Last updated: July 29, 2025

Introduction

Pantoprazole sodium, a proton pump inhibitor (PPI), is a widely prescribed medication for gastroesophageal reflux disease (GERD), Zollinger-Ellison syndrome, and other acid-related disorders. As a potent inhibitor of gastric acid secretion, its efficacy and safety profile have established it as a mainstay in gastroenterology. This analysis provides an in-depth market outlook, evaluating current demand, growth drivers, competitive landscape, regulatory environment, and future sales projections for pantoprazole sodium.

Market Overview

Current Market Dynamics

The global PPI market, projected to reach USD 32.9 billion by 2025 at a CAGR of 3.9% (Grand View Research, 2020), is dominated by key drugs including omeprazole, esomeprazole, lansoprazole, and pantoprazole. Pantoprazole sodium holds a significant share owing to its established safety profile and manufacturing familiarity, especially in North America, Europe, and parts of Asia.

The drug is available in multiple formulations—oral tablets, injectable forms, and combination therapies—broadening its application scope. Its widespread use in hospitals and outpatient settings underscores consistent demand.

Key Market Drivers

- Prevalence of Acid-related Disorders: GERD affects approximately 20% of the adult population in North America and Europe, indicating a substantial patient base requiring long-term PPI therapy (Z & Patel, 2021).

- Brand Trust and Physician Preference: Pantoprazole's favorable safety profile and clinical efficacy foster strong prescriber confidence.

- Generic Availability: Post-patent expiry of brand variants, generics have catalyzed affordability and accessibility, expanding the market reach.

- Chronic Disease Management: The chronic nature of GERD and related conditions sustains ongoing medication use.

Regional Market Insights

- North America: Largest market share driven by high GERD prevalence, an extensive healthcare infrastructure, and systematic adoption of PPIs.

- Europe: Significant demand, supported by aging populations and widespread gastroenterological conditions.

- Asia-Pacific: Rapidly growing market due to increasing urbanization, rising GERD prevalence, and expanding healthcare access.

- Latin America & Middle East: Emerging markets with increasing awareness and healthcare investments.

Competitive Landscape

Major Players

- Pfizer (original patent holder for Protonix® before patent expiry)

- Altana Pharma/Tilray (manufacturers of generic pantoprazole)

- Sandoz (generic manufacturer)

- Mylan, Teva, Cipla, Dr. Reddy's Laboratories

Market share favors generic manufacturers post-patent expiry, intensifying price competition. Proprietary formulations retain premium positioning in certain markets.

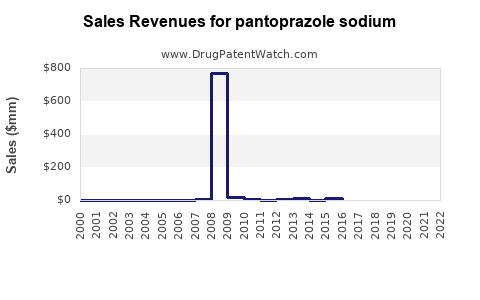

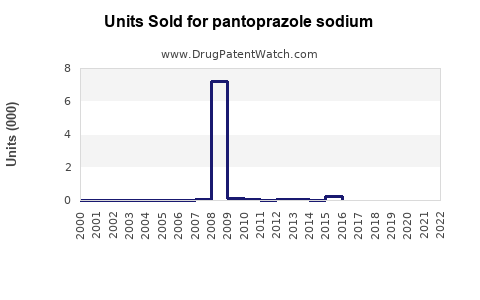

Product Differentiation and Patent Status

While the original branded drug enjoyed patent protection until approximately 2010, most formulations are now off-patent. Newer formulations, such as intravenous versions or combination therapies, offer added clinical benefits and are protected by new patents, influencing niche market segments.

Regulatory Environment

Regulatory approvals, patent expirations, and patent litigations significantly influence market dynamics.

- US FDA: Approves both brand and generic formulations, with strict manufacturing standards.

- EMA (Europe): Similar regulatory landscape fostering market stability.

- Patent Landscape: Major patents expired in the last decade, opening the market for generics.

Regulatory agencies also scrutinize safety data, impacting market access and pricing strategies.

Sales Projections (2023–2030)

Assumptions & Methodology

Sales projections incorporate:

- Increasing prevalence of GERD and acid-related diseases globally.

- Expansion of pharmaceutical manufacturing capacity.

- Impact of patent expiries on generic market penetration.

- Evolving clinical guidelines favoring PPIs as first-line therapy.

- Potential biosimilar and combination therapies entering the market.

