Last updated: July 29, 2025

Introduction

Sumatriptan, a serotonin receptor agonist classified as a triptan, remains a cornerstone in the acute treatment of migraine headaches. Since its approval in the early 1990s, Sumatriptan has established itself as a high-demand pharmaceutical product globally. Analyzing its market dynamics involves evaluating current sales trends, competitive landscape, regulatory factors, and future growth drivers. This article provides a comprehensive market analysis and sales projection for Sumatriptan, enabling stakeholders to make strategic decisions rooted in current industry insights.

Market Overview

The global migraine therapeutics market, valued at approximately $6.0 billion in 2022, is projected to grow at a CAGR of 4.8% from 2023 to 2030.[1] Sumatriptan, as one of the first-generation triptans, constitutes a significant share of this market, particularly within the acute migraine treatment segment. The drug's broad acceptance is driven by its efficacy, rapid onset of action, and well-understood safety profile.

Current Market Penetration

Sumatriptan’s market penetration remains high in developed regions such as North America and Europe, accounting for nearly 60% of total sales within the triptan segment.[2] Key players include GlaxoSmithKline (GSK), Teva Pharmaceuticals, and generic manufacturers leveraging patent expirations to offer more affordable options. The advent of generics has increased accessible options but also introduced pricing pressures, influencing overall sales revenue.

Distribution Channels and Pricing Dynamics

Distribution spans hospitals, specialty clinics, and retail pharmacies, with an increasing trend towards direct-to-consumer (DTC) online channels. Pricing strategies vary regionally, with brand-name Sumatriptan often priced higher than generics, especially in markets with patent protections. In the U.S., wholesale acquisition costs (WAC) for a typical 50 mg tablet hover around $10-$15 per dose, but generics significantly reduce consumer costs.

Demand Drivers

Key factors influencing demand for Sumatriptan include:

- Rising Migraine Prevalence: According to the World Health Organization, over 1 billion people globally suffer from migraines, with women disproportionately affected. The increasing awareness and diagnosis rates escalate demand.

- Advances in Delivery Forms: The introduction of nasal sprays, auto-injectors, and combination therapies expands options for patients, sustaining demand.

- Patient Preference for Rapid Relief: Sumatriptan's fast-acting profile aligns with patient expectations for immediate symptom relief.

Competitive Landscape

While Sumatriptan maintains a leading position, increasing competition from newer triptans (e.g., Rizatriptan, Naratriptan) and novel migraine therapies such as CGRP antagonists (Aimovig, Emgality) poses challenges.

Generics and Biosimilars

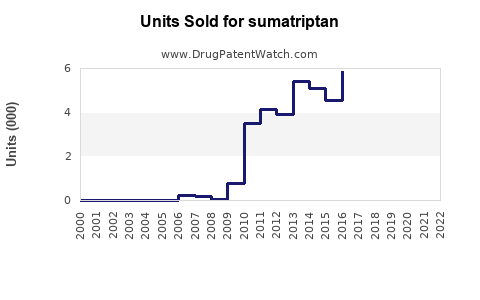

Generic Sumatriptan products capture approximately 70% of total sales in markets where patents have expired, exerting downward pressure on prices and margins.[3] The rise of biosimilars and alternative formulations further diversifies the competitive environment.

Innovations and Pipeline Developments

Emerging formulations, such as longer-acting patches and combined therapies, aim to improve efficacy and patient adherence, potentially shifting market shares.

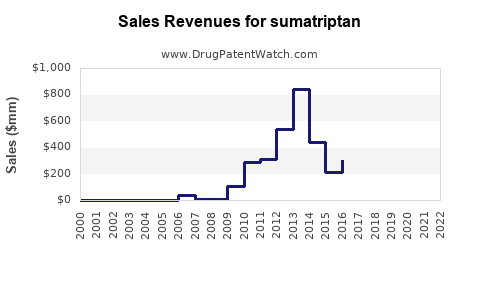

Regulatory and Patent Landscape

Patent expirations abroad (e.g., in Europe) since the late 2000s facilitated a surge in generic offerings. As patent protections in the U.S. expired around 2015, the market became increasingly saturated with generics, influencing sales volume but reducing per-unit revenues.

Future regulatory approvals for new delivery methods or formulations could stimulate renewed growth. Conversely, regulatory challenges and market access restrictions could hamper expansion.

