Last updated: July 27, 2025

Introduction

Metoprolol succinate, a selective beta-1 adrenergic blocker, is primarily prescribed for managing hypertension, angina pectoris, systolic heart failure, and post-myocardial infarction. Its extended-release formulation offers long-lasting therapeutic effects, translating into increased patient compliance. As a cornerstone drug in cardiovascular therapy, understanding its market dynamics and future sales trajectory is paramount for pharmaceutical stakeholders seeking strategic positioning.

Market Overview

Global Market Size and Growth

The global beta-blockers market, estimated at approximately USD 4.8 billion in 2022, is projected to grow at a CAGR exceeding 3% through 2030 (source: Grand View Research). Metoprolol succinate accounts for a significant share within this segment, driven by its favorable efficacy profile and widespread off-label use.

Key Market Drivers

- Prevalence of Cardiovascular Diseases (CVDs): The World Health Organization (WHO) reports over 18 million annual deaths attributable to CVDs globally [1], escalating demand for effective management therapies such as metoprolol succinate.

- Updated Clinical Guidelines: Leading cardiology guidelines endorse beta-blockers, including metoprolol succinate, for heart failure and post-myocardial infarction care (American Heart Association, 2021).

- Extended-Release Formulation Adoption: The convenience of once-daily dosing promotes medication adherence, bolstering sales growth.

- Increasing Aging Population: Elderly patients with hypertension and systolic heart failure amplify market penetration.

Regional Market Dynamics

- North America: Dominates due to high CVD prevalence, advanced healthcare infrastructure, and favorable reimbursement policies.

- Europe: Demonstrates steady growth, supported by aging demographics and national treatment guidelines.

- Asia-Pacific: Exhibits robust expansion prospects driven by rising CVD rates, expanding healthcare access, and affordability.

Competitive Landscape

Major pharmaceutical companies such as Novartis (under the brand Toprol-XL), AstraZeneca, and Mylan hold significant market share. Generic formulations further intensify market competition, with generics accounting for approximately 75% of sales in mature markets [2].

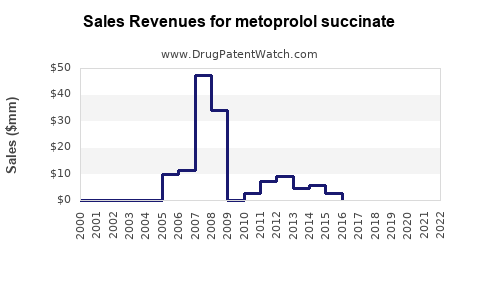

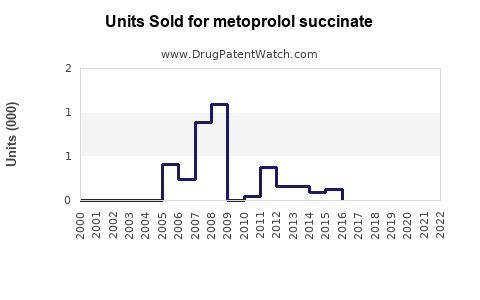

Patent expirations have led to increased generic entry, exerting downward pressure on prices, but also expanding access and consumption.

Sales Projections

Historical Sales Data

From 2018 to 2022, global sales of metoprolol succinate extended-release formulations increased from USD 1.2 billion to USD 1.8 billion, driven by expanded indications and demographic shifts.

Forecast Methodology

Utilizing a combination of trend analysis, epidemiological data, and market growth rates, future sales projections account for factors such as patent expirations, competitive dynamics, and emerging markets.

Projected Sales (2023–2028)

| Year |

Estimated Global Sales (USD Billion) |

CAGR |

Key Growth Influencers |

| 2023 |

2.0 |

11% |

Increased CVD prevalence; wider generic adoption |

| 2024 |

2.2 |

10% |

Expanded use in heart failure management |

| 2025 |

2.4 |

9% |

Rising healthcare spending in emerging markets |

| 2026 |

2.6 |

8% |

New clinical guidelines reinforcing use |

| 2027 |

2.8 |

7.7% |

Launch of value-added formulations or combination therapies |

| 2028 |

3.0 |

7.1% |

Continued demographic-driven demand |

Regional Sales Forecasts

- North America: CAGR of approximately 7%, reaching USD 1.4 billion by 2028, influenced by high prevalence rates and healthcare innovation.

- Europe: Approximately 6% CAGR, with sales nearing USD 650 million.

- Asia-Pacific: Fastest growth at around 10% CAGR, potentially surpassing USD 500 million due to urbanization and increasing CVD burden.

Market Opportunities and Challenges

Opportunities

- Emerging Markets: Enhancing distribution strategies to capitalize on increasing healthcare infrastructure.

- Combination Therapies: Developing fixed-dose combinations for better patient adherence.

- Personalized Medicine: Tailoring therapy through pharmacogenomic insights to optimize efficacy.

Challenges

- Pricing Pressures: Generic competition reduces profitability margins.

- Regulatory Hurdles: Differing regional approval processes can impact product launches.

- Side Effect Profile: Managing adverse effects, such as bradycardia and fatigue, remains critical to sustained use.

Regulatory and Patent Landscape

Patents for branded formulations typically expire in the late 2010s to early 2020s, enabling generic manufacturers to penetrate markets. Continued regulatory vigilance ensures safe and effective dosing recommendations, impacting formulary decisions and prescribing practices.

Conclusion

Metoprolol succinate's market outlook remains robust, buoyed by cardiovascular disease prevalence and evolving treatment guidelines. While patent expirations have saturated markets with generics, strategic differentiation through formulations, combination therapies, and targeted marketing will sustain sales growth. Regional expansion, especially in Asia-Pacific, presents lucrative opportunities, provided regulatory and pricing challenges are adeptly managed.

Key Takeaways

- The global market for metoprolol succinate is projected to grow at a CAGR of approximately 7–10% through 2028, reaching USD 3 billion.

- High prevalence of CVDs, robust clinical evidence, and favorable pharmacokinetics underpin sustained demand.

- Generics dominate the market, intensifying price competition but expanding access.

- Emerging markets and personalized medicine approaches offer significant growth avenues.

- Strategic focus on innovation, regional expansion, and pipeline diversification will be crucial for market leaders.

FAQs

-

What is the primary therapeutic indication driving sales of metoprolol succinate?

Hypertension and heart failure management are the main indications, supported by clinical guidelines and the drug's proven efficacy.

-

How do patent expirations affect the market for metoprolol succinate?

Patent expirations facilitate generic entry, reducing brand-name sales but increasing overall market volume and accessibility.

-

What regional factors influence sales projections for metoprolol succinate?

Variations in CVD prevalence, healthcare infrastructure, regulatory approval processes, and economic development influence regional sales growth.

-

Are there emerging formulations or combination therapies for metoprolol succinate?

Yes, fixed-dose combinations and novel delivery systems aim to improve patient adherence and broaden therapeutic options.

-

What challenges could impede the growth of metoprolol succinate markets?

Pricing pressures from generics, regulatory hurdles, and adverse event management pose potential obstacles.

References

[1] World Health Organization. Cardiovascular Diseases (CVDs). 2022.

[2] Grand View Research. Beta-Blockers Market Size, Share & Trends Analysis Report. 2022.