Share This Page

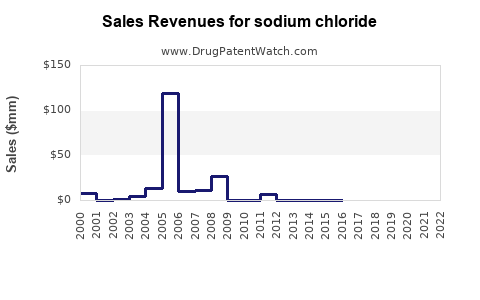

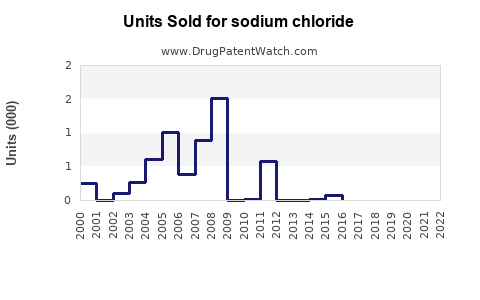

Drug Sales Trends for sodium chloride

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for sodium chloride

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| SODIUM CHLORIDE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| SODIUM CHLORIDE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| SODIUM CHLORIDE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| SODIUM CHLORIDE | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| SODIUM CHLORIDE | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Sodium Chloride

Introduction

Sodium chloride (NaCl), commonly known as table salt, plays a fundamental role across various industries, including healthcare, food production, chemical manufacturing, and water treatment. Once considered a mere household commodity, sodium chloride's industrial and pharmaceutical applications have propelled it into a vital global market. This report analyzes current market dynamics and provides sales projections, offering insights for industry stakeholders and potential investors.

Market Overview and Industry Scope

Pharmaceutical Applications

Sodium chloride is a staple in medical settings, primarily utilized in intravenous (IV) therapy for hydration, electrolyte balance correction, and medication delivery. The global saline solution market, largely driven by sodium chloride, is a critical component of healthcare infrastructure. The increasing prevalence of chronic diseases requiring IV therapy and expanding healthcare access in emerging markets underpin steady demand growth.

Food Industry

As an essential food additive, sodium chloride enhances flavor, preserves food, and acts as a chemical reagent during food processing. Rising global population coupled with urbanization intensifies demand for processed foods, further bolstering market prospects.

Chemical Manufacturing and Industrial Use

Sodium chloride serves as a raw material for the production of chlorine and caustic soda, necessary in manufacturing plastics, solvents, and other chemicals. Furthermore, salt contributes to de-icing products, water softening, and other industrial processes, especially in colder regions.

Water Treatment

In water desalination and purification processes, salt-based disinfectants and hardness removers serve critical functions, expanding sodium chloride’s industrial relevance.

Market Size and Growth Drivers

The global sodium chloride market was valued at approximately USD 20 billion in 2022 and is projected to reach USD 25.8 billion by 2030, registering a compound annual growth rate (CAGR) of 3.2% (Source: Industry Reports). Growth trajectories across healthcare, food, and industrial sectors substantiate this upward momentum.

Key Growth Drivers

-

Healthcare Expansion: Increasing population aging and chronic disease burden spur demand for saline solutions and related medical products.

-

Food Industry Growth: Urbanization, rising disposable incomes, and demand for processed foods globally contribute to steady consumption.

-

Industrial Demand: The chemical sector's expansion, especially for chlorine and caustic soda manufacturing, sustains market growth.

-

Environmental and Regulatory Factors: Stringent safety standards favor the use of high-purity sodium chloride in sensitive applications, driving niche market segments.

Regional Market Insights

North America

Led by the United States, with widespread healthcare infrastructure and industrial activity, North America holds a substantial market share (~35%). The region benefits from advanced pharmaceutical R&D and industrial development.

Europe

Europe exhibits mature markets, with significant demand driven by healthcare systems and chemical industries. Stringent environmental regulations also promote high-quality, pharmaceutical-grade sodium chloride.

Asia-Pacific

The fastest-growing region, with a projected CAGR of over 4%, driven by rapid urbanization, expanding healthcare infrastructure, and industrialization in China and India.

Latin America and Middle East & Africa

Emerging markets with increasing investments in healthcare and manufacturing sectors, though current market sizes remain smaller but poised for growth.

