Share This Page

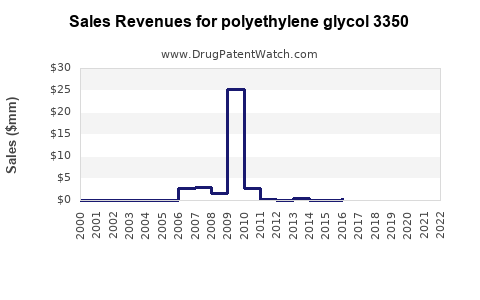

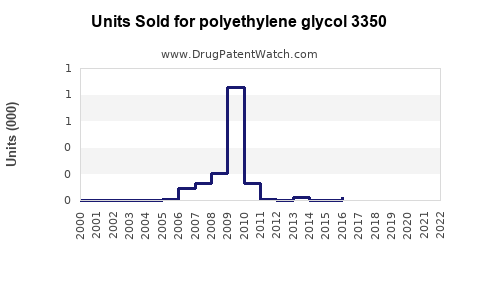

Drug Sales Trends for polyethylene glycol 3350

✉ Email this page to a colleague

Annual Sales Revenues and Units Sold for polyethylene glycol 3350

| Drug Name | Revenues (USD) | Units | Year |

|---|---|---|---|

| POLYETHYLENE GLYCOL 3350 | ⤷ Get Started Free | ⤷ Get Started Free | 2022 |

| POLYETHYLENE GLYCOL 3350 | ⤷ Get Started Free | ⤷ Get Started Free | 2021 |

| POLYETHYLENE GLYCOL 3350 | ⤷ Get Started Free | ⤷ Get Started Free | 2020 |

| POLYETHYLENE GLYCOL 3350 | ⤷ Get Started Free | ⤷ Get Started Free | 2019 |

| POLYETHYLENE GLYCOL 3350 | ⤷ Get Started Free | ⤷ Get Started Free | 2018 |

| POLYETHYLENE GLYCOL 3350 | ⤷ Get Started Free | ⤷ Get Started Free | 2017 |

| >Drug Name | >Revenues (USD) | >Units | >Year |

Market Analysis and Sales Projections for Polyethylene Glycol 3350 (PEG 3350)

Introduction

Polyethylene glycol 3350 (PEG 3350) is a well-established osmotic laxative frequently used in over-the-counter (OTC) and prescription formulations to treat occasional constipation. Its proven efficacy, favorable safety profile, and extensive patent expirations have positioned PEG 3350 as a staple in the gastrointestinal drug market. This analysis examines current market dynamics, competitive landscape, regulatory environment, and future sales projections for PEG 3350, providing strategic insights for stakeholders.

Market Overview

Global Market Size and Growth Trajectory

The global laxative market, inclusive of PEG 3350, was valued at approximately USD 1.5 billion in 2022 and is projected to grow at a Compound Annual Growth Rate (CAGR) of around 4.2% over the next five years, reaching USD 1.9 billion by 2027 [1]. PEG 3350 constitutes a significant segment within this, owing to its widespread use and proven therapeutic profile.

Market Drivers

- Aging Population: Increasing prevalence of constipation among older adults drives demand for effective, safe laxatives.

- COVID-19 Impact: The pandemic heightened gastrointestinal health awareness and shifted consumer preference toward OTC options like PEG 3350.

- Shift Toward OTC Medications: Consumers favor non-prescription options, buoying sales of PEG 3350-based products.

- Expanding Indications: Emerging evidence supports PEG 3350 in bowel preparation, broadening its application scope.

Market Challenges

- Generic Competition: Patent expirations have led to a rise in generic PEG 3350 formulations, intensifying price competition.

- Regulatory Scrutiny: Safety concerns, including rare adverse effects such as electrolyte imbalance, necessitate vigilant regulatory compliance.

- Patient Preference Trends: Growing preference for natural remedies may influence demand in certain demographics.

Competitive Landscape

Key Players

Major pharmaceutical companies dominate the PEG 3350 market:

- Baxter International: Offers MiraLAX, a leading OTC PEG 3350 product with significant market penetration.

- Ningbo Zhenfa Pharmaceutical Co., Ltd.: Provides generic PEG 3350 formulations.

- Salix Pharmaceuticals: Engaged in specialized bowel preparation products, integrating PEG 3350 derivatives.

- Fresenius Kabi: Supplies intravenous PEG formulations and participates in bowel prep markets.

