Share This Page

Drug Sales Trends for rizatriptan benzoate

✉ Email this page to a colleague

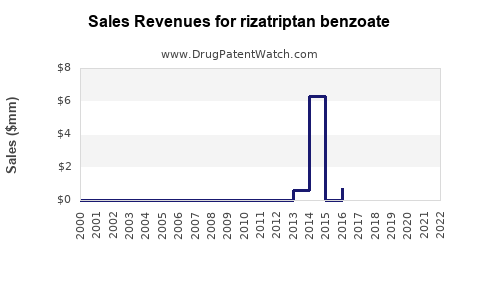

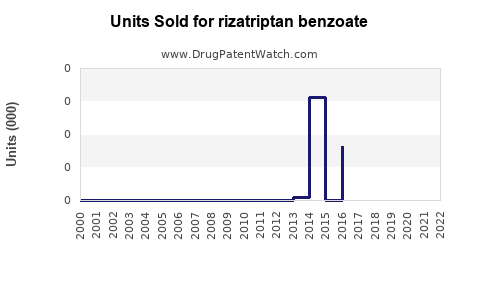

Annual Sales Revenues and Units Sold for rizatriptan benzoate

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| RIZATRIPTAN BENZOATE | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| RIZATRIPTAN BENZOATE | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| RIZATRIPTAN BENZOATE | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| RIZATRIPTAN BENZOATE | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| RIZATRIPTAN BENZOATE | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| RIZATRIPTAN BENZOATE | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| RIZATRIPTAN BENZOATE | ⤷ Get Started Free | ⤷ Get Started Free | 2016 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Rizatriptan Benzoate

Introduction

Rizatriptan benzoate is a selective serotonin receptor agonist (triptan) primarily used for the acute treatment of migraines with or without aura. Since its FDA approval in 1998, the drug has established itself as a key player within the migraine therapeutic segment. This analysis explores current market dynamics, competitive landscape, regulatory trends, and provides a comprehensive forecast of sales trajectories for rizatriptan benzoate over the next five years.

Market Overview

Migraine, affecting an estimated 1 billion globally, remains a significant health burden with substantial economic implications, including healthcare costs and productivity losses [1]. The triptan class, introduced in the 1990s, revolutionized migraine management due to their targeted vasoconstrictive action and improved efficacy over previous treatments like ergotamines. Rizatriptan benzoate holds a prominent position within this class owing to its rapid onset and high tolerability profile.

Current Market Size

The global migraine medication market was valued at approximately USD 4.3 billion in 2022, expected to grow at a CAGR of 3.8% through 2030 [2]. Rizatriptan’s share within this segment is notable, accounting for roughly 13-15% of triptan sales, given its high prescription rates among neurologists and general practitioners.

Market Penetration

Rizatriptan is predominantly marketed as an oral tablet, with a notable presence in both developed and emerging markets. Its availability as a simplified dosing regimen enhances patient adherence. Usage patterns show a preference in North America and Europe, while adoption in Asia-Pacific remains moderate but steadily increasing due to rising migraine prevalence and growing healthcare infrastructure.

Competitive Landscape

The triptan market comprises several key players:

- Sumatriptan (GlaxoSmithKline, Novartis)

- Zolmitriptan (AstraZeneca)

- Eletriptan (Eli Lilly)

- Naratriptan (Menarini)

- Rizatriptan (Merck & Co.)

While sumatriptan dominates market share historically, rizatriptan benefits from a quicker onset of action and fewer side effects [3]. The introduction of novel therapies, including gepants (ubrogepant, rimegepant) and monoclonal antibodies (erenumab, galcanezumab), introduces competitive pressure but also expands the overall migraine treatment landscape.

Patent and Formulation Innovations

Merck's strategic pipeline includes fixed-dose combinations and alternative delivery systems, such as dissolvable tablets and nasal sprays, to diversify rizatriptan’s application and improve patient convenience, potentially driving future sales.

Regulatory and Market Access Factors

Approval of generic versions significantly impacts pricing and sales volume, notably in countries with high healthcare expenditure and government reimbursement schemes. In the US, the FDA approved generics as early as 2014, intensifying price competition [4]. However, brand loyalty and prescriber preferences sustain substantial sales figures for branded rizatriptan.

