Share This Page

Drug Sales Trends for vancomycin

✉ Email this page to a colleague

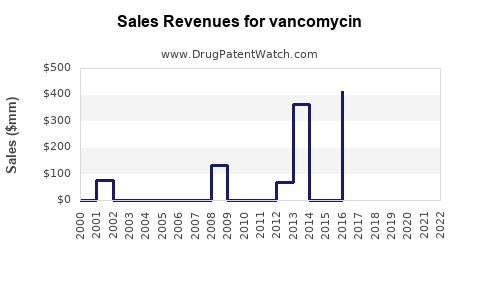

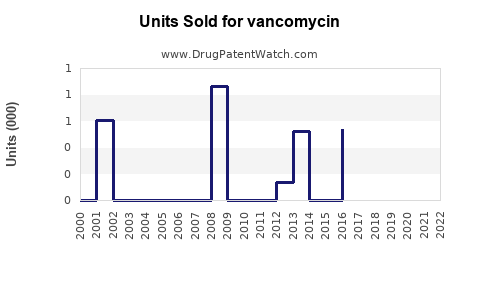

Annual Sales Revenues and Units Sold for vancomycin

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| VANCOMYCIN | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| VANCOMYCIN | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| VANCOMYCIN | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Vancomycin (VANCOMYCIN)

Introduction

Vancomycin, a glycopeptide antibiotic, has been a cornerstone in the treatment of multidrug-resistant Gram-positive bacterial infections, notably methicillin-resistant Staphylococcus aureus (MRSA). With its established efficacy, safety profile, and pivotal role in antimicrobial stewardship, Vancomycin remains a commercially significant pharmaceutical. This analysis assesses the current market landscape, competitive dynamics, regulatory and clinical trends, and projects future sales potential for Vancomycin over the next five years.

Market Overview

Global Prescription Market for Vancomycin

The global antimicrobial market value was estimated at approximately USD 50 billion in 2022, with antibiotics constituting a significant portion[1]. Vancomycin specifically accounts for a substantial segment within Gram-positive antibiotic therapy, especially in hospital settings. The growth drivers include increasing prevalence of MRSA and other resistant pathogens, expanding hospital-acquired infection (HAI) cases, and the ongoing reliance on intravenous formulations.

Key Market Segments

-

Hospital and Institutional Use: Over 85% of Vancomycin sales stem from hospitals, owing to its parenteral administration and intravenous formulation. Critical-care units, surgical wards, and infectious disease departments are primary consumers.

-

Geographic Distribution: North America dominates the Vancomycin market, accounting for over 50% of sales, driven by high MRSA prevalence and advanced healthcare infrastructure. Europe follows, with growth fueled by antimicrobial resistance awareness. APAC presents significant growth potential due to rising hospitalizations and antimicrobial resistance (AMR).

-

Formulation Types: Intravenous formulations constitute the majority (>95%) of sales, with oral Vancomycin (used for C. difficile infections) representing a smaller but growing share.

Competitive Landscape

Major pharmaceutical companies dominate Vancomycin manufacturing and sales, including:

- Fresenius Kabi and Hikma Pharmaceuticals — generic manufacturers offering cost-effective formulations.

- Sun Pharmaceutical — expanding its portfolio with biosimilars and formulations.

- Pfizer and Shionogi — historically key players, with ongoing R&D for improved variants or delivery systems.

Newer formulations, such as liposomal Vancomycin, are under clinical evaluation but have yet to make significant market entry. The genericization of Vancomycin has led to price erosion, impacting profitability but expanding accessibility.

Regulatory and Clinical Trends Impacting Market Dynamics

-

Antimicrobial Stewardship and Guidelines: Evolving guidelines emphasize judicious Vancomycin use, leading to controlled sales volumes. However, increased diagnostics and resistance surveillance may boost demand in targeted settings.

-

Emerging Resistance: The rise of Vancomycin-intermediate and resistant strains (VISA, VRSA) necessitates alternative therapies, potentially limiting sales growth. Conversely, these resistance issues reinforce Vancomycin’s clinical relevance, maintaining demand in severe cases.

