Last updated: July 27, 2025

Introduction

Victoza (liraglutide) is a glucagon-like peptide-1 (GLP-1) receptor agonist developed by Novo Nordisk, primarily approved for type 2 diabetes management. Its expanding indications include obesity treatment (under the brand Wegovy) and cardiovascular risk reduction. Given its multifaceted application and increasing global prevalence of obesity and diabetes, understanding Victoza's market landscape and sales outlook is vital for stakeholders. This analysis synthesizes current market dynamics, commercial strategies, and future revenue projections rooted in epidemiological trends, competitive positioning, and regulatory developments.

Market Overview

Global Pharmaceutical Market for Diabetes and Obesity Treatments

The treatment landscape for type 2 diabetes (T2D) encompasses insulin, metformin, SGLT2 inhibitors, DPP-4 inhibitors, and GLP-1 receptor agonists. The global diabetes drugs market was valued at approximately USD 50 billion in 2022, with projections indicating a CAGR of 7% through 2030 [1]. The obesity therapeutics market, although smaller, is expanding rapidly, expected to reach USD 16 billion by 2030, driven by increasing obesity prevalence and approval of novel therapeutics like GLP-1 analogs [2].

Novo Nordisk’s Victoza, as a leading GLP-1 agent, commands significant market share in both diabetes and obesity segments, benefiting from a robust portfolio, favorable clinical outcomes, and comprehensive marketing strategies.

Epidemiological Drivers

The global prevalence of T2D is estimated at over 537 million adults, expected to reach 700 million by 2045 [3]. Obesity affects more than 650 million adults worldwide [4]. The dual burden amplifies demand for effective, safe, and convenient therapeutics like Victoza. Moreover, the cardiovascular benefits demonstrated in trials (e.g., LEADER study) enhance its value proposition, especially for high-risk populations.

Competitive Landscape

Victoza faces competition from other GLP-1 receptor agonists, notably Trulicity (Eli Lilly), Ozempic (Novo Nordisk), and newer agents like Rybelsus (oral semaglutide). While Trulicity and Ozempic offer similar efficacy profiles, Victoza benefits from early market entry and extensive clinical use. The arrival of oral semaglutide has shifted some market share from injectable GLP-1s but also expanded overall market adoption by offering oral administration. Biosimilars are not yet present, maintaining high barriers to generic competition.

Regulatory and Labeling Expansion

Victoza’s approval for weight management (Wegovy) in several regions has diversified its revenue streams. Additionally, recent approvals for cardiovascular risk reduction in T2D patients bolster sales opportunities, especially within health systems emphasizing comprehensive risk management. Regulatory support enhances global penetration, particularly in emerging markets where diabetes and obesity are surging.

Market Penetration and Pricing Strategy

Victoza's pricing varies globally, often positioned at a premium due to clinical efficacy and safety profile. Its high-cost structure limits access in some markets but is counterbalanced by insurance coverage and government rebates in developed countries. Strategic partnerships with payers and healthcare providers facilitate sustained growth.

Sales Projections: 2023-2030

Methodology and Assumptions

Forecasting considers epidemiological data, market penetration rates, pipeline developments, competitive dynamics, and healthcare policy trends. Adoption rates are projected to accelerate in developing economies due to increasing disease prevalence, while mature markets are expected to see gradual saturation.

2023-2025 Outlook

-

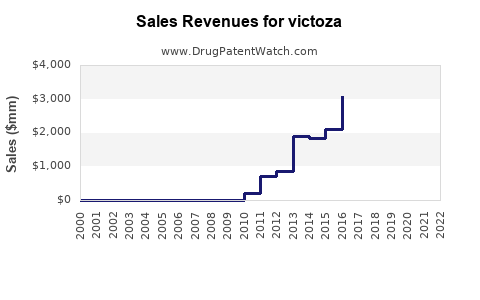

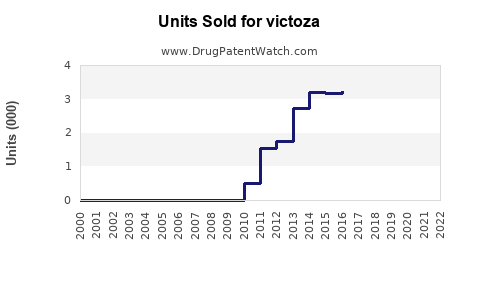

2023: Victoza’s global sales are estimated at approximately USD 3.3 billion, driven by existing diabetes treatment demand and early uptake of expanded indications. The ongoing COVID-19 recovery further stabilizes chronic disease management markets.

