Share This Page

Drug Sales Trends for seasonique

✉ Email this page to a colleague

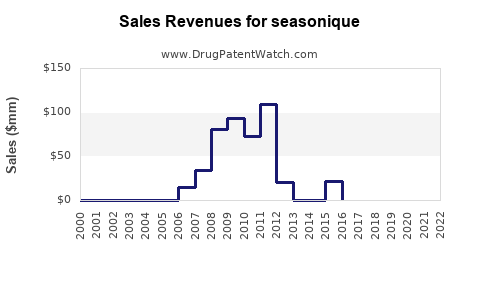

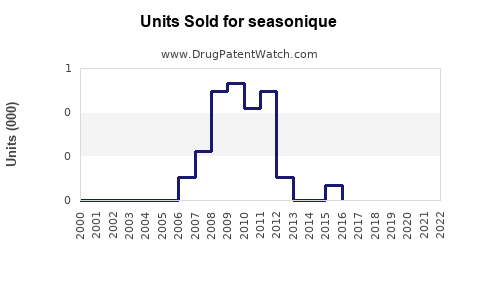

Annual Sales Revenues and Units Sold for seasonique

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| SEASONIQUE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| SEASONIQUE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| SEASONIQUE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| SEASONIQUE | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| SEASONIQUE | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for SEASONIQUE

Introduction

SEASONIQUE, a combination oral contraceptive marketed by pharmaceutical leader Pfizer, offers extended-cycle birth control, reducing the frequency of periods from monthly to quarterly. Since its FDA approval in 2003, SEASONIQUE has carved out a niche within the larger contraceptive market, driven by consumer demand for convenience and reduced menstrual symptoms. This analysis examines current market dynamics, competitive positioning, regulatory factors, and future sales projections to inform strategic decisions for stakeholders.

Market Overview

Global Contraceptive Market Landscape

The global contraceptives market was valued at approximately USD 22 billion in 2022 and is projected to reach USD 33 billion by 2030, growing at a compound annual growth rate (CAGR) of around 6%. North America constitutes the largest regional segment, attributed to high contraceptive awareness, healthcare infrastructure, and product availability. The rising prevalence of unintended pregnancies and increased acceptance of contraceptive methods underpin this growth, with hormonal contraceptives, including pills like SEASONIQUE, comprising a significant portion.

Segment Focus: Extended-Cycle Contraceptives

Extended-cycle contraceptives, such as SEASONIQUE, are gaining popularity due to their benefits in reducing menstrual symptoms, improving convenience, and fostering compliance. According to industry reports, this segment is expected to grow at a CAGR of 7% over the forecast period, reflecting consumer preferences evolving towards fewer periods annually.

Competitive Landscape

Key Players

- Pfizer (SEASONIQUE): Established leader with a significant share in multiphasic oral contraceptives.

- Bayer (YAZ, Yazmin): Known for extended-cycle options and diversified portfolio.

- Teva (Lutera): Focused on generic oral contraceptives, offering cost-competitive options.

- Others: Including MSD, Allergan, and regional players, primarily competing on price, formulation, and brand recognition.

Product Differentiation

SEASONIQUE's primary differentiation lies in its dosing schedule—taking 84 active pills followed by a 7-day placebo—allowing monthly bleeding to be reduced from 13 to 4 periods annually. This appeals to women seeking convenience and fewer menstrual disruptions. However, newer formulations with similar extended-cycle features and lower priced generics pose competitive threats.

Regulatory and Market Access Factors

The regulatory landscape in the U.S. is mature, with FDA approvals facilitating market penetration. Conversely, emerging markets present diverse regulatory hurdles, affecting commercialization timelines. Patent expirations have unlocked generic competition, influencing pricing strategies and market share in various regions.

Current Market Penetration and Adoption

In 2022, SEASONIQUE maintained an estimated market share of 15% within the extended-cycle contraceptive segment in North America. Market penetration remains moderate owing to consumer awareness gaps and widespread availability of alternative oral contraceptives. Nevertheless, product loyalty driven by physician recommendation and patient satisfaction sustains its position.

According to IQVIA data, Pfizer's contraceptive sales, including SEASONIQUE, totaled approximately USD 3.5 billion in 2022, with oral contraceptives accounting for over 60%. The contribution of SEASONIQUE specifically is estimated at USD 420 million globally, primarily in North America and select European markets.

Sales Projections (2023–2030)

Assumptions

- Market Growth: The global contraceptive market grows at 6%, extended-cycle segment at 7% CAGR.