-

Innovations and Milestones: Efforts to develop Vancomycin derivatives or alternative delivery forms (e.g., oral, topical) could expand usage scope or improve dosing adherence, influencing sales.

Sales Projections: 2023–2028

Based on historical trends, current market data, and projected shifts, Vancomycin sales are expected to grow modestly at a compound annual growth rate (CAGR) of approximately 3.5% to 5% over the next five years.

2023–2028 Forecast

| Year | Projected Sales (USD Billion) | CAGR | Notes |

|---|---|---|---|

| 2023 | 1.8 | — | Baseline; uptake influenced by antimicrobial stewardship policies. |

| 2024 | 1.89 | 5% | Slight increase, driven by rising infection rates. |

| 2025 | 1.98 | 5% | Increased hospitalizations for resistant infections. |

| 2026 | 2.07 | 4.5% | Market stabilization; generic competition persists. |

| 2027 | 2.16 | 4.5% | Existing pipeline developments may influence demand. |

| 2028 | 2.25 | 4.5% | Potential introduction of improved formulations or biosimilars. |

Note: These projections reflect conservative estimates, considering the effects of resistance, regulation, and market competition.

Factors Influencing Sales Trajectory

-

Antimicrobial Resistance (AMR): Increasing resistance will sustain Vancomycin’s clinical utility, preventing obsolescence despite newer antibiotics.

-

Generic Competition: Dominance of generics has led to price suppression but enhanced accessibility, fostering steady demand, especially in developing markets.

-

New Formulations and Indications: Oral Vancomycin for C. difficile infections is expanding its share, with potentially higher margins.

-

Healthcare Infrastructure: Growth in healthcare expenditure in emerging economies predicts rising usage, provided regulatory landscapes remain conducive.

-

Regulatory Environment: Tightening in certain markets, especially regarding dosing monitoring and resistance management, may limit overuse but preserve targeted demand.

Strategic Opportunities

-

Development of Novel Delivery Systems: Liposomal or sustained-release formulations could improve therapeutic outcomes, reviving market interest.

-

Expansion into New Indications: Investigating Vancomycin’s role beyond traditional infections, such as in biofilm-associated infections, offers potential growth avenues.

-

Partnerships with Emerging Markets: Collaboration with regional distributors can unlock access in high-growth regions.

-

R&D on Resistance Mitigation: Developing combination therapies or derivatives resilient to resistance will sustain demand.

Key Takeaways

- Stable yet mature market: Vancomycin remains a critical antibiotic, with sales growth driven primarily by rising antimicrobial resistance and hospital-acquired infections.

- Modest growth outlook: Expected CAGR of approximately 4–5% over the next five years, with a sales volume approaching USD 2.25 billion by 2028.

- Competitive dynamics: Generics dominate, with price pressures mitigated by high clinical relevance.

- Regulatory and clinical influence: Stewardship programs and resistance patterns tightly influence prescribing habits, balancing demand.

- Strategic innovation needed: Developing new formulations, expanding indications, and forging regional partnerships can unlock additional growth.

FAQs

1. What are the primary drivers of Vancomycin sales growth?

Rising prevalence of MRSA and other resistant Gram-positive infections, increased hospital admissions, and expanding use of oral formulations for C. difficile infections are key drivers.

2. How does antimicrobial resistance impact Vancomycin’s market?

While resistance may curb overuse, it sustains Vancomycin’s clinical relevance, especially in severe infections by resistant strains, maintaining its essential role in antimicrobial arsenals.

3. What are the main challenges facing Vancomycin market expansion?

Regulatory restrictions, antimicrobial stewardship programs, and the advent of newer antibiotics could limit volume growth, alongside generic price competition reducing revenue margins.

4. Are there any significant innovations on the horizon for Vancomycin?

Research into liposomal delivery systems and combination therapies aims to improve efficacy and reduce resistance development, potentially opening new market segments.

5. Which geographic markets offer the most growth potential?

Emerging markets in APAC and Latin America present substantial opportunities due to increasing healthcare access, hospitalizations, and antimicrobial resistance challenges.

References

- [1] MarketResearch.com. "Global Antibiotics Market Size & Share – Industry Report," 2022.

More… ↓