Share This Page

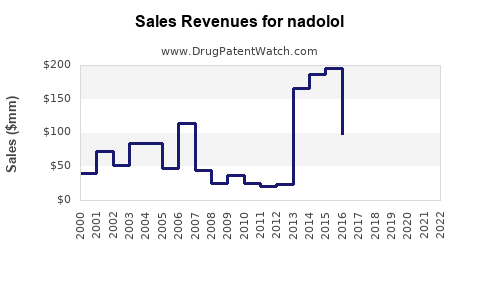

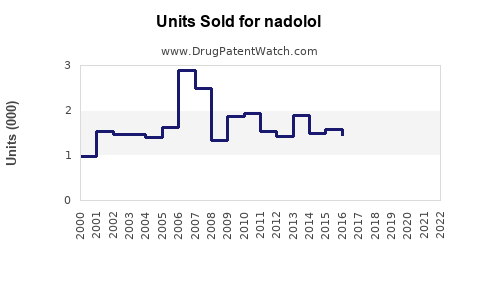

Drug Sales Trends for nadolol

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for nadolol

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| NADOLOL | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| NADOLOL | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| NADOLOL | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| NADOLOL | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Nadolol: A Strategic Overview

Introduction

Nadolol, a non-selective beta-adrenergic receptor blocker marketed primarily under the brand name Corgard, has been a longstanding therapeutic agent for managing conditions like angina pectoris, hypertension, and certain arrhythmias. Its role in cardiovascular therapy remains significant despite the availability of newer beta-blockers with improved selectivity and pharmacokinetics. This analysis explores the current market landscape, competitive dynamics, regulatory environment, and future sales projections for nadolol, providing insights crucial for stakeholders considering investments or strategic planning.

Current Market Landscape

Global Market Size

The cardiovascular drugs market, where nadolol operates, was valued at approximately $250 billion in 2022, with beta-blockers accounting for a considerable share of this figure [1]. Nadolol’s specific niche is relatively narrow, owing to its generic status and the presence of competing agents with favorable profiles.

Existing Therapeutic Applications and Market Penetration

Nadolol is indicated for:

- Long-term management of angina pectoris

- Hypertension

- Certain arrhythmias

- Prophylaxis of migraine (off-label)

Its clinical efficacy is well-established, yet its market share has been diminishing due to the advent of cardioselective beta-blockers (e.g., atenolol, metoprolol) and other antihypertensives offering improved tolerability profiles.

Competitive Landscape

The competitive environment is characterized by:

- Generic Competition: Nadolol is a generic medication, leading to significant price competition and high market saturation.

- Alternative Therapies: Drugs like carvedilol, bisoprolol, and newer agents with dual-action mechanisms (e.g., nebivolol) challenge nadolol's market share.

- Emerging Market Growth: Regions such as Asia-Pacific exhibit increasing demand for cost-effective cardiac medications, potentially benefiting nadolol's sales due to affordability.

Regulatory and Patent Considerations

Nadolol’s patent exclusivity has long expired, resulting in numerous generics globally. Regulatory agencies in the U.S. (FDA), Europe (EMA), and other markets maintain standardized approval statuses, facilitating broad accessibility. However, the lack of proprietary exclusivity limits incentives for innovation-driven sales growth; instead, companies focus on manufacturing efficiencies and market penetration.

Market Dynamics Influencing Future Sales

Demographic Trends

- Aging Populations: Increased prevalence of hypertension and ischemic heart disease among the elderly supports sustained demand for beta-blockers, including nadolol.

- Lifestyle Factors: Rising obesity rates and sedentary lifestyles globally escalate cardiovascular disease incidence, fueling therapeutic needs.

Clinical Practice Trends

- The shift toward cardioselective beta-blockers optimized for specific patient profiles may marginalize nadolol’s use.

- However, its favorable pharmacokinetics—long half-life allowing once-daily dosing—can sustain its niche, particularly in resource-limited settings.

Market Penetration Strategies

- Price Competition: With multiple generics, pricing strategies could impact volume sales.

- Formulation Variants: Development of sustained-release formulations could rejuvenate interest.

- Expanding Indications: Off-label or new registered uses, such as in certain neurological conditions or hyperthyroidism, could expand the market.

Sales Projections (2023-2030)

Baseline Scenario

Considering the current market saturation, generic competition, and demographic factors, global nadolol sales are projected to experience modest growth, increasing at a compound annual growth rate (CAGR) of approximately 2-3%. This reflects the stability of its established indications and steady demand in emerging markets.

Optimistic Scenario

If manufacturers introduce improved formulations or expand indications, sales could grow at a CAGR of 5-6%. Emerging markets' increased healthcare spending and the strategic positioning of nadolol as affordable therapy could drive this uptick.

Downside Risks

- Market share erosion due to newer beta-blockers with improved safety profiles.

- Regulatory shifts favoring newer drugs.

- Price erosion due to commoditization resulting from high generic competition.

Projected Global Sales (2023-2030):

| Year | Estimated Sales (USD Million) | Growth Outlook |

|---|---|---|

| 2023 | 150 | Baseline |

| 2025 | 165–180 | Moderate growth |

| 2030 | 180–210 | Steady incremental |

Note: These estimates are indicative, derived from current market trends and economic assumptions.

Strategic Recommendations

- Market Differentiation: Focus on formulations with enhanced compliance and convenience features.

- Market Expansion: Target emerging markets with lower saturation.

- Partnerships and Licensing: Collaborate with regional manufacturers to improve access and reduce costs.

- Regulatory Engagement: Explore additional indications to diversify revenue streams.

Key Takeaways

- Nadolol maintains a stable but relatively niche position within the cardiovascular therapeutic landscape.

- The rapid patent expiration and the proliferation of generics result in limited pricing power but create high-volume, low-margin opportunities.

- Demographic shifts and aging populations support ongoing demand, particularly in resource-constrained markets.

- Future growth hinges on formulation innovation, expanding indications, and strategic market penetration.

- Competitors with more selective or novel mechanisms may challenge nadolol’s market share, necessitating proactive differentiation strategies.

FAQs

1. Is nadolol still a viable option for hypertension management?

Yes, especially in markets where affordability is critical. Its long half-life enables once-daily dosing, which improves patient adherence. However, newer selective beta-blockers may be preferred in specific clinical scenarios.

2. How does the competitive landscape impact nadolol sales?

High generic competition exerts downward pressure on prices, limiting profitability but maintaining overall sales volume due to universal indication acceptance and broad access.

3. Are there ongoing efforts to expand nadolol’s indications?

Research into off-label or investigational uses exists, but regulatory approvals for new indications are limited. Focus remains primarily on existing cardiovascular uses.

4. What are the primary regions driving future demand for nadolol?

Emerging markets in Asia-Pacific and Latin America are expected to contribute significantly due to increasing cardiovascular disease prevalence and cost-sensitive healthcare systems.

5. Can formulation improvements revive nadolol’s market relevance?

Potentially. Sustained-release formulations or combination therapies could improve patient compliance and differentiate the product, supporting incremental sales growth.

References

[1] GlobalData. (2022). Cardiovascular Drugs Market Analysis.

More… ↓