-

2024-2025: A compound annual growth rate (CAGR) of approximately 15-20% is expected, fueled by increased adoption in emerging markets, obesity market expansion, and macroeconomic factors favoring innovation.

2026-2030 Projections

-

Market Penetration: As the obesity indication (Wegovy) gains broader acceptance and as cardiovascular benefits are recognized, Victoza’s sales could see a substantial upward trajectory.

-

Forecasted Revenue: By 2030, global sales could reach USD 8-12 billion annually, representing a CAGR of approximately 12-15% from 2023 levels. This projection hinges on regulatory expansions, competitive responses, and continued epidemiological growth.

Factors Influencing Future Sales

- Clinical Validation: Ongoing trials may expand substrate indications, increasing its market scope.

- Pricing and Reimbursement: Health policy shifts towards value-based care can impact pricing strategies, either boosting revenue through premium positioning or constraining it via price controls.

- Patent and Competition: The expiration of key patents around 2028 could introduce biosimilars, impacting pricing and market share. Novo Nordisk's ability to innovate and secure new indications remains critical for sustained growth.

- Global Access: Expansion into markets like China and India, where diabetes prevalence is soaring, is pivotal. Effective partnerships and localized pricing strategies will be decisive.

Risks and Challenges

- Competitive Pressure: Entry of oral GLP-1 analogs and combination therapies could erode market share.

- Regulatory Hurdles: Delays or restrictions in key markets may hamper expansion.

- Pricing Pressures: Governments and insurers seeking cost containment may limit reimbursement levels.

- Pipeline Uncertainty: Dependence on pipeline success for growth; failure to develop next-generation therapies poses risks.

Conclusion

Victoza stands as a cornerstone in the GLP-1 receptor agonist class, with strong upward sales potential driven by rising global diabetes and obesity rates, expanding indications, and favorable clinical outcomes. Strategic focus on emerging markets, demonstration of cardiovascular benefits, and pipeline innovation are essential to capturing future growth. As market dynamics evolve, Novo Nordisk’s agility in navigating competition and regulation will ultimately determine Victoza’s long-term market leadership and revenue contribution.

Key Takeaways

- Robust Growth Potential: Victoza’s sales could reach USD 8-12 billion annually by 2030, a significant increase from current levels, supported by epidemiological trends and expanding indications.

- Competitive Differentiation: Its proven efficacy and safety profile, combined with regulatory approvals for weight management and cardiovascular risk reduction, reinforce its market position.

- Market Expansion Opportunities: Significant growth lies in emerging markets, where diabetes and obesity prevalence are escalating, alongside efforts to improve affordability and access.

- Pipeline and Innovation: Continued clinical trials and pipeline development are critical for sustaining growth amid increasing competition and patent expirations.

- Strategic Risks: Price regulation, biosimilar entry, and competitive innovations pose ongoing challenges that Novo Nordisk must address proactively.

FAQs

Q1: How does Victoza compare with other GLP-1 receptor agonists in the market?

A1: Victoza offers a long track record, extensive clinical data, and proven cardiovascular benefits, making it a preferred choice in many cases. However, newer agents like semaglutide (Ozempic, Wegovy) are gaining popularity due to ease of dosing and potential superior efficacy, intensifying competition.

Q2: What impact will patent expiry around 2028 have on Victoza’s sales?

A2: Patent expirations typically open markets to biosimilar competition, which could reduce pricing power and market share. Continuous innovation and indication expansion are vital for offsetting these risks.

Q3: How are regulatory developments influencing Victoza’s market prospects?

A3: Regulatory approvals for additional indications and expanded access in emerging markets enhance sales prospects. Conversely, regulatory delays or restrictions could limit growth and geographic reach.

Q4: Will emerging markets significantly contribute to Victoza’s future sales?

A4: Yes. Countries like China, India, and Brazil exhibit rising diabetes prevalence. Tailored pricing, local manufacturing, and strategic partnerships are key to capitalizing on these opportunities.

Q5: What role does clinical trial evidence play in Victoza’s market strategy?

A5: Strong clinical data underpin regulatory approvals, payer reimbursement, and physician prescribing behavior. Ongoing trials that demonstrate additional benefits support sustained and expanded use.

Sources:

- Fortune Business Insights. “Diabetes Drugs Market Size, Share & Industry Analysis, 2022.”

- Grand View Research. “Obesity Therapeutics Market Size, Share & Trends Analysis, 2022.”

- International Diabetes Federation. “IDF Diabetes Atlas, 10th Edition, 2021.”

- World Obesity Federation. “Global Obesity Observatory, 2022.”