Share This Page

Drug Sales Trends for theophylline

✉ Email this page to a colleague

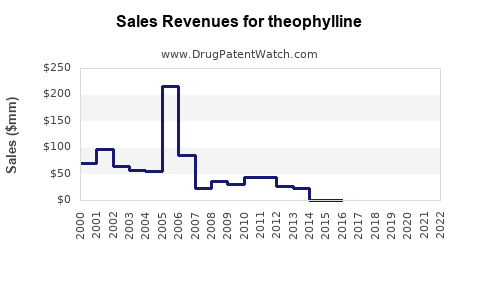

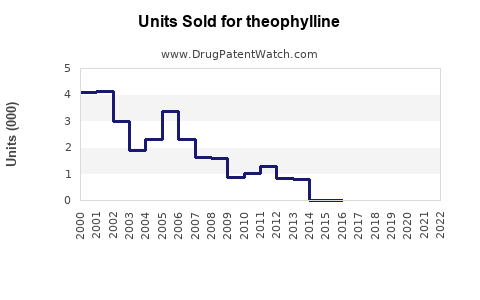

Annual Sales Revenues and Units Sold for theophylline

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| THEOPHYLLINE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| THEOPHYLLINE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| THEOPHYLLINE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| THEOPHYLLINE | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| THEOPHYLLINE | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| THEOPHYLLINE | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| THEOPHYLLINE | ⤷ Get Started Free | ⤷ Get Started Free | 2016 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Theophylline: An In-Depth Review

Overview of Theophylline

Theophylline, a methylxanthine derivative, has been a cornerstone in the management of respiratory diseases since its introduction in the early 20th century. It functions primarily as a bronchodilator, working by relaxing airway smooth muscle and exhibiting anti-inflammatory effects. Historically used in the treatment of asthma and chronic obstructive pulmonary disease (COPD), its market has experienced shifts driven by medical advancements, safety profiles, and emerging therapies.

Global Market Landscape

Current Market Size

As of 2023, the global pharmaceutical market for theophylline is estimated at approximately USD 300 million. This figure reflects its use in both over-the-counter (OTC) formulations and prescription medications. Key markets include North America, Europe, and Asia-Pacific, with North America accounting for roughly 40% of the sales, driven by high prevalence rates of respiratory diseases and established manufacturing infrastructure.

Market Drivers

- Established Efficacy & Cost-Effectiveness: Theophylline’s long-standing use and low-cost profile sustain its demand, particularly in developing economies.

- Supply Chain Stability: Mature manufacturing channels enhance product availability and affordability.

- Anticipated Growth in COPD and Asthma Prevalence: Rising global prevalence, especially in aging populations, sustains demand for bronchodilators.

Market Challenges

- Safety Concerns & Narrow Therapeutic Window: Side effects related to toxicity, including cardiac arrhythmias and seizures, restrict use, especially where safer alternatives are available.

- Emergence of Newer Agents: Advances in biologics and inhaled corticosteroids have reduced reliance on theophylline.

- Regulatory Limitations: Stringent approval processes in major markets hinder innovation and new formulations.

Competitive Landscape

Major pharmaceutical companies, such as Boehringer Ingelheim and Merck, have historically produced theophylline. However, the market is fragmented, with numerous generic producers offering varied formulations. Given the molecule’s age and patent expirations, revenue predominantly stems from generic sales rather than proprietary formulations.

Emerging niche markets include slow-release formulations and combination therapies aimed at improving safety profiles and patient adherence.

Regional Market Dynamics

- North America: Market maturity limits growth, but usage persists in resource-constrained settings and specific patient populations. The FDA’s cautious stance on theophylline’s safety profile restricts its broader adoption.

- Europe: Similar to North America, with additional concerns about regulatory oversight. However, some countries continue to utilize theophylline due to cost advantages.

- Asia-Pacific: Rapidly growing market driven by increasing respiratory disease burdens, urbanization, and healthcare affordability improvements. Countries like India and China are significant contributors to regional sales.

- Latin America & Africa: Utilization often centered around low-cost generic options, vital where healthcare infrastructure is limited.

Sales Projections (2024–2030)

Forecast Assumptions

- Moderate Compound Annual Growth Rate (CAGR): 2.5% to 3.5%, considering the overall decline in reliance due to newer therapies but offset by demand in developing regions.

