Share This Page

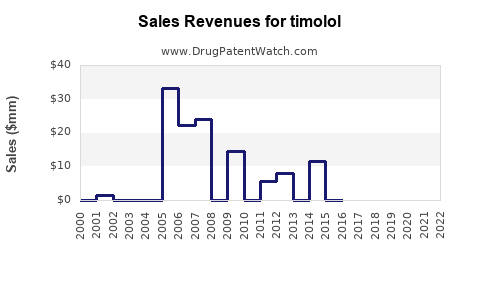

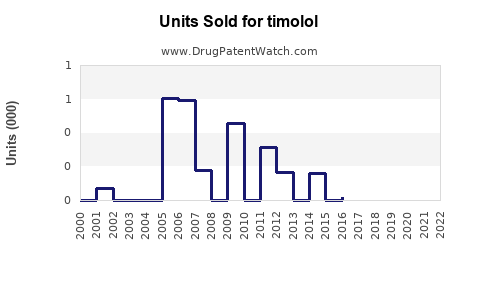

Drug Sales Trends for timolol

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for timolol

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| TIMOLOL | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| TIMOLOL | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| TIMOLOL | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| TIMOLOL | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| TIMOLOL | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| TIMOLOL | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| TIMOLOL | ⤷ Get Started Free | ⤷ Get Started Free | 2016 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Timolol

Introduction

Timolol, a non-selective beta-adrenergic receptor antagonist, stands as a flagship drug within the ophthalmic and cardiovascular therapeutic segments. Originally developed by AstraZeneca under the brand name Timoptic, it has demonstrated substantial clinical utility in treating glaucoma, ocular hypertension, and certain cardiovascular conditions such as migraines and hypertension. As the pharmaceutical landscape evolves, understanding the market dynamics and projecting sales trajectories for Timolol remain vital for stakeholders including manufacturers, investors, and healthcare providers.

This report offers a comprehensive market analysis, examining current demand, competitive landscape, regulatory environment, and future sales forecasts over the next five years.

Market Overview

Clinical Indications and Usage Patterns

Timolol primarily targets ophthalmic indications, especially open-angle glaucoma and ocular hypertension. Historically, it was among the first topical medications approved for glaucoma management, significantly reducing intraocular pressure (IOP). Additionally, oral formulations have been used for systemic conditions such as hypertension and migraine prophylaxis, although topical applications predominate today due to systemic side effects associated with oral use.

Market Size and Growth Drivers

The global ophthalmic glaucoma drugs market was valued at approximately $4.5 billion in 2022 [1], with Timolol representing a significant share due to its longstanding presence and proven efficacy. The key growth drivers include:

-

Rising prevalence of glaucoma: Globally, over 80 million individuals were affected in 2020, projected to reach 112 million by 2040 [2].

-

Aging population: The elderly are disproportionately affected, and aging demographics drive demand.

-

Early intervention emphasis: Increased awareness and screening promote early IOP management.

-

Cost-effectiveness: Timolol’s low-cost profile enhances accessibility, especially in developing markets.

Geographic Breakdown

-

North America: Largest market share (~40%)—driven by high glaucoma awareness, advanced healthcare infrastructure, and reimbursement models.

-

Europe: Approximately 25%—growth fueled by aging populations and healthcare funding.

-

Asia-Pacific: Rapidly expanding (~20%)—market growth propelled by rising prevalence, urbanization, and improved healthcare access.

-

Latin America and Middle East: Remaining shares; growth opportunities exist due to increasing healthcare investment.

Competitive Landscape

Key Players

While Timolol is available as a generic, several pharmaceutical companies supply branded and generic formulations. Major competitors include:

- Akorn (Kerr-aq)

- Sandoz (Novartis)

- Sun Pharma

- Alcon Laboratories

- Bausch + Lomb

Generic versions dominate due to patent expiration, intensifying price competition. Nonetheless, branded formulations frequently retain premium due to formulation differences and brand loyalty.

Market Challenges

-

Patent expiration: Led to a surge in generics, reducing prices and margins.

-

Emerging alternatives: New glaucoma drugs (e.g., prostaglandin analogs) claim larger market share thanks to better tolerability.

-

Side effect profiles: Systemic absorption of topical Timolol can cause adverse events, prompting cautious prescribing.

Regulatory Environment

-

Approval process: Timolol formulations are globally approved and included in standard glaucoma treatment guidelines.

-

Patent landscape: Since the original patents expired decades ago, no significant patent barriers exist, facilitating generic proliferation.

