Share This Page

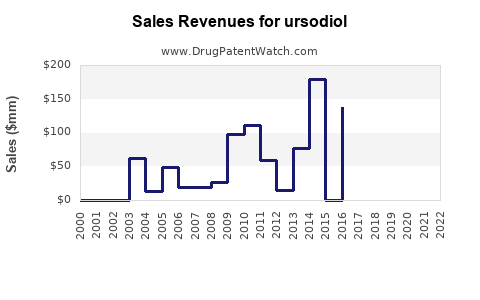

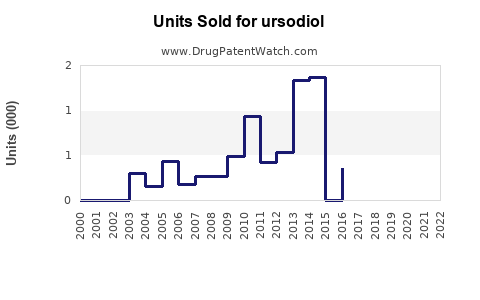

Drug Sales Trends for ursodiol

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for ursodiol

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| URSODIOL | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| URSODIOL | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| URSODIOL | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| URSODIOL | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| URSODIOL | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| URSODIOL | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Ursodiol (Ursodeoxycholic Acid)

Introduction

Ursodiol, commercially known as ursodeoxycholic acid, is a bile acid used primarily for the dissolution of cholesterol gallstones and the treatment of primary biliary cholangitis (PBC). Its therapeutic efficacy, established safety profile, and broad applications position ursodiol as a significant player in the hepatology and gallstone treatment markets. This analysis examines the current market landscape, growth drivers, competitive dynamics, and sales forecasts for ursodiol over the next five years.

Market Overview

Therapeutic Applications

Ursodiol's primary indications include:

- Gallstone Dissolution: Cholesterol gallstones in symptomatic patients who are not surgical candidates.

- Primary Biliary Cholangitis (PBC): Slows disease progression and improves survival when administered early.

- Off-label Uses: Includes treatment for certain cholestatic liver diseases and prevention of gallstone formation in rapid weight loss patients.

Global Market Size

The global bile acids market was valued at approximately USD 800 million in 2022, with ursodiol constituting roughly 60% due to high prescription rates and well-established efficacy [1]. North America remains the dominant market, accounting for about 45% of sales, driven by high prevalence rates of gallstone disease and robust healthcare infrastructure.

Market Drivers

-

Rising Incidence of Gallstone Disease

Globally, gallstone prevalence ranges from 10-20%, with increased rates in Western countries due to obesity, aging populations, and sedentary lifestyles [2]. -

Increasing Adoption of Non-surgical Therapies

Growing preference for medical management over surgery in suitable candidates favors ursodiol, especially in patients contraindicated for cholecystectomy. -

Approval for PBC and Broader Indications

Regulatory approvals in key markets (e.g., FDA approval for PBC) have expanded ursodiol’s therapeutic scope, fueling sales. -

Off-label Use and Preventive Medicine

Use in rapid weight loss programs and certain cholestatic conditions broadens the patient base.

Competitive Landscape

Key Players

- Dr. Reddy’s Laboratories: One of the largest producers, with global market share.

- Teva Pharmaceuticals: Offers generic ursodiol formulations.

- Mylan (Now part of Viatris): Significant contributor in generic markets.

- Hetero Drugs: Focused on emerging markets with competitive pricing.

Brand vs. Generic

The market is predominantly generic, with little officially branded ursodiol products. Patent expirations over the last decade have increased generic penetration, reducing prices and increasing accessibility.

Regulatory Environment

Ursodiol is approved in major markets including the US, European Union, and parts of Asia. Regulatory bodies mandate rigorous quality standards underlying generic formulations, which influences market competition.

Market Challenges

- Pricing pressures due to generic competition.

- Limited scope for innovation given the drug's age and established efficacy.

- Market saturation in mature regions, constraining growth.

Sales Projections (2023-2028)

Assumptions

- Moderate annual growth rate of 4% in key markets, influenced by rising prevalence and expanded indications.

- New formulations and combination therapies do not significantly alter the current market penetration.

- Patent expirations have stabilized; no major patent cliff anticipated within this period.

Forecast Breakdown

| Year | Estimated Global Sales (USD Billion) | Growth Rate | Remarks |

|---|---|---|---|

| 2023 | 1.3 | — | Baseline year |

| 2024 | 1.35 | 3.8% | Increase driven by PBC awareness |

| 2025 | 1.41 | 4.4% | Expanding use in emerging markets |

| 2026 | 1.47 | 4.2% | Steady market growth |

| 2027 | 1.54 | 4.8% | Increased adoption in non-European markets |

| 2028 | 1.61 | 4.5% | Maturation phase |

Total projected market size in 5 years: USD 1.61 billion

Emerging Trends & Opportunities

- Expanding in Asia-Pacific: Rapid urbanization and rising gallstone prevalence open lucrative markets.

- Combination Therapies: Developing adjunctive formulations with statins or other hepatoprotective agents.

- Biomarker-Guided Therapy: Personalized medicine approaches to optimize ursodiol efficacy could drive future sales.

Conclusion

The ursodiol market displays steady, predictable growth, primarily fueled by demographic shifts, escalating gallstone disease, and expanding indications such as PBC. While generic competition caps margins, the growing burden of hepatobiliary diseases ensures sustained demand. Companies seeking growth should focus on emerging markets, differentiated formulations, and clinical expansion in off-label indications.

Key Takeaways

- Market Strengths: Established efficacy, high acceptance, broad indication spectrum.

- Growth Opportunities: Emerging markets, off-label use, and combination therapies.

- Challenges: Pricing pressures, market saturation, limited innovation.

- Strategic Focus: Expansion in Asia-Pacific, clinical trials for new indications, and maintaining regulatory compliance.

FAQs

1. What are the main drivers behind ursodiol’s market growth?

Rising gallstone prevalence, increasing diagnosis rates of PBC, demographic aging, and broadening therapeutic indications.

2. How does generic competition impact ursodiol sales?

It significantly reduces prices and profit margins but ensures widespread accessibility, sustaining overall sales volumes.

3. Are there emerging therapeutic alternatives to ursodiol?

Yes, newer approaches include extracorporeal shock wave lithotripsy and novel pharmacological agents, but none currently threaten ursodiol’s market dominance.

4. Which regions offer the most growth potential for ursodiol?

Asia-Pacific, Latin America, and parts of the Middle East show high growth potential due to rising hepatobiliary disease burdens.

5. What future developments could influence ursodiol sales?

Advancements in personalized medicine, combination formulations, and expanded clinical indications could enhance future market share.

References

[1] Market Research Future. (2022). Bile acids market report.

[2] Shaffer, E. A. (2006). Gallstone disease: Epidemiology, genetics, and pathogenesis. Hepatology, 43(2), 214–226.

More… ↓