- Market Penetration of New Formulations: Slow adoption of advanced release systems and combination medications could bolster sales.

- Regulatory Environment: Continued safety concerns could constrain growth, though reforms may facilitate market expansion.

Projected Market Values

| Year | Estimated Market Size (USD Million) | Key Trends |

|---|---|---|

| 2024 | 330 | Continued reliance in emerging markets; regulatory scrutiny persists. |

| 2025 | 340 | Incremental growth driven by Asia-Pacific expansion; emerging combination therapies. |

| 2026 | 355 | Introduction of safety-enhanced formulations; potential for niche uses. |

| 2027 | 370 | Slight uptick as global respiratory disease awareness increases. |

| 2028 | 385 | Market stabilization; increased generic competition. |

| 2029 | 395 | Market mature; growth driven by increased disease prevalence. |

| 2030 | 410 | Overall steady growth, with regional variances. |

Key Factors Influencing Sales Growth

- Emerging Markets Expansion: Population increases coupled with economic growth elevate demand.

- Transition to Safer Alternatives: The development of biologics and inhaled antagonists may temper potential growth.

- Formulation Innovation: Slow-release and combination therapies could command premium pricing, influencing sales volumes.

Strategic Opportunities and Risks

Opportunities

- Niche Uses and Formularies: Specialty clinics and resource-limited healthcare systems will continue to rely on theophylline, especially with affordable generics.

- Product Differentiation: Developing formulation innovations (e.g., sustained release) could extend market lifespan.

- Regulatory Engagement: Proactively addressing safety concerns may unlock new indications or expanded labeling.

Risks

- Safety Profile Limitations: Side effects restrict large-scale adoption in developed markets.

- Competitive Market Entry: Introduction of newer, safer respiratory drugs threatens theophylline’s market share.

- Pharmacovigilance Requirements: Increased monitoring costs and regulatory burdens could impact profitability.

Regulatory and Patent Outlook

The patent landscape for theophylline is largely expired, leading to widespread generic manufacturing. Regulatory agencies prioritize safety, with strict labeling and dosing guidelines. For new formulations, approval processes involve demonstrating bioequivalence and safety improvements, requiring significant investment.

Key Takeaways

- Theophylline remains relevant primarily in developing markets and niche clinical contexts due to cost-effectiveness.

- Market growth is modest, driven largely by increased prevalence of respiratory diseases and expanding healthcare infrastructure in emerging economies.

- Innovations focusing on safety and convenience—such as sustained-release formulations—offer growth opportunities but face stiff competitive and regulatory hurdles.

- Traditional reliance on theophylline diminishes in developed countries where newer biologic therapies and inhalers dominate.

- Strategic positioning in emerging markets, coupled with formulation innovation, can sustain sales momentum over the next decade.

FAQs

1. Is theophylline still widely used in current clinical practice?

Yes, particularly in resource-limited settings and for certain patient populations. However, its use has declined in developed countries due to safety concerns and the availability of newer therapies.

2. What are the main safety issues associated with theophylline?

Theophylline’s narrow therapeutic window can lead to toxicity, causing side effects such as nausea, insomnia, tachyarrhythmias, and seizures if not properly monitored.

3. Are there ongoing efforts to develop improved formulations of theophylline?

Yes, extended-release and combination formulations aim to improve safety, adherence, and efficacy, which could prolong its clinical relevance.

4. How will emerging biologic treatments impact theophylline’s market?

Biologics like omalizumab and monoclonal antibodies have begun replacing theophylline in many indications due to superior safety and efficacy, limiting future growth of the traditional molecule.

5. What geographic markets are expected to show growth for theophylline sales?

Emerging markets in Asia-Pacific, Latin America, and parts of Africa are projected to sustain or slightly increase demand due to affordability and existing healthcare practices.

References

- Market Research Future, "Global Theophylline Market Research Report 2023," 2023.

- GlobalData, "Respiratory Drugs and Devices Market Forecast," 2022.

- US Food and Drug Administration (FDA), "Drug Safety Communications," 2021.

- IQVIA, "Global Trends in Respiratory Disease Treatment," 2022.

- World Health Organization, "Global Status of Chronic Respiratory Diseases," 2021.

More… ↓