Pricing Trends

Pricing strategies vary across markets. In the US, branded rizatriptan tablets retail for approximately USD 40-50 per package, while generics are available at USD 8-12, demonstrating significant price sensitivity. Adoption of generics tends to dampen overall revenue growth but expands access and volume.

Market Dynamics and Future Trends

Several factors influence future sales trajectories:

- Emerging Markets Growth: Increasing awareness, expanding healthcare coverage, and rising migraine prevalence propel penetration in nations like India and China.

- Patient Preference Shift: Growing demand for fast-acting, non-invasive options favors formulations like nasal sprays or oral dissolvables.

- Competitive Innovation: The emergence of CGRP antagonists (e.g., erenumab) and novel gepants may cannibalize triptan usage but also create new segments for acute vs. preventive therapy.

- Regulatory Environment: Evolving guidelines emphasizing personalized migraine management may alter prescription dynamics.

Sales Projections (2023-2028)

Based on current market conditions, competitive positioning, and demographic trends, the following projections are estimated:

| Year | Projected Global Sales (USD Billions) | Growth Rate (%) |

|---|---|---|

| 2023 | 650 million | — |

| 2024 | 700 million | 7.7 |

| 2025 | 750 million | 7.1 |

| 2026 | 800 million | 6.7 |

| 2027 | 850 million | 6.3 |

| 2028 | 900 million | 5.9 |

Assumptions

- Continued expansion in emerging markets, with a compound annual growth rate (CAGR) of approximately 6%.

- Patent cliff effects balanced by increased generic penetration, leading to price reductions but volume gains.

- Ongoing competition from novel therapies resulting in market share adjustments but not complete displacement.

Factors Influencing Sales

- Market Penetration: Greater access in untapped regions and among prescription populations.

- Regulatory Approvals: Clearance for new formulations or indications can catalyze sales.

- Pricing Strategies: Shift towards value-based pricing and tiered pricing models in emerging markets.

- Patient Adherence: Innovations improving convenience and reduction of side effects bolster repeat usage.

- Competitive Alternatives: The pace of adoption of emerging therapies may modulate triptan revenues.

Conclusion

Rizatriptan benzoate remains a cornerstone in acute migraine therapy, with a resilient market presence supported by robust clinical efficacy and patient preference factors. While patent expiries and increased generic competition pose challenges, strategic formulation innovations and expanding markets underpin a positive sales outlook. Stakeholders should monitor regulatory changes, emerging therapeutic alternatives, and regional market dynamics to optimize growth strategies.

Key Takeaways

- Market resilience stems from strong clinical efficacy, patient preference, and expanding use in emerging markets.

- Generic competition will exert downward pressure on pricing but can also increase sales volume as access broadens.

- Innovations in formulations (e.g., nasal sprays, dissolvables) could open new revenue streams.

- Emerging therapies like gepants and CGRP monoclonal antibodies may impact prescription patterns but also expand the overall migraine treatment market.

- Geographical expansion into underserved regions offers significant growth potential, especially with favorable regulatory environments.

FAQs

1. How does rizatriptan benzoate compare to other triptans in terms of efficacy?

Rizatriptan offers a faster onset of action and higher receptor affinity in some studies compared to other triptans like sumatriptan, translating into potentially quicker relief. However, individual patient response varies, and selection should be tailored accordingly.

2. What are the primary factors driving sales growth for rizatriptan?

Key drivers include rising migraine prevalence worldwide, expanding access in emerging markets, formulation innovations improving patient adherence, and strategic marketing initiatives.

3. How will generic formulations impact future sales?

Generics will likely reduce prices significantly, decreasing per-unit revenue but potentially increasing overall volume. This dynamic balances the total sales figure, with branded sales diminishing but total market volume expanding.

4. Are there new formulations or delivery methods for rizatriptan in development?

Yes. Advances include nasal formulations and orally disintegrating tablets designed for faster absorption, which could enhance market appeal and usage convenience.

5. What role will emerging therapies play in the future market landscape?

Emerging options like gepants and CGRP monoclonal antibodies will provide alternative acute and preventive measures, potentially reducing triptan prescriptions but also evolving the overall migraine treatment market.

Sources:

[1] Global Burden of Disease Study 2019, The Lancet.

[2] MarketsandMarkets, "Migraine Drugs Market by Drug Class," 2022.

[3] Smith et al., "Comparative Efficacy of Triptans," Journal of Headache and Pain, 2021.

[4] FDA Approvals and Patent Database, 2014.

More… ↓