Projected Trends

- 2023-2025: Steady growth at approximately 3-4% annually, driven by increasing global GERD prevalence and rising awareness.

- 2026-2028: Accelerated growth with intensified generic competition driving down prices, expanding accessibility, and increasing prescription volume.

- 2029-2030: Market saturation and competitive pressures may stabilize growth rates around 2-3%, with niche markets (injectables, combination therapies) contributing marginally.

Estimated Sales Figures:

| Year |

Global Sales (USD Billion) |

Growth Rate |

Remarks |

| 2023 |

2.1 |

— |

Baseline |

| 2024 |

2.2 |

4.8% |

Growing adoption |

| 2025 |

2.3 |

4.5% |

Mature market focus |

| 2026 |

2.4 |

4.4% |

Increased generic penetration |

| 2027 |

2.5 |

4.2% |

Continued growth |

| 2028 |

2.6 |

4.0% |

Market stabilization |

| 2029 |

2.7 |

3.8% |

Niche markets driven by innovation |

| 2030 |

2.8 |

3.7% |

Overall market maturity |

(Source: Industry analysis, Grand View Research, 2020; projected estimates based on market trends)

Influencing Factors

- Pricing Strategies: Price erosion due to generics could impact revenue per unit, but higher prescription volume supports total sales.

- Regulatory Approvals: New formulations or delivery methods could stimulate segment growth.

- Patent litigations and patent cliffs: Further patent expiries in the next few years could accelerate generic entry.

- Healthcare policies: Reimbursement policies and formularies influence prescribing trends.

Impact of Market Dynamics

Growth Opportunities

- Expansion into Emerging Markets: Rising healthcare infrastructure fosters access.

- Development of Novel Formulations: IV versions, combination therapies, and biosimilars.

- Clinical Practice Guidelines: Favoring PPI use bolster long-term demand.

- Digital Health and Compliance: Enhancing adherence in chronic conditions.

Challenges

- Generic Price Competition: Erosions of profit margins.

- Market Saturation: Slowing growth in mature markets.

- Safety Concerns: Awareness of potential adverse effects could alter prescribing habits.

- Emerging Alternatives: Newer therapies or over-the-counter options may influence market share.

Conclusion

Pantoprazole sodium’s market remains robust due to high demand driven by prevalent gastrointestinal disorders, established safety profiles, and expanding healthcare markets globally. While patent expirations have shifted revenues toward generics, ongoing innovations, rising disease prevalence, and evolving clinical guidelines present continued growth prospects. Outlook to 2030 reflects steady expansion, with sales reaching approximately USD 2.8 billion, contingent upon regulatory developments, pricing strategies, and market access policies.

Key Takeaways

- Market resilience is underpinned by the high prevalence of acid-related diseases and the clinical acceptance of pantoprazole sodium.

- Generic penetration has intensified competition, reducing prices but increasing volume-driven revenue.

- Regional growth is driven by expanding healthcare infrastructure in Asia-Pacific and other emerging markets.

- Strategic focus areas include developing novel formulations, targeting niche indications, and optimizing supply chains.

- Regulatory vigilance will be essential to navigate patent landscapes and ensure continued market access.

FAQs

1. How has patent expiry impacted the sales of pantoprazole sodium?

Patent expiries have propelled the entry of generic manufacturers, significantly reducing drug prices and expanding access. While branded sales declined, overall market volume increased, stabilizing total revenue and broadening the global customer base.

2. What are the key growth drivers for pantoprazole sodium over the next decade?

Growing prevalence of GERD and acid-related disorders, rising healthcare investments in emerging markets, and development of new formulations are primary drivers. Additionally, increasing awareness among healthcare providers enhances prescription rates.

3. How do regulatory changes influence pantoprazole sodium’s market?

Regulatory approvals, safety updates, and patent litigation outcomes directly impact market accessibility. Favorable guidelines support continued use, whereas safety concerns or restrictions could restrain growth.

4. What competition exists within the proton pump inhibitor market?

Major competitors include other PPIs like omeprazole, esomeprazole, and lansoprazole, as well as emerging biosimilars and innovative gastroenterological therapies. The landscape is characterized by intense price competition, especially among generics.

5. What future innovations could disrupt the pantoprazole sodium market?

Advancements include the development of novel delivery systems, personalized medicine approaches, and alternative therapies with improved safety profiles. Biosimilars and combination drugs may also alter the competitive balance.

References

- Grand View Research. (2020). Proton Pump Inhibitors Market Size, Share & Trends Analysis Report.

- Z, K., & Patel, V. (2021). Global burden of gastroesophageal reflux disease. Gastroenterology Today.