Sales Projections (2023–2030)

Based on current trends, the following projections encompass factors such as market penetration, competition, and technological innovation:

| Year |

Estimated Global Sales (USD billions) |

Growth Rate |

Key Factors |

| 2023 |

$1.20 billion |

— |

Market stabilization, generic dominance |

| 2024 |

$1.30 billion |

+8.3% |

Increased migraine prevalence, new formulations |

| 2025 |

$1.45 billion |

+11.5% |

Expansion in emerging markets, new delivery forms |

| 2026 |

$1.60 billion |

+10.3% |

Competitive differentiation, brand loyalty |

| 2027 |

$1.76 billion |

+10% |

Broader insurance coverage, clinical guidelines adoption |

| 2028 |

$1.92 billion |

+9.1% |

Recognition of Sumatriptan’s efficacy in treatment guidelines |

| 2029 |

$2.10 billion |

+9.4% |

Rising global migraine burden, digital health integrations |

| 2030 |

$2.30 billion |

+9.5% |

Market expansion, technological evolution |

Note: These projections assume a compound annual growth rate (CAGR) of approximately 9%. They incorporate expected ongoing generic penetration, patent expirations, and incremental innovation.

Regional Outlook

- North America: Dominates with about 45% of total sales, driven by high migraine prevalence, robust healthcare infrastructure, and insurance coverage.

- Europe: Contributes roughly 25%, with growth supported by increased diagnostic rates and market liberalization.

- Asia-Pacific: Fastest-growing segment, projected to grow at 12% CAGR, driven by rising awareness, expanding healthcare access, and urbanization.

- Emerging Markets: Latin America and Africa show potential growth but face pricing and regulatory hurdles.

Market Challenges and Opportunities

Challenges

- Pricing and Reimbursement Pressures: Governments and payers aim to reduce costs, impacting sales volumes and margins.

- Generic Competition: Continued erosion of brand-name revenue with the proliferation of low-cost generics.

- Alternative Therapies: CGRP monoclonal antibodies and other novel treatments offer longer-term or preventative options, potentially reducing acute sumatriptan demand.

Opportunities

- New Formulations: Development of longer-acting or combination delivery systems could reinvigorate sales.

- Digital Health Integration: Apps and remote monitoring can enhance adherence, expand indications, and personalize therapy.

- Market Penetration: Increasing access in underrepresented regions through partnerships and pricing strategies offers growth potential.

Conclusion

Sumatriptan remains a vital therapeutic agent within the migraine treatment landscape. Its robust safety profile and rapid efficacy sustain steady demand, especially in developed markets. However, patent expiration, intense generic competition, and the emergence of target-specific biologics temper growth prospects. With a strategic focus on innovation, market expansion, and differentiated delivery mechanisms, Sumatriptan’s sales trajectory is expected to grow at a CAGR near 9% over the next decade, reaching approximately $2.3 billion globally by 2030.

Key Takeaways

- The global Sumatriptan market is mature but poised for moderate growth driven by increased migraine prevalence and innovation.

- Generic competition significantly affects pricing strategies and revenue, emphasizing the importance of differentiating formulations.

- Emerging markets present substantial growth opportunities, fueled by rising awareness and expanding healthcare infrastructure.

- Innovations in delivery systems and digital health integration will be critical to sustaining long-term sales.

- Stakeholders should monitor patent and regulatory developments, as they directly influence market access and competitiveness.

FAQs

1. How does patent expiration impact Sumatriptan sales?

Patent expiration in multiple regions has led to a surge in generic formulations, increasing accessibility but reducing per-unit revenue for brand-name Sumatriptan. This commoditization drives sales volume but exerts downward price pressure.

2. Are there new formulations of Sumatriptan in development?

While current formulations remain largely unchanged, ongoing research explores longer-acting patches, nasal sprays, and combination therapies aiming to improve adherence and efficacy, potentially revitalizing market interest.

3. How is Sumatriptan affected by competition from CGRP therapies?

CGRP monoclonal antibodies primarily prevent migraines rather than abort existing episodes, limiting direct competition. However, increased adoption of these agents could decrease the frequency of acute treatment requirements, impacting Sumatriptan sales over time.

4. What regions are expected to drive future Sumatriptan growth?

Asia-Pacific and Latin America are poised for significant growth due to rising migraine prevalence, improved healthcare access, and evolving regulatory environments.

5. How can manufacturers sustain profitability amidst generic competition?

Investing in innovative delivery technologies, expanding indications, improving patient adherence, and strategic pricing are essential for maintaining sustainable revenue streams.

References

[1] MarketsandMarkets. "Migraine Therapeutics Market by Product (Sumatriptan, Rizatriptan), Delivery (Oral, Nasal, Parenteral), Distribution Channel, Region - Global Forecast to 2030." 2022.

[2] IQVIA. "Pharmaceutical Market Analysis 2022."

[3] EvaluatePharma. "Generic Drug Market Outlook." 2022.