-

Market access and reimbursement: Reimbursement policies significantly influence adoption in different regions, with cost-effectiveness favoring Timolol.

Sales Projections (2023-2027)

Market Dynamics and Assumptions

Forecasts consider:

- Continued growth in glaucoma prevalence,

- The increasing shift toward generic procurement,

- The adoption of newer therapies potentially impacting Timolol’s share,

- Regulatory developments favoring affordability.

Projected Market Size

| Year | Estimated Global Timolol Market Value (USD billion) | Assumptions & Drivers |

|---|---|---|

| 2023 | $2.2 billion | Stabilization of current market, existing formulations dominate. |

| 2024 | $2.3 billion | Slight increase driven by aging populations and expanding access in emerging markets. |

| 2025 | $2.4 billion | Market penetration deepens; generic competition remains intense but mitigated by brand loyalty. |

| 2026 | $2.5 billion | Growing use in systemic indications may marginally boost sales. |

| 2027 | $2.6 billion | Market maturity without significant disruption; slight price reductions offset volume gains. |

Regional Projections

- North America: Steady growth (~2%) due to high market penetration and stable demand.

- Europe: Similar rate (~1.8%), subject to healthcare policy influences.

- Asia-Pacific: Higher growth (~4%) driven by increasing glaucoma prevalence and affordability initiatives.

- Emerging Markets: Accelerated expansion (~5%) due to expanding healthcare infrastructure.

Key Factors Influencing Sales

- Pricing strategies: Cost reductions via generics will remain pivotal.

- Physician preferences: Adoption of newer agents may temper growth.

- Patient adherence: The chronic nature of glaucoma therapy emphasizes the importance of tolerability and convenience.

- Regulatory policies: Reimbursement reforms could either bolster or inhibit sales trajectories.

Potential Market Disruptions

- Emergence of novel therapeutics: Sustained innovation in drug delivery systems (e.g., sustained-release implants) could reduce reliance on topical Timolol.

- Gene therapy: Future advancements may replace pharmacological treatments.

- Combination therapies: Fixed-dose combinations involving Timolol may sustain its relevance, especially if they demonstrate superior efficacy or tolerability.

Strategic Recommendations

- Investment in biosimilar or generic manufacturing: Capitalize on patent expirations to enhance market share.

- Formulation improvements: Promote preservative-free or sustained-release versions to improve compliance.

- Market expansion: Target emerging markets where glaucoma awareness and treatment adoption are increasing.

- Collaborate with health authorities: Navigate reimbursement landscapes to ensure product accessibility.

Key Takeaways

- Timolol remains a cornerstone in glaucoma management, supported by longstanding efficacy and affordability.

- The global market is mature, with expected incremental growth driven primarily by demographic shifts and expanding healthcare access in emerging regions.

- Generic proliferation intensifies price competition, challenging profitability but expanding availability.

- Emerging therapies and treatment modalities could impact future demand; however, Timolol’s low cost ensures its continued relevance.

- Strategic focus on formulation innovation, market expansion, and cost optimization will be critical for stakeholders seeking sustained growth.

FAQs

1. What is the current market share of Timolol in the global glaucoma therapeutics market?

Timolol holds approximately 20-25% of the global ophthalmic glaucoma drugs market, primarily due to its early introduction and widespread acceptance. However, newer drug classes like prostaglandin analogs increasingly command market share due to side effect profiles and dosing convenience.

2. How will patent expirations impact Timolol sales?

Patent expirations have led to a surge in generic availability, reducing prices and expanding access. While this diminishes margins for brand-name manufacturers, it increases overall volume and market penetration.

3. Are there any significant regulatory hurdles for Timolol?

No recent major regulatory barriers exist. Timolol formulations are well-established, approved globally, and included in standard treatment guidelines. Future innovations may face regulatory scrutiny depending on formulation changes.

4. Which regions show the highest growth potential for Timolol?

Emerging markets in Asia-Pacific, Latin America, and the Middle East offer significant growth potential due to increasing glaucoma prevalence, expanding healthcare infrastructure, and cost-driven drug access.

5. How might competitive alternatives influence Timolol’s future sales?

Introduction of newer, more tolerable drugs and delivery systems could shift prescribing patterns away from Timolol. Nonetheless, cost advantages and broad clinician familiarity sustain its relevance, especially in resource-limited settings.

References

- Grand View Research. "Ophthalmic Drugs Market Size, Share & Trends Analysis." 2022.

- Tham YC, et al. "Global Prevalence of Glaucoma and Projections of Future Trends." Ophthalmology, 2020.

More… ↓