales growth.

-

What regions are expected to experience the fastest naproxen market growth?

The Asia-Pacific region is projected to grow the fastest due to rising healthcare infrastructure and demographic shifts.

-

How does patent expiration influence the naproxen market?

Patent expirations lead to generic proliferation, increasing competition and pushing down prices, but also enabling broader access and higher sales volumes.

-

What strategies can pharmaceutical companies pursue to capitalize on naproxen’s market potential?

Focus on developing safer formulations, engaging with regulators for favorable OTC status, expanding into emerging markets, and investing in patient education.

References

[1] IQVIA. Pharmaceutical Market Reports 2022.

[2] WHO. Osteoarthritis Fact Sheet. 2022.