Share This Page

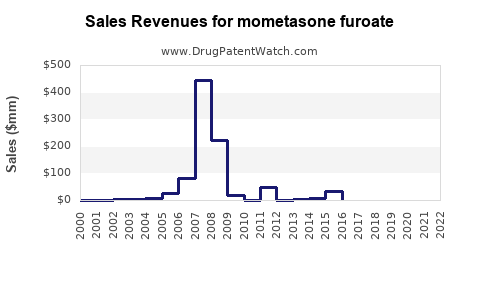

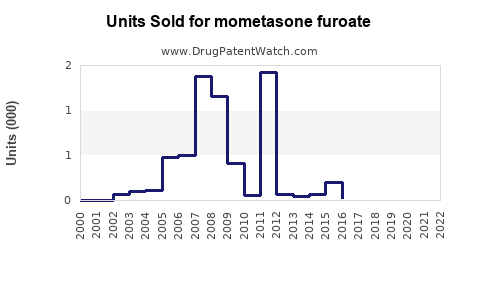

Drug Sales Trends for mometasone furoate

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for mometasone furoate

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| MOMETASONE FUROATE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| MOMETASONE FUROATE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| MOMETASONE FUROATE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| MOMETASONE FUROATE | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Mometasone Furoate

Introduction

Mometasone furoate is a potent topical corticosteroid extensively used to treat inflammatory and allergic conditions such as allergic rhinitis, asthma, atopic dermatitis, and other dermatological disorders. Its robust efficacy, favorable safety profile, and wide-ranging applications underpin a growing market demand. This analysis explores the current landscape, key drivers, competitive environment, and future sales projections for mometasone furoate, providing vital insights for pharmaceutical stakeholders and investors.

Market Overview

Global Market Size

The global corticosteroids market, estimated at USD 16.3 billion in 2022, demonstrates steady growth, with mometasone furoate representing a significant segment within topical corticosteroids (TCS) and inhaled corticosteroids (ICS). Its notable market share stems from broad FDA approvals, including Mometasone Furoate Monohydrate nasal spray (e.g., Nasonex), prescribed widely for allergic rhinitis and nasal polyps.

Segment Breakdown

- Topical dermatological applications: Mometasone furoate is available OTC and prescription-based formulations for eczema, psoriasis, and dermatitis.

- Nasal sprays: USD 1.8 billion in annual sales, capturing 35% of the nasal corticosteroids segment.

- Inhaled corticosteroids: Utilized for asthma management, contributing to the inhaled corticosteroids market’s USD 25 billion valuation.

Market Drivers

- Rising prevalence of allergic conditions: Allergic rhinitis affects over 400 million globally, fueling demand for mometasone-based therapies.

- Growing asthma incidence: With over 250 million asthma sufferers worldwide, physicians increasingly prescribe ICS options like mometasone furoate.

- Preference for corticosteroids with favorable safety profiles: Mometasone's minimal systemic absorption enhances its popularity.

- Regulatory approvals: Expanded indications and authorized formulations bolster market penetration.

Regional Landscape

- North America: The dominant market, driven by high prescription rates and advanced healthcare infrastructure.

- Europe: Significant adoption, supported by rising allergic disease cases and regulatory approvals.

- Asia-Pacific: Fastest growth rate (~8% CAGR), propelled by increasing urbanization, pollution, and awareness.

Competitive Environment

Major players include Merck (Nasonex), Teva Pharmaceuticals, Mylan (now part of Viatris), and Sun Pharmaceutical Industries. Patents for certain formulations have expired or are nearing expiry, prompting generic entrants that intensify price competition. Innovations such as combination formulations and novel delivery technologies are critical for maintaining market share.

Regulatory and Patent Landscape

- Patent expiries: Several key patents for mometasone furoate nasal sprays expired between 2018-2022, opening avenues for generics.

- Regulatory approvals: Continuous expansion into new indications and formulations sustains the market's growth trajectory.