Market Challenges and Limitations

-

Price Volatility: Fluctuations in raw material costs, energy prices, and geopolitical factors impact profitability.

-

Environmental Regulations: Stricter environmental protocols for salt mining, processing, and disposal elevate compliance costs.

-

Quality Differentiation: Growing demand for pharmaceutical-grade sodium chloride necessitates significant investment in purification and quality assurance.

Sales Projections by Application Segment (2023-2030)

| Segment | 2023 Market Share | Projected CAGR (2023-2030) | 2023-2030 Sales Estimate (USD billion) |

|---|---|---|---|

| Healthcare/Pharmaceutical | 30% | 3.5% | $6.0 billion → $7.9 billion |

| Food Industry | 40% | 2.8% | $8.0 billion → $9.8 billion |

| Chemical & Industrial | 20% | 3.4% | $4.0 billion → $5.3 billion |

| Water Treatment & Others | 10% | 3.2% | $2.0 billion → $2.6 billion |

The healthcare segment is expected to grow increasingly faster, reflecting the rising demand for sterile, pharmaceutical-grade salt. The food sector, representing the largest share, benefits from ongoing global population growth.

Competitive Landscape

Major players include:

-

Cargill, Inc.: Dominates with diversified salt production, emphasizing high-purity pharmaceutical grades.

-

Tata Chemicals Ltd.: Prominent in Asia-Pacific, leveraging regional industrial and healthcare expansion.

-

AkzoNobel: Focuses on chemical-grade salts pertinent to industrial use.

-

ICL Group: Engaged across all segments, emphasizing innovation in sustainable salt production.

Emerging regional companies bolster competition in local markets, emphasizing quality and cost efficiency.

Future Trends and Innovation Opportunities

-

Sustainability Initiatives: Adoption of eco-friendly mining and processing techniques aligns with global environmental standards.

-

Product Innovation: Development of specialized salts, such as low-sodium formulations and pharmaceutical-grade products, will drive niche markets.

-

Integration with Supply Chains: Vertical integration ensures consistent quality and supply reliability, vital for healthcare applications.

-

Digitalization and Automation: Smart manufacturing enhances efficiency and traceability, reducing costs and improving compliance.

Key Regulatory Considerations

Stringent standards from agencies such as the U.S. Food and Drug Administration (FDA), European Medicines Agency (EMA), and ISO certifications influence manufacturing and quality assurance processes. Compliance enhances market access, especially for pharmaceutical and food-grade salts.

Key Takeaways

- The sodium chloride market is projected to grow at a CAGR of over 3% through 2030, reaching approximately USD 25.8 billion.

- Healthcare, food, and chemical industries dominate demand, with healthcare demonstrating the fastest growth rate.

- Regional dynamics favor Asia-Pacific, with rapid industrialization and expansion of healthcare infrastructure.

- High-purity pharmaceutical-grade sodium chloride offers lucrative niche markets but demands high compliance standards.

- Sustainability, innovation, and regulation compliance will be critical to maintaining competitive advantage.

FAQs

1. What are the primary drivers of demand for sodium chloride in healthcare?

The increasing prevalence of chronic diseases requiring IV therapies, aging populations, and growing healthcare access in emerging markets drive demand for pharmaceutical-grade sodium chloride.

2. How does regional variation affect the sodium chloride market?

North America and Europe feature mature markets with high-quality volume demands, while Asia-Pacific exhibits rapid growth driven by industrialization and expanding healthcare systems.

3. What challenges threaten the market’s growth?

Price volatility, stringent environmental regulations, and the need for high-purity quality standards are significant challenges for producers.

4. Are there emerging applications for sodium chloride?

Yes. Innovations in water desalination, renewable energy storage, and specialized pharmaceutical formulations represent emerging opportunities.

5. How will sustainability initiatives influence the sodium chloride industry?

Environmental regulations and sustainability commitments will push companies toward eco-friendly mining and processing practices, potentially increasing costs but also creating differentiation and compliance advantages.

Sources:

[1] Industry Reports on Sodium Chloride Market, 2022-2030.

[2] World Health Organization; Global Healthcare Infrastructure Data, 2022.

[3] International Salt Industry Association; Market Trends and Forecasts, 2022.

More… ↓