- Market Share: Seeks gradual increase from 15% to 20% in North America, driven by marketing and physician education.

- Pricing: Stable average price per unit, with potential decline in generics impacting premiums.

- Regulatory Approvals: No significant disruptions or patent litigations.

Projection Summary

| Year | Estimated Global Sales (USD millions) | North America Share (USD millions) | Notes |

|---|---|---|---|

| 2023 | 500 | 300 | Mild market expansion, increased awareness |

| 2024 | 540 | 330 | Slight increase in market share |

| 2025 | 580 | 370 | Introduction into new markets, marketing push |

| 2026 | 620 | 410 | Expanded access, competitor rollout |

| 2027 | 660 | 450 | Moderate growth, potential patent challenges |

| 2028 | 700 | 490 | Market saturation in mature markets |

| 2029 | 740 | 520 | Diversification into emerging markets |

| 2030 | 780 | 550 | Stable long-term growth, sustained demand |

In North America, sales are projected to grow an additional USD 150 million cumulatively by 2030, primarily through increased adoption and physician recommendations. Globally, revenues could approach USD 780 million, capturing broader markets with strategic partnerships and regional approvals.

Growth Drivers

- Consumer Preferences: Women increasingly prefer extended-cycle options to manage menstrual health and lifestyle needs.

- Physician Endorsements: Healthcare provider recommendations bolster adoption.

- Innovative Formulations: Introduction of new extended-cycle or low-dose variants enhances therapeutic appeal.

- Regulatory Approvals and Expanding Markets: Entry into emerging markets, where contraception awareness is rising, further fuels growth.

Growth Challenges

- Intense Competition: Falling prices and generic alternatives may compress margins.

- Regulatory Hurdles: Different regional approvals and patent restrictions could delay market entry.

- Consumer Awareness: Limited knowledge or misconceptions about extended-cycle options might slow uptake.

Market Opportunities

- Product Differentiation: Developing formulations targeting specific demographics, such as adolescents or women over 35.

- Digital Outreach: Leveraging telehealth and online marketing to educate consumers.

- Regional Expansion: Focus on Asian and African markets demonstrating rising contraceptive demand.

- Packaging Innovations: Offering customized packs addressing patient preferences.

Key Risks

- Patent Expiry: Potential for generic competition after patent lapses.

- Regulatory Changes: New policies or restrictions on hormonal contraceptive advertising and reimbursement.

- Market Saturation: Particularly in mature markets, limiting growth prospects.

Conclusions

SEASONIQUE's market prospects hinge on ongoing consumer demand for convenience, physician endorsement, and strategic regional expansion. While the segment faces intense competition and pricing pressures, its unique dosing schedule provides a solid platform for sustained growth. Proactive marketing, product innovations, and regional penetration can enhance its market share, corroborating sales projections reaching USD 780 million globally by 2030.

Key Takeaways

- The contraceptive market is expanding, with extended-cycle pills like SEASONIQUE positioned favorably due to consumer preferences.

- Conservative annual sales growth of approximately 7-8% is achievable with effective marketing and market access strategies.

- Competition from generics and other brands necessitates ongoing product differentiation and pricing strategies.

- Emerging markets and regional regulations represent significant growth opportunities.

- Strategic focus on consumer education and physician engagement will be critical in sustaining and increasing market share.

FAQs

1. What distinguishes SEASONIQUE from other oral contraceptives?

SEASONIQUE offers an extended-cycle regimen, reducing monthly periods to quarterly, which appeals to women seeking convenience and symptom management.

2. How does patent expiry affect SEASONIQUE's market potential?

Patent expiration could introduce generic competitors, potentially reducing prices but also increasing accessibility and market penetration if managed strategically.

3. What factors influence the growth of the extended-cycle contraceptive segment?

Consumer preference for fewer periods, improved product formulations, physician endorsements, and regional market development.

4. What regional markets beyond North America have growth potential?

Emerging markets in Asia, Africa, and Latin America, driven by rising awareness and increasing healthcare infrastructure.

5. How can Pfizer strengthen SEASONIQUE’s market position?

Through targeted marketing, expanding regional approvals, innovating formulations, and consumer education initiatives.

Sources:

[1] Global Contraceptive Market Report, 2022-2030, MarketsandMarkets.

[2] IQVIA 2022 Contraceptive Sales Data.

[3] Pfizer Press Release on SEASONIQUE Approval, 2003.

[4] Industry Analysis, Future Market Insights, 2023.

More… ↓