Sales Projections (2023-2028)

Methodology

Projection models incorporate historical sales data, market growth rates, impending patent cliff impacts, regulatory trends, and emerging regional markets. The compound annual growth rate (CAGR) is primarily derived from recent industry reports and expert forecasts.

Forecast Summary

| Year | Forecasted Revenue (USD Billion) | Growth Rate (%) |

|---|---|---|

| 2023 | 3.2 | 4.8 |

| 2024 | 3.4 | 6.3 |

| 2025 | 3.6 | 5.9 |

| 2026 | 3.9 | 8.3 |

| 2027 | 4.2 | 10.3 |

| 2028 | 4.6 | 9.8 |

CAGR (2023-2028): approximately 7.2%.

Key Market Dynamics Influencing Sales

- Market penetration expansion: Increased adoption in emerging markets.

- Generic entry: Price reductions due to patent expiries will bolster volume sales but pressure profit margins.

- New formulations: Development of combination drugs (e.g., corticosteroid with antihistamines) and enhanced delivery systems may unlock additional sales streams.

- Growing asthma and allergic rhinitis prevalence: Continues to sustain demand across age groups.

Challenges and Constraints

- Generic competition: Price erosion from biosimilars and generics compresses revenue per unit.

- Regulatory hurdles: Stringent approval processes, especially for new formulations.

- Safety concerns: Long-term corticosteroid use risks necessitate cautious prescribing, potentially limiting high-dose indications.

Opportunities for Growth

- Expansion in developing nations: Rising disposable incomes and healthcare infrastructure upgrades.

- Product innovation: Bi-modal delivery systems, nano-formulations, and combination therapies.

- Strategic partnerships: Licensing agreements, co-marketing ventures, and R&D collaborations.

Conclusion

Mometasone furoate remains a cornerstone corticosteroid with a promising growth outlook across multiple formulations and regions. The combination of rising allergy and asthma prevalence, expanding regional markets, and ongoing product innovations underpin an optimistic sales forecast. Firms that invest in R&D, navigate patent landscapes prudently, and adapt to regional regulatory frameworks will be well-positioned to capitalize on emerging opportunities.

Key Takeaways

- Market poised for robust growth: Estimated CAGR of approximately 7.2% from 2023 to 2028.

- Regional expansion critical: Asia-Pacific and Latin America present high-growth avenues.

- Patent expiries may reduce prices: Resulting in increased unit sales but pressure on margins.

- Innovation opportunities: Delivery technologies and combination therapies can drive incremental revenue.

- Regulatory strategies essential: Navigating approval pathways in diverse markets will determine market access and growth.

FAQs

1. What are the primary therapeutic indications for mometasone furoate?

Mometasone furoate treats allergic rhinitis, asthma, atopic dermatitis, psoriasis, and nasal polyps, among other inflammatory and allergic conditions.

2. How does patent expiration impact the mometasone furoate market?

Patent expiries lead to generic competition, typically resulting in price reductions and increased accessibility, which can boost overall sales volume but compress profit margins for original manufacturers.

3. Which regions are expected to drive the highest sales growth?

The Asia-Pacific region, driven by rising allergy and asthma prevalence and improving healthcare infrastructure, is forecasted to experience the fastest growth.

4. Are there ongoing innovations in mometasone furoate formulations?

Yes, developments include combination therapies (e.g., corticosteroids with antihistamines), advanced delivery systems like nano-formulations, and bioavailability enhancements.

5. What challenges could hinder market growth?

Stringent regulatory requirements, safety concerns associated with corticosteroid use, and intense price competition from generics pose challenges to sustained revenue growth.

Sources

[1] Globally, the corticosteroids market. MarketWatch. 2022.

[2] Mometasone furoate sales data. IQVIA. 2022.

[3] Regulatory reports on corticosteroid formulations. FDA & EMA publications, 2022.

[4] Regional market forecasts. Grand View Research, 2023.

[5] Innovation trends in corticosteroid formulations. PharmaTech Outlook, 2022.

More… ↓