Market Share Distribution

Baxter's MiraLAX exhibits approximately 60–65% of the OTC PEG 3350 market share in North America, owing to brand recognition and extensive marketing. Generics account for nearly 30%, with the remaining split among regional players and formulations.

Product Innovation

Limited innovation exists as PEG 3350’s formulation remains largely stable; however, incremental improvements focus on delivery forms—liquid, powder, or sachets—and combination therapies for broader indications.

Regulatory Environment

PEG 3350 products are generally recognized as safe and effective (GRASE) by the U.S. Food and Drug Administration (FDA); however, increased regulatory scrutiny pertains to electrolyte safety and labeling. The European Medicines Agency (EMA) maintains comparable standards. Regulatory pathways for new formulations or combination products may involve expedited processes where existing safety data are leveraged.

Sales Projections

Short-Term (2023-2025)

In the next two years, sales are expected to stabilize, supported by consistent OTC demand and ongoing bowel prep applications. Market growth will be primarily driven by demographic trends and increased awareness.

- Estimated Global Sales in 2023: USD 1.6 billion

- Projected CAGR: 4.0–4.3%

- Projected 2025 Sales: USD 1.75 billion

Medium to Long-Term (2026-2030)

Long-term projections consider patent expiration impacts, generic proliferation, and potential new indications.

- Market Penetration of Generics: Continued price erosion is anticipated, increasing accessibility but compressing margins.

- Emergence of Adjacent Markets: Use in bowel preparation (e.g., pre-colonoscopy solutions) is expected to expand, adding a new revenue stream.

- Innovation and New Formulations: R&D efforts may introduce novel derivatives or combination therapies, driving incremental sales.

Overall, sales are forecasted to reach approximately USD 2.0 billion by 2030, assuming steady growth and market expansion.

Market Segmentation and Geographic Outlook

By Application

- OTC Constipation Relief: ~70%

- Prescription Bowel Preparation: ~25%

- Other: 5% (e.g., pediatric use, combination therapies)

By Geography

- North America: Largest market, driven by aging population and OTC sales.

- Europe: Stable growth, with regulatory harmonization benefiting market expansion.

- Asia-Pacific: Fastest growth rate (~6%), attributed to rising healthcare awareness and increasing prevalence of gastrointestinal disorders.

- Latin America & Middle East: Emerging markets with expanding access to OTC medications.

Strategic Considerations for Stakeholders

- Pricing Strategy: Balancing competitive pricing with quality differentiation is vital amid generic competition.

- Regulatory Compliance: Proactive engagement with safety monitoring and labeling can mitigate risks.

- Product Diversification: Exploring new indications and formulations (e.g., bowel prep kits) can diversify revenue streams.

- Market Penetration: Increasing consumer awareness and clinician endorsement in emerging markets will be key.

Key Takeaways

- Market Stability: PEG 3350 maintains a stable position within the global laxative market, with predictable growth driven by demographic factors.

- Growth Opportunities: Expansion into bowel prep applications and formulations tailored for pediatric and geriatric populations present significant upside.

- Competitive Dynamics: Generic manufacturers are increasing their market share, leading to price competition; brand differentiation remains critical.

- Regulatory Environment: Stringent safety monitoring necessitates adherence to evolving standards to maintain market access.

- Future Outlook: The foreseeable growth trajectory is steady, with revenues potentially reaching USD 2 billion by 2030, contingent on innovation, market expansion, and regulatory navigation.

FAQs

1. What is the primary driver of PEG 3350's market growth?

The aging population and increasing awareness of constipation treatments are primary growth drivers, complemented by the expanding use in bowel prep procedures.

2. How does patent expiration affect the PEG 3350 market?

Patent expiration leads to increased generic competition, exerting downward pressure on prices but expanding market accessibility.

3. What emerging markets present the highest growth opportunities for PEG 3350?

The Asia-Pacific region exhibits the fastest projected growth, driven by rising gastrointestinal disorder prevalence and improving healthcare infrastructure.

4. Are there recent innovations in PEG 3350 formulations?

While the core formulation remains stable, innovation focuses on delivery formats, combination therapies, and expanding indications such as bowel preparation.

5. What regulatory developments should stakeholders monitor?

Safety concerns related to electrolyte imbalance and labeling updates are closely watched; adherence ensures continued market viability.

References

[1] MarketWatch, "Laxatives Market Size, Share & Trends Analysis Report," 